Marta Posada and Adolfo López-Paredes (2008)

How to Choose the Bidding Strategy in Continuous Double Auctions: Imitation Versus Take-The-Best Heuristics

Journal of Artificial Societies and Social Simulation

vol. 11, no. 1 6

<https://www.jasss.org/11/1/6.html>

For information about citing this article, click here

Received: 05-Feb-2007 Accepted: 25-Nov-2007 Published: 31-Jan-2008

Abstract

Abstract

|

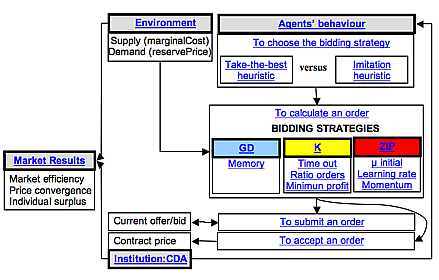

| Figure 1. Model structure |

| Table 1: Pseudo-code of CDA protocol (He et al. 2003) |

1.{Initialize the initial bid/ask : ac=2*maximum reserve price, bc= 0 |

| Table 2: Pseudo-code of the imitation heuristic |

If profit (t) ≥ market average profit (t-1) |

| Table 3: Pseudo-code of the take-the-best heuristic |

If profit (t) ≥ profit (t-1) |

| Table 4: Pseudo-code to form agent's beliefs | |

| BUYER's beliefs | SELLER's beliefs |

If bid from an alternative bidding strategy < realized bid |

If ask from an alternative bidding strategy > realized ask |

If bid from an alternative bidding strategy < accepted ask |

If ask from an alternative bidding strategy > accepted bid |

|

|

(1) |

|

|

(2) |

where ABL is the number of accepted bids in HM with price lower than x, AL is the number of accepted and rejected asks with price lower than x, RBG is the number of rejected bids with price greater than x, AAG is the number of accepted asks in HM with price greater than x, BG is the number of accepted or rejected bids with price greater than x, and RAL is the number of rejected asks with price lower than x. Interpolation is used for prices at which no orders are registered in HM

|

|

(3) |

|

|

(4) |

where Δt is calculated using the individual trader's learning rate (β), the momentum learning coefficient (γ), and the difference between the bid target and the bid in the last round in the following way:

|

|

(5) |

where the target order is calculated following Preist and van Tol (1998), increasing the margin if the last order was accepted and decreasing it if the last order was rejected.

| Table 5: List of parameters and their default values | |

| ZIP parameters | Value |

| Initial profit margin (μ) | [0.05 , 0.35] |

| Learning rate coefficient (β) | [0.1 , 0.5] |

| momentum learning coefficient (γ) | [0 , 0.1] |

| GD parameter | |

| Memory | 8 |

| K parameters | |

| Minimum profit | [0.01 , 0.03] |

| Time out | [0.05 , 0.15] |

| Ratio orders | [0.0125 , 0.0375] |

| Table 6: Experiments for three environments (E) and two choosing heuristics (A) | ||||

| Take-the-best heuristic | Imitation heuristic | (P0,Q0) | Buyers' surplus //sellers' surplus | |

