Abstract

Abstract

- This paper describes the development of the Individual

Reporting Compliance Model (IRCM), an agent-based model for simulating

tax reporting compliance in a community of 85,000 U.S. taxpayers.

Design features include detailed tax return characteristics, taxpayer

learning, social networks, and tax agency enforcement measures. The

taxpayer's compliance reporting decision is modeled as a partially

observable Markov decision process that takes into account taxpayers'

heterogeneous risk profiles and non-stationary beliefs about the

expected costs associated with alternative reporting strategies. In

order to comply with legal requirements prohibiting the disclosure of

taxpayer information, artificial taxpayers are created using data from

the Statistics of Income (SOI) Public Use File (PUF). Misreported

amounts for major income and offset items are imputed to tax returns

are based on examination results from random taxpayer audits. A

hypothetical case study illustrates how IRCM can be used to compare

alternative taxpayer audit selection strategies.

- Keywords:

- Partially Observable Markov Decision Process, Taxpayer Compliance, Repast

Introduction

Introduction

- 1.1

- In tax year (TY) 2006, the U.S. Internal Revenue Service

(IRS) estimates the gross tax gap – the true amount of tax due but not

paid voluntarily and timely – was $450 billion, representing 16.9

percent of the total tax due from individuals and corporations. The

loss of revenue associated with the tax gap is a burden that falls

disproportionately on compliant taxpayers and contributes to the

nation's budget deficit. Consequently, finding ways to reduce the tax

gap is an ongoing concern for the IRS.

- 1.2

- Research on individuals' motives for complying with tax

laws has flourished since the 1972 publication of Allingham and

Sandmo's (1972)

groundbreaking theoretical work on the subject. However, this vast body

of knowledge has not been successfully integrated into computational

tools that could help tax administrators improve taxpayer compliance.

The lack of progress on applications development stems from

researchers' inability to incorporate sufficient realism into

theoretical models of taxpayer behavior (Alm

1999). The realization that analytical methods are often

inadequate for modeling complex social phenomena has led to the growing

interest in agent-based modeling (Axtell

2000; Janssen &

Ostrom 2006; Alm et al. 2010).

- 1.3

- During the last decade a number of agent-based models

(ABMs) of taxpayer compliance have appeared in the literature (Antuñes et al. 2007; Bloomquist 2004, 2006; Davis et al. 2003; Hokamp & Pickhardt 2010;

Korobow et al. 2007; Mittone & Patelli 2000;

Szabó et al. 2008; Zaklan et al. 2009; Andrei et al. 2014).

Mainly exploratory in nature, these models lack the degree of realism

required for applied use, such as a detailed representation of income

reporting requirements and key institutional relationships linking

taxpayers, tax preparers, employers and the tax agency. This paper

introduces a model that addresses many of these operational

deficiencies.

- 1.4

- This paper describes the design and implementation of the

Individual Reporting Compliance Model (IRCM), an ABM that simulates the

income tax reporting behavior of a community of 85,000 individual

taxpayers. This paper's main contribution to the ABM literature is a

model on a topic (tax compliance) having significant importance for

national and sub-national governments worldwide and that incorporates a

high degree of fidelity to the environment in which both taxpayers and

tax agencies operate. For example, the IRCM (or the "model") includes

many enforcement mechanisms used by tax agencies, such as audits and

information reporting, as well as detailed information on the reporting

compliance for major income and offset items. A point-and-click

interface allows the user to easily explore the impact on taxpayer

reporting compliance of alternative assumptions concerning tax agency

enforcement and information reporting. In order to comply with IRS

disclosure rules no taxpayer data is used. Instead, a dataset of

artificial taxpayers is created by selecting cases (with replacement)

from the Statistics of Income (SOI) Public Use File (PUF) (Weber 2004) that are close

statistical matches for actual tax returns. The model is written in

Java and uses Repast (North et al.

2007) software libraries for random number generation and

chart production. Finally, the model design allows for new information

about taxpayer behavior to be incorporated as such information becomes

available.

- 1.5

- The outline of this paper is as follows. Section two gives

an overview of the IRCM framework and describes agents and agent

behaviors. Section three describes the steps involved in constructing

the dataset of artificial taxpayers used by the model. Section four

discusses model validation and calibration. Section five presents a

hypothetical case study analyzed using IRCM. Section six concludes and

highlights topics for further research.