E1 Environment | SE1C | SE1I | (210, 60) | 1500 // 1500 |

E2 Environment | SE2C | SE2I | (210, 60) | 0 // 1500 |

E3 Environment | SE3C | SE3I | (210, 60) | 1500 // 0 |

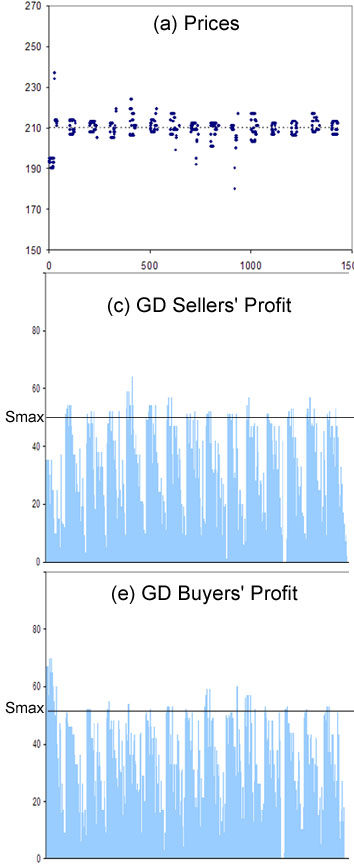

| E1 (GD buyers, GD sellers) | E1 (ZIP buyers, ZIP sellers) |

|

|

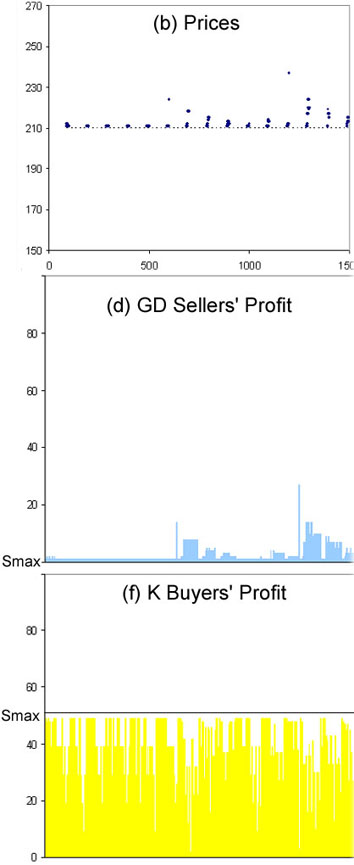

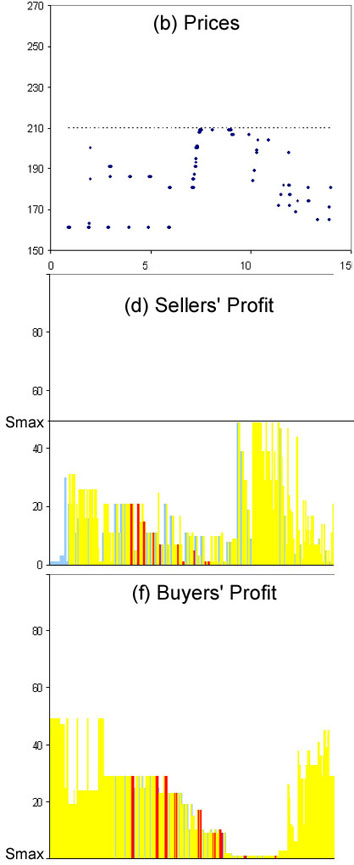

| Figure 2. Path of price convergence and agents' surplus in a run of a market populated by a homogeneous population (all GD or all ZIP) in E1 environment | |

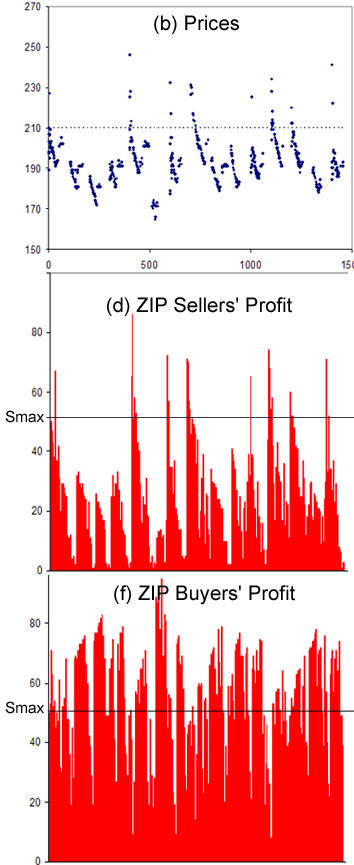

| E2 (demand is perfectly elastic) (GD sellers, K buyers) | E3(supply is perfectly elastic) (GD sellers, K buyers) |

|

|

| Figure 3. Path of price convergence and surplus in a run of a market populated by a heterogeneous population (10 GD sellers and 10 K buyers) in E2 and E3 asymmetric environments. K buyers steal all the sellers' surplus. It does not depend on the elasticity of the market side they are. | |

| Table 7: Average α convergence coefficient for 30 runs | ||||||

| E1 | E2 Perfectly elastic demand | E3 Perfectly elastic supply | ||||

| Period | SE1C Take-the-best heuristic | SE1I Imitation heuristic | SE2C Take-the-best heuristic | SE2I Imitation heuristic | SE3C Take-the-best heuristic | SE3I Imitation heuristic |