Model Description

-

Agents

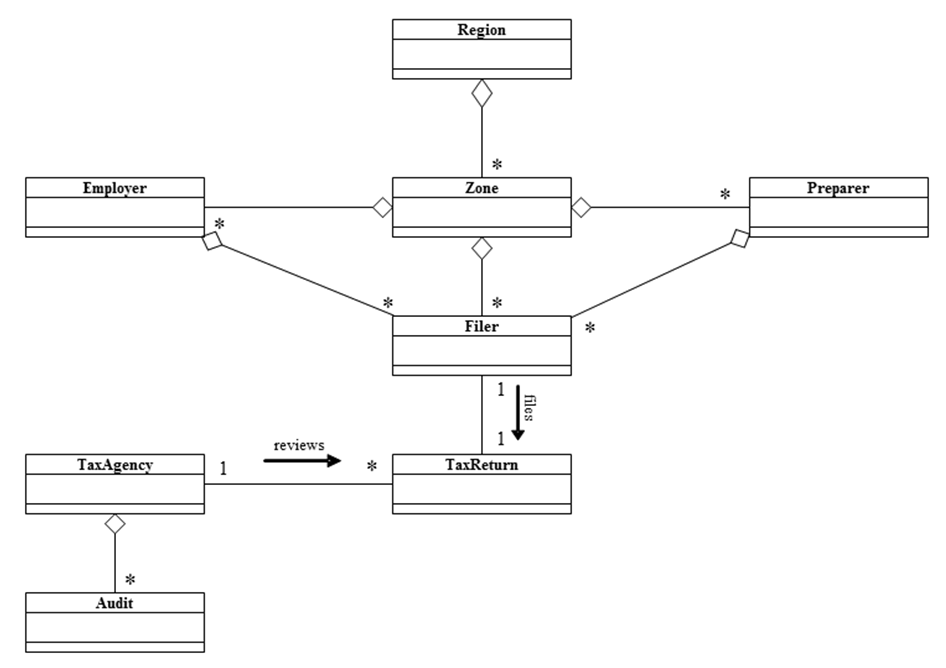

- 1.6

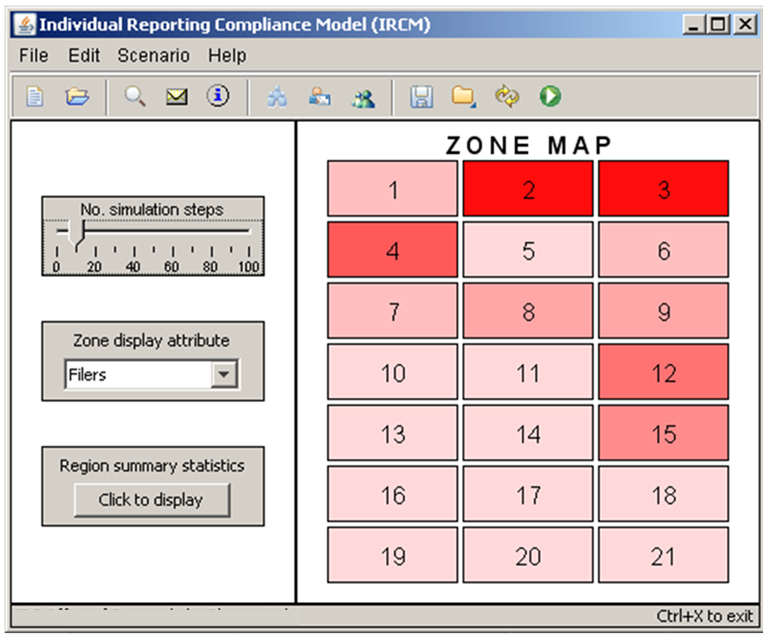

- Figure 1 graphically displays the IRCM agent architecture.

A single Region is composed of multiple non-overlapping zones. Each

Zone represents the place of residence for a group of filers (e.g., a

postal zip code zone). Each Zone also has a list of all tax preparers

and employers located within its borders. A Preparer agent prepares tax

returns for its clients. Employer agents represent firms having one or

more employees. Form 1040 filers are represented by Filer agents. A tax

return is an instance of the TaxReturn class. All tax returns are

reviewed by a tax agency (an instance of the TaxAgency class) and are

subject to a possible audit. The tax agency selects filers for audit

using one of three user-specified audit strategies: random, fixed

proportion, and constrained maximum yield (CMY). The CMY audit

selection strategy uses a simple learning algorithm to incrementally

improve overall yield per return audited.