| 1 | 22,8 | 23,0 | 23,0 | 23,2 | 0,8 | 1,0 |

| 2 | 17,1 | 18,2 | 20,2 | 19,9 | 2,6 | 3,1 |

| 3 | 13,7 | 15,6 | 16,5 | 17,7 | 2,7 | 3,5 |

| 4 | 12,2 | 14,2 | 13,6 | 16,5 | 2,6 | 4,8 |

| 5 | 9,4 | 10,8 | 9,5 | 13,9 | 2,2 | 4,4 |

| 6 | 7,0 | 6,7 | 7,9 | 10,6 | 1,8 | 4,6 |

| 7 | 5,9 | 6,1 | 6,5 | 7,7 | 1,8 | 5,7 |

| 8 | 4,8 | 7,2 | 5,3 | 7,6 | 1,6 | 7,8 |

| 9 | 4,8 | 8,0 | 4,4 | 8,6 | 2,7 | 8,4 |

| 10 | 4,4 | 6,9 | 3,6 | 10,9 | 1,9 | 9,7 |

| 11 | 4,5 | 8,0 | 2,8 | 13,3 | 1,9 | 9,3 |

| 12 | 3,6 | 6,6 | 2,0 | 14,5 | 1,4 | 10,3 |

| 13 | 2,7 | 7,0 | 1,6 | 12,5 | 2,1 | 10,8 |

| 14 | 3,9 | 8,1 | 1,8 | 10,6 | 1,6 | 9,7 |

| 15 | 2,2 | 5,7 | 1,8 | 7,5 | 2,2 | 9,3 |

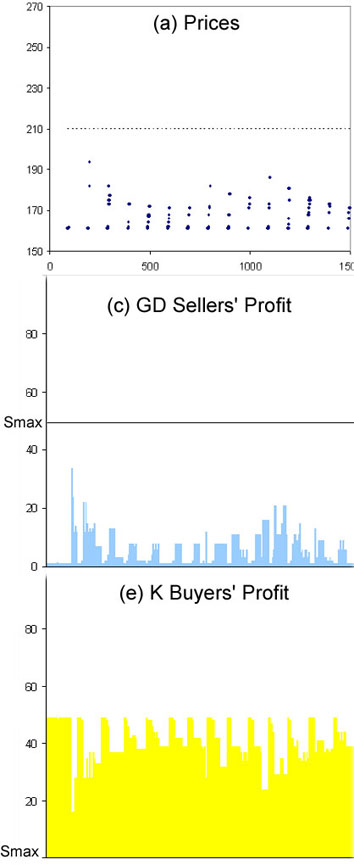

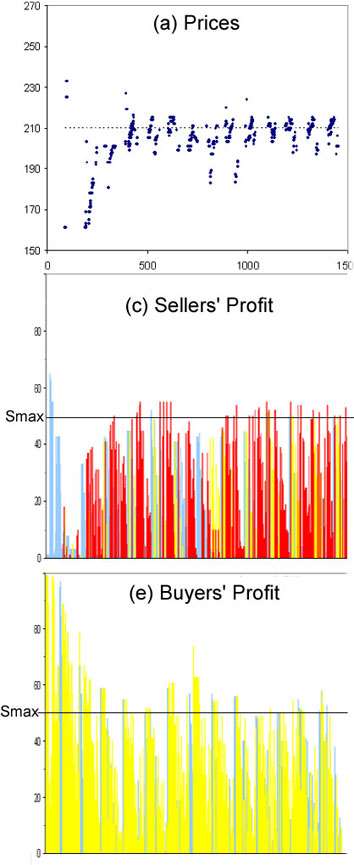

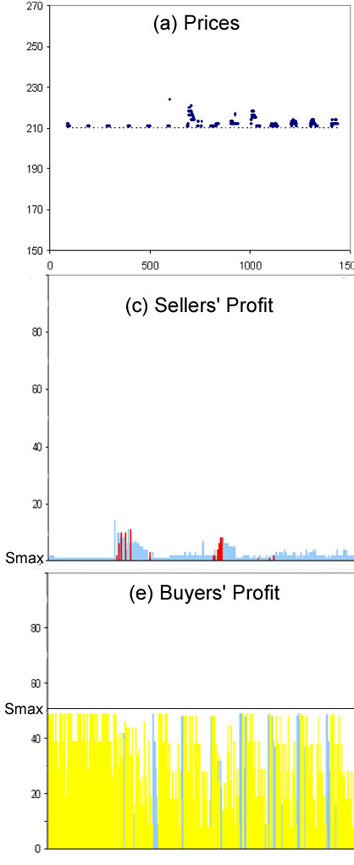

| Take-the-best heuristic SE1C | Imitation heuristic SE1I |

|

|

| Figure 4. Path of price convergence and agents' surplus in a run of a market populated by an initial population of 10K buyers and 10 GD sellers in E1 environment. In E1, demand and supply are symmetric. There is no evidence of price convergence when agents use "imitation" to update their bidding strategies. On the other hand, take-the-best leads to price convergence and the maximum surplus of both buyers and sellers. | |