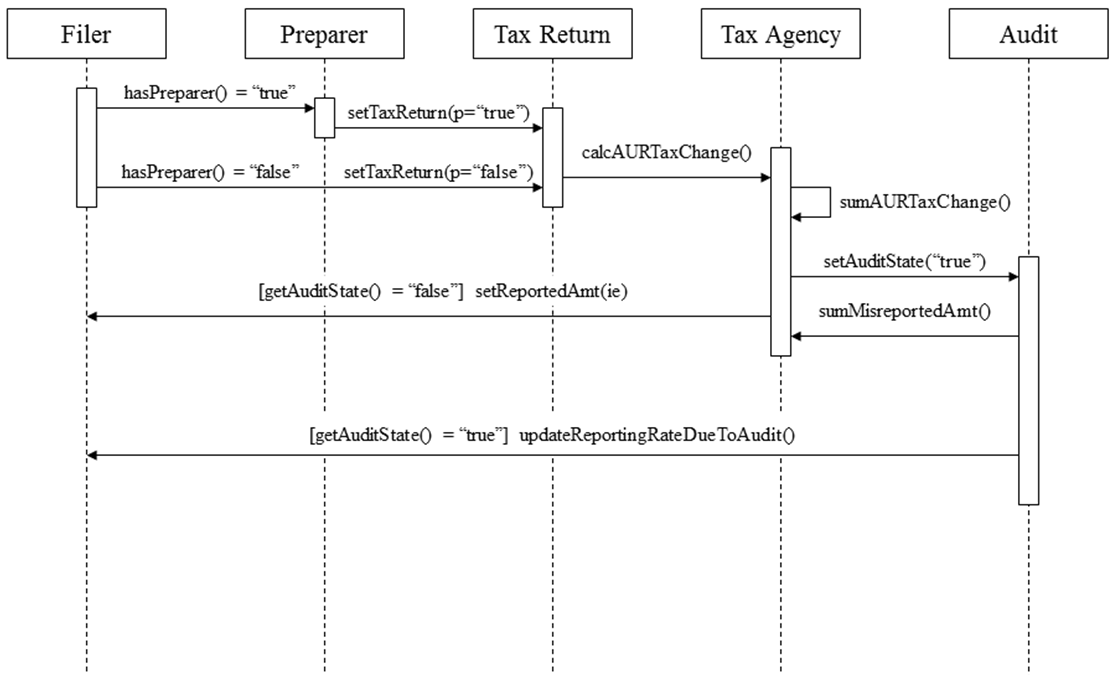

- 1.7

- The interaction between filers and the tax agency is

illustrated in Figure 2. The

filer either uses a paid preparer or self-prepares. The tax agency

reviews the return and determines if any discrepancies are present on

items with third-party information reporting (e.g., Form W-2 for wage

and salary income). If the return is audited the amount misreported is

recorded. If not audited, the filer decides how much income to report

in the next period for items with little or no third-party information

reporting. If audited, the filer may reevaluate reporting on all major

income and offset items.