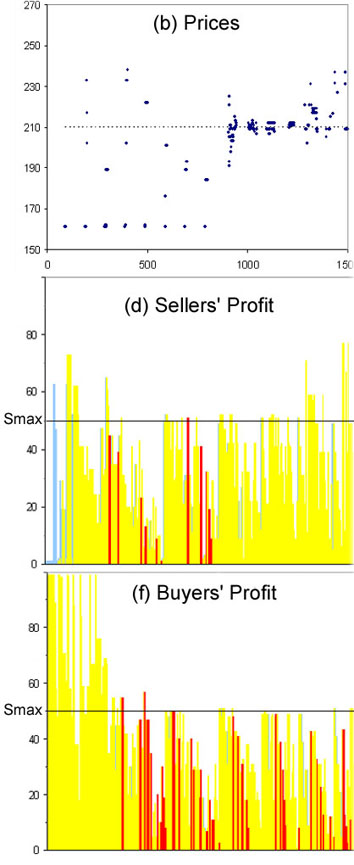

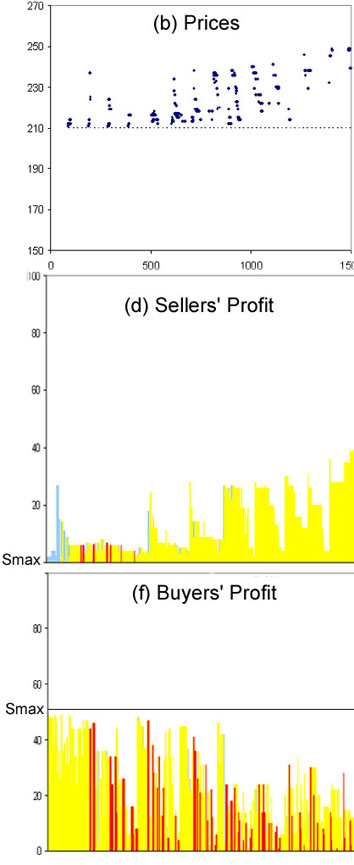

| Take-the-best heuristic SE2C | Imitation heuristic SE2I |

|

|

| Figure 5. Path of price convergence and agents' surplus in a run of a market populated by an initial population of 10 K buyers and 10 GD sellers in E2 environment. After some periods, the agents change their bidding strategy. Sellers adopt mainly the K or ZIP bidding strategy to improve their profits (5.c). As many sellers are parasite, the K buyers' profits decrease and buyers, who use the take-the-best heuristic, choose the GD bidding strategy to improve their profits (5.e). As a result, price convergence is achieved when the demand is perfectly elastic (5.a). When agents use the imitation heuristic, price convergence is not achieved because many buyers and sellers are parasite. | |

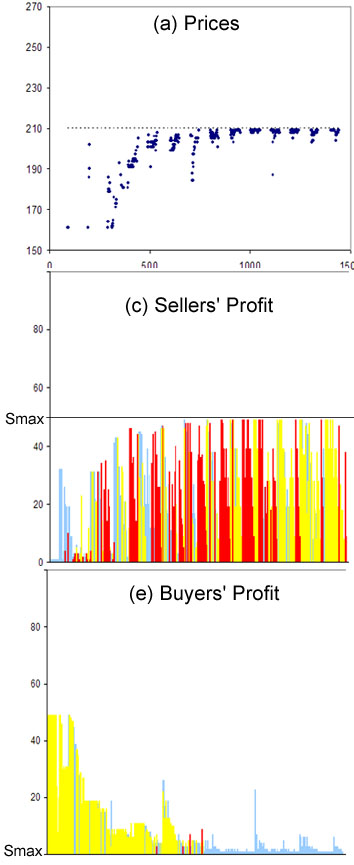

| Take-the-best heuristic SE3C | Imitation heuristic SE3I |

|

|

| Figure 6. Path of price convergence and agents' surplus in a run of markets populated by an initial population of 10 K buyers and 10 GD sellers in E3 environment (as it was in previous analysis explained in section 6.2). Agents' surplus is close to the maximum surplus (6.c and 6.e). As result there are no changes in bidding strategies when agents learn with the take-the-best. But, when agents change their bidding strategies by imitation, the parasitic K bidding strategy emerges as the main strategy for sellers and buyer. As result, price convergence is not allowed, prices are higher than P0, and the maximum surplus is obtained by sellers (where agents adopt the parasitic behaviour). | |

|

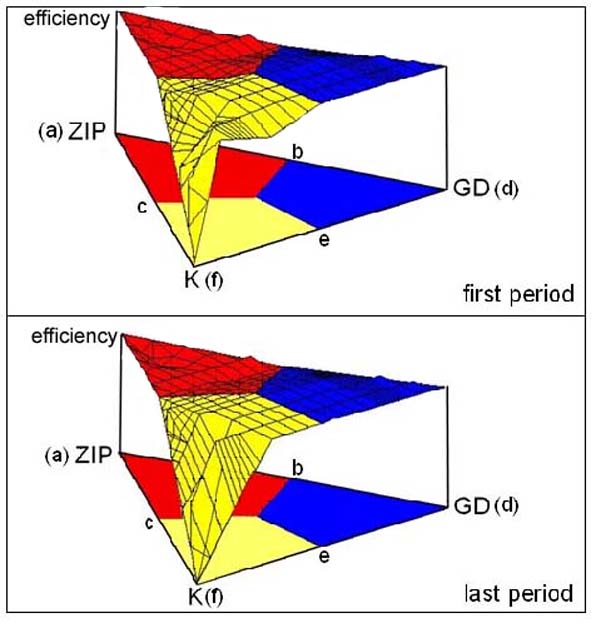

| Figure 7. Market efficiency in the bidding strategy space at the first and at the last trading period when the agents have fixed bidding strategies in the E1 symmetric environment |

2In one setting a single agent of one type competes against an homogeneous populations of a different type. In the other setting two types of agents compete in a market where one has a counterpart of the other type.

3The model has been programmed in SDML and the source code is available at http://www.insisoc.org/take_the_best/. SDML is a strictly declarative model language freely available from the Centre for Policy Modelling (http: //cfpm.org)

4The initial current bid is zero and the initial current ask is the double of the maximum reserve price.

5Artificial financial markets that adopt the CDA as institution uses a different approach: agents are endowed with a set of stocks and/or money, and agents can buy/sell at their choice. Our approach is more close to Experimental Economics, where agents behave as buyer or seller. It allows us to validate the results of simulations with real empirical evidence from market experimentation with humans.

6The number of combinations with repetition is (k+n-1)!/(n! (k-1)!) where k is the number of bidding strategies from which choose and n is the number to be chosen (i.e., the number of agents).

7It is not possible to report in the paper these values for all populations of the bidding strategy space. They are available in http://www.insisoc.org/take_the_best/.

CHEN, S.-H. (2000) Toward an agent-based computational modelling of bargaining strategies in double auction markets with genetic programming in Lecture Notes in Computer Science 1983. pp. 517-531.

CHEN, S.-H., Tai, C.-C. (2003) Trading restrictions, price dynamics and allocative efficiency in double auction markets: analysis based on agent-based modelling and simulations in Advances in Complex Systems 6 (3). pp. 283-302

CLIFF, D. (2001) Evolutionary optimization of parameters sets for adaptive software-agent traders in continuous double auction in Tech. Rep of HP Laboratories 01-99, Hewlett Packard Laboratories, Bristol, England

CLIFF, D., Bruten, J. (1997) Zero is not enough: On the lower limit of agent intelligence for continuous double auction markets in Tech. Rep of HP Laboratories 97-141.

CONTE, R., Paolucci, M. (2001) Intelligent social learning in Journal of Artificial Societies and Social Simulation, 4 (1) < https://www.jasss.org/4/1/3.html>

DAS, R., Hanson, J., Kephart, J., Tesauro, G. (2001) Agent-human interactions in the continuous double auction in Proceedings of the International Joint Conferences on Artificial Intelligence. pp. 1169-1187.

DIMSON, E., Mussavian, M. (1998) A brief history of market efficiency in European Financial Management 4 (1). pp. 91-193.

DIXON, H., Wallis, S., Moss, S. (1995). Axelrod meets Cournot: oligopoly and the evolutionary metaphor, part I. Discussion Papers in Economics, nº 95/8, Un. Of York. Later on (2002) same title in Computational Economics 20. pp. 139-156.

EASLEY, D., Ledyard, J. (1992) Theories of Price Formation and Exchange in Double Oral Auctions in Friedman and Rust (eds.), The double auction markets: Institutions, theories and evidence. pp. 63-98, Addison-Wesley.