Figure 1. IRCM Agent Hierarchy Model Execution

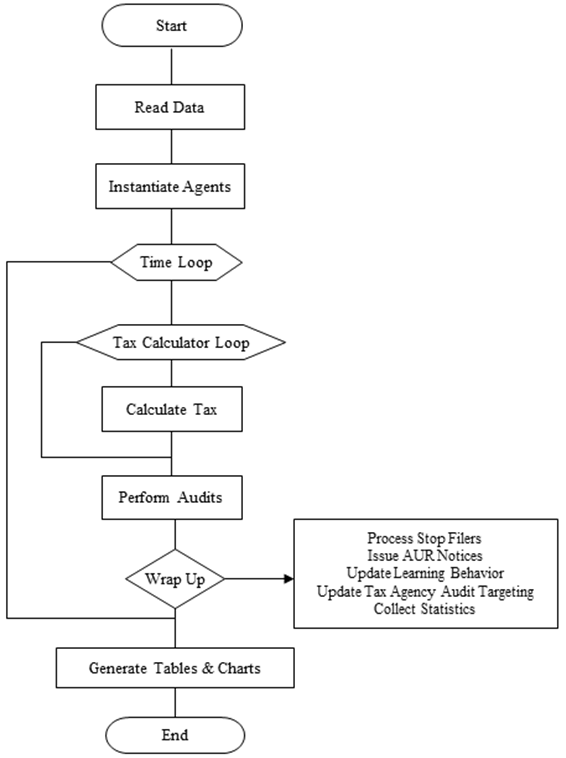

- 1.8

- The steps followed in executing a simulation using IRCM are

shown in Figure 3. The model

reads tax return data for the population of artificial taxpayers and

instantiates agents. During instantiation, IRCM estimates a true amount

for the most important Form 1040 income and offset items which is

defined as the reported amount plus imputed misreporting. Imputed

amounts are based on audit results from the TY 2001 National Research

Program (NRP) study. Details of the imputation methodology are

described in Bloomquist (2012).

- 1.9

- Each time step represents one filing cycle (year). Tax

calculations are performed twice for all taxpayers, once using reported

amounts and again using estimated true amounts. The difference in

calculated tax using true and reported amounts is the tax gap for each

filer. By default, IRCM assumes the difference between the true and

reported tax amounts is the amount identified by the tax auditor. An

option is provided to account for underreporting not detected by

examiners (see Bloomquist 2012).

- 1.10

- Tax audits are performed at the penultimate step in each

time loop. During wrap up, the tax agency issues notices to taxpayers

who are not audited but where computer checking of tax returns against

information documents detects some underreporting. In addition, filers

who stop filing, either because they leave the region or no longer have

an obligation to file, are replaced by a new filer having identical

income and network relationships as the "stop filer" being replaced,

but with reporting behavior and memory reset to baseline levels (i.e.,

no memory of a prior audit experience or audits of reference group

members, if that option is selected). The reporting behavior of filers

who are not "stop filers" is also updated at each time step, as is the

audit selection strategy of the tax agency. Finally, data collection

occurs during the wrap-up phase. When the user-specified number of time

steps has completed the model generates output in the form of tables

and charts that can be reviewed and saved for further analysis.

Figure 2. Interaction Between Filer and Tax Agency

Figure 3. IRCM Execution Sequence: Top-Level View Filer Response to a Tax Audit

- 1.11

- Following Gemmell and Ratto (2012)

a filer's response to a tax audit is based on user-supplied

probabilities that cover two mutually-exclusive states (selected for a

tax audit or not selected) and four response categories (perfect

compliance, increase compliance, decrease compliance and no change).

Since taxpayers do not know with certainty that taking a specific

action will result in being selected for a tax audit, this problem is

classified as a partially observable Markov decision process (POMDP) (Ghallab et al. 2004). A POMDP

is a 5-tuple

T = (S,A,P,C,O) (1) where

- S is a finite set of states

- A is a finite set of actions

- P is a probability distribution where for each if there

exists and such that Lastly, we have

?s'?S P(s,a,s') = 1 (2) - is the cost/reward (or expected cost/reward) experienced from transition to state s' from state s with transition probability Pa(s'|s). The quantity Pa(s'|s) is the probability that if action a is executed in state s, then state s' will result. For example, if a taxpayer decides to increase compliance following a tax audit, one can infer that the action is being taken in order to reduce the probability of being selected for an audit (and the associated costs) in future time periods.

- O is a set of observations with

probabilities Pa(o|s),

for any a?A, s?S

and o?O. Pa(o|s)

represents the probability of observing o in state s

after executing action a. Finally, it is required

that the sum of probabilities over the set of observations is 1,

?o?O Pa(o|s) = 1 (3)

- 1.12

- Since the observations in a POMDP represent probability

distributions, rather than exact states of the system, the probability

distributions are called belief states and are

updated using Bayes Rule. The use of Bayes Rule implies that the

probabilities represented by Pa(o|s)

are not static but change as knowledge of the enforcement environment

changes.

- 1.13

- In IRCM neither the belief states (O)

nor the cost functions (C) of individual filers are

modeled explicitly but are implied in the stochastically driven

"choices" made by filers. This approach is taken since, at present, so

little empirical data is available to indicate about how taxpayers

perceive the tax enforcement environment or the specific causes that

motivate changes in observed behavior. However, modeling filers'

response to audits as a stochastic process is supported by observed

behavior in tax compliance laboratory experiments (Alm

1999).

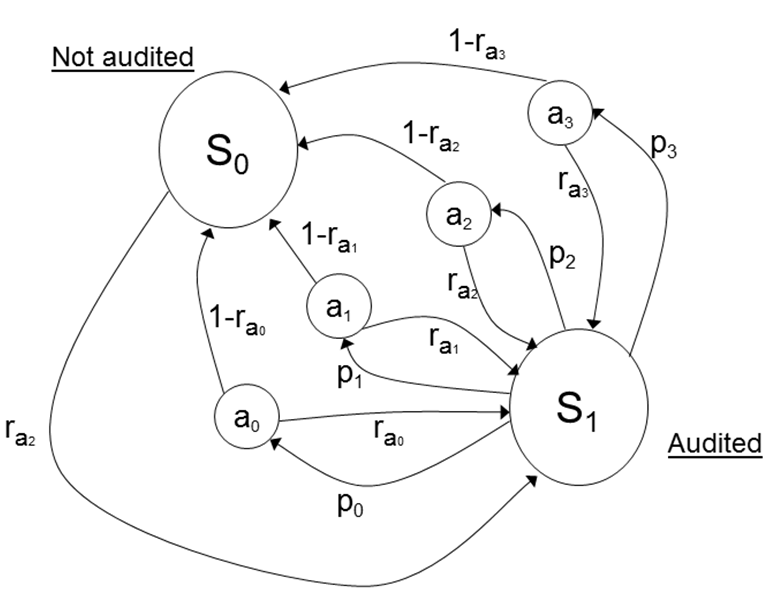

- 1.14

- Figure 4

graphically illustrates the POMDP portraying a filer's response to a

tax audit. The two states are not audited (S0)

and audited (S1). The filer's

belief about the probability of audit is defined as rak

= b(r|ak)

which implies that the filer's perceived probability of being selected

for a tax audit depends on his or her belief about how the baseline

audit probability (r) changes with a change in

reporting behavior (action) ak.

Figure 4. POMDP of the Filer's Response to the Tax Audit Environment - 1.15

- In Figure 4 it is

assumed a0 = no change in

reporting compliance, a1 =

an increase in reporting compliance, a2

= decrease in reporting compliance and a3

= perfect reporting compliance. If not audited in time t

the filer may start or increase underreporting in time t+1

on income subject to little or no information reporting, assuming the

filer has such income from one or more sources. If the filer is audited

in time t, the decision to select action a0…a3

is determined in IRCM by a random draw and the user-specified

probabilities p0…p3.

Although IRCM models the filer's response as a stochastic process,

actual filers are presumed to select an action ak

based on their (heterogeneous and non-stationary) beliefs about the

expected cost associated with that action.

User Interface

- 1.16

- Figure 5 displays

the IRCM's main screen where the user defines the baseline and

alternative scenarios, launches simulations, and views output for the

region and zones. Zones can be displayed with different characteristics

including the number of filers, average reported income, and tax

compliance rate. Tables summarizing key measures can be displayed for

the entire region or for individual zones. From these tables the user

can drill-down to the level of individual employers and tax preparers

located within the selected area. This capability is useful for model

verification and to investigate the spatial variation in filing and

compliance behavior.

Figure 5. IRCM Main Screen

Study

Area Selection and Artificial Taxpayer Data

Study

Area Selection and Artificial Taxpayer Data

- 2.1

- The area selected as the test-bed region is a single county

with 85,000 individual tax filers in TY 2001. The region was selected

based on its overall similarity to the nation on key economic and

demographic characteristics (e.g., age structure, industry structure,

racial composition, per capita income, etc.) as well as number of

filers, which is sufficiently small to be modeled on a personal

computer. In order to preserve taxpayer anonymity yet allow for

independent verification and validation, the model is implemented using

a dataset of artificial taxpayers. The basic idea in creating a dataset

of artificial taxpayers is to substitute cases from the 2001 Statistics

of Income (SOI) Public Use File (PUF) for actual tax returns of

individual filers in the study area. Although most fields in the PUF

are derived from tax forms, SOI modifies the data in order to protect

the identity of individuals. The statistical matching procedure used to

create the database of artificial taxpayers is described in detail in

Bloomquist (2012).