GIGERENZER, G. Goldstein, D.G. (1996) Reasoning the fast and frugal way: Models of bounded rationality in Psychological Review 103(4). pp. 650-669.

GIGERENZER, G., Selten, R. (ed.) (2001) Bounded Rationality: The Adaptive Tool-box, MIT Press, Cambridge, Mass.

GJERSTAD, S., Dickhaut, J. (1998) Price formation in double auctions in Games and Economic Behaviour 22. pp. 1-29.

GODE, D., Sunder, S. (1993) Allocative efficiency of market with zero-intelligent traders: Market as a partial substitute for individual rationality in Journal of Political Economy 101. pp. 119-137.

HOLT, C. A. (1995) Industrial Organization: A Survey of Laboratory Research in: J.H. Kagel and A. Roth eds The Handbook of Experimental Economics. Princeton University Press. pp. 349-443.

KIRMAN, A., Vriend, N. (2001) Evolving market structure: an ACE model of price dispersion and loyalty in Journal of Economic Dynamics & Control 25. pp. 459-502.

MARKS, R (2005) Market Design Using Agent-Based Models in L. Tesfastion and K. Judd eds Handbook of Computational Economics 2. North Holland.

MUCHNICK, L., Solomon, S. (2007) Markov Nets and the NatLab platform; Application to Continuous Double Auction in Salzano and Colander (eds.), Complexity Hints for Economic Policy, Springer http://shum.huji.ac.il/~sorin/ccs/isi/Markov-Nets.pdf

NELSON, R.R., Winter, S.G. (1982) An Evolutionary Theory of Economic Change, Cambridge, MA: Harvard University Press.

POSADA, M., Hernández, C., López, A. (2005) Learning in a Continuous Double Auction Market in Lecture Notes in Economics and Mathematical Systems 564. pp. 41-51.

POSADA, M., Hernández, C., López, A. (2006) Strategic Behaviour in a Continuous Double Auction Market in Lecture Notes in Economics and Mathematical Systems 584. pp. 31-43.

POSADA, M. (2006) Strategic Software Agents in Continuous Double Auction under Dynamic Environments in Lecture Notes in Computer Science 4224. pp. 1223- 1233.

POSADA, M., Hernández, C., López, A. (2007a) An Artificial Economics View of the Walrasian and Marshallian Stability in Lecture Notes in Economics and Mathematical Systems 599. pp. 101-111.

POSADA, M., Hernández, C., López, A. (2007b) Testing Marshallian and Walrasian Instability with an Agent Based Model in Lecture Notes in Computer Science, forthcoming.

PREIST, C., van Tol, M. (1998). Adaptive agents in a persistent shout double auction in Proceedings of the First International Conference on Information and Computation Economics. pp. 11-18.

ROTH, A., Erev, I. (1995) Learning in extensive- form games: experimental data and simple dynamic models in the intermediate term in Games and Economic Behaviour, 8. pp. 164-212.

RUST, J., Miller, J., Palmer, R. (1993) Behaviour of trading automata in computerized double auctions in Friedman and Rust (eds.), The double auction markets: Institutions, theories and evidence Addison-Wesley. pp. 155-198.

SMITH, V. (1962) An Experimental Study of Competitive Market Behavior in Journal of Political Economy, 70. pp. 111-137.

SMITH, V. (1976) Bidding and Auctioning Institutions: Experimental Results in Papers in Experimental Economics, Cambridge University Press. pp. 106-127.

SMITH, V. (1989) Theory, Experiment and Economics in Journal of Economic Perspectives, Winter. pp. 783-801.

SMITH,V. (2003) Constructivist and Ecological Rationality in Economics in The American Economic Review, 93(3). pp. 465-508.

TESAURO, G., Das, R. (2001) High performance bidding agents for the continuous double auction in Proceedings of the Third ACM Conference on Electronic Commerce. pp. 206-209.

VRIEND, N. (2000) An illustration of the essential difference between individual and social learning, and its consequences for computational analyses in Journal of Economic Dynamics & Control 24. pp. 1-19.

WALSH, W., Das, G., Tesauro, G., Kephart, J. (2002) Analysing complex strategic interactions in multi-agent games in Workshop on Game Theoretic and Decision Theoretic Agents. pp. 109-118.

WEIBULL, J. (1995) Evolutionary Game Theory, Cambridge, MA, MIT Press.

Return to Contents of this issue

© Copyright Journal of Artificial Societies and Social Simulation, [2008]