Model Validation and Calibration

- 2.2

- A two-stage approach is used to validate and calibrate the

IRCM. In stage 1 (validation) the model is executed using values from

the PUF (the "SOI reporting regime" option) and output is compared to

IRS estimates of reporting noncompliance published tax gap studies. The

method of comparison follows the cumulative approach of Axtell and

Epstein (1994). They

propose a hierarchy of four levels at which an ABM can be validated. A

model with Level 0 validity is considered to be a caricature of

reality. At this level the model needs to show only that the system as

a whole exhibits behavior that is consistent with the available data

(e.g., the aggregate response of agents to changing environmental

conditions is in the appropriate direction). At Level 1 the model is

expected to be in qualitative agreement with empirical

macro-structures. This is demonstrated by comparing the distributional

characteristics of the actual population to the modeled population. To

be valid at Level 2 the model must show quantitative agreement with

empirical macro-structures. Finally, at Level 3 the model exhibits

quantitative agreement with empirical micro-structures, as determined

from cross-sectional and longitudinal analysis of the agent population.

IRCM's on-board graphical and statistical routines are used to

demonstrate model validity through Level 2 (Bloomquist

2012). Validation at Level 3 requires panel data on

individuals' tax reporting behavior, which is a standard not yet

available to researchers.

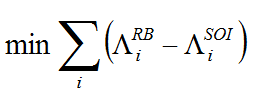

- 2.3

- The goal in stage 2 (calibration) is to find a combination

of values for the six "rule-based reporting regime" parameters that can

closely replicate IRCM output using the "SOI reporting regime" option.

Formally, we want to minimize the sum of differences in reported

incomes between the SOI and rule-based reporting regimes:

(4) In expression (4),

is the calculated

reported amount using the rule-based reporting regime in IRCM for

income type i and

is the calculated

reported amount using the rule-based reporting regime in IRCM for

income type i and  is the calculated

reported amount for income type i using the SOI

reporting regime. A solution for expression (4) is found by inspection

using multi-stage Monte Carlo simulation, the details of which are

described in Bloomquist (2012).

is the calculated

reported amount for income type i using the SOI

reporting regime. A solution for expression (4) is found by inspection

using multi-stage Monte Carlo simulation, the details of which are

described in Bloomquist (2012).

Case

Study

Case

Study

- 3.1

- This section presents a simulation experiment that shows

how the IRCM can be used to assess the impact on taxpayer compliance of

alternative audit case selection strategies. For this experiment the

IRCM is executed using the rule-based reporting regime option with

default values for the six parameters. In addition, it is assumed that

if taxpayer j is audited then each of j's

neighbors or co-workers have a 25 percent chance of increasing their

compliance, a 25 percent chance of decreasing their compliance and a 50

percent chance of no change. Both coworker and neighbor reference

groups are assumed to have a fixed size of five members. Default values

were used for all other model options.

- 3.2

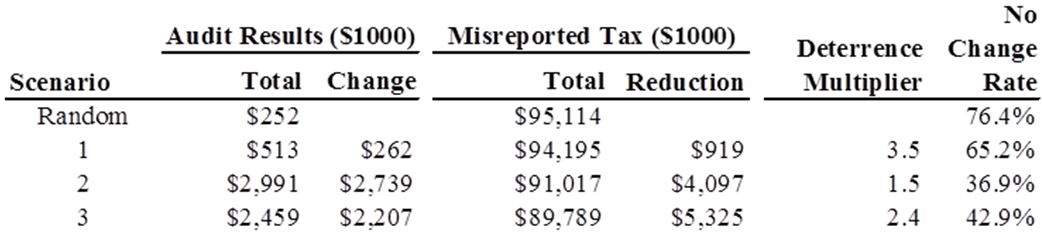

- Table 1 displays the output from IRCM for four alternative

audit allocation strategies. The strategy labeled "Random" is the

baseline for comparing all other strategies and represents the direct

effect (Audit Results), total misreported tax, and no change rate when

individuals are randomly selected for a tax audit. Strategy 1

represents a slight improvement over the Random strategy by assigning

more audits to groups of taxpayers with the highest average expected

yield while not auditing more than one percent of taxpayers in a given

audit class. Strategy 2 is similar to Strategy 1 but has no fixed

constraint on the maximum coverage rate for audit classes. This

strategy has the largest direct tax change ($2,739,000) and the lowest

no change rate. However, this strategy also has the lowest deterrence

multiplier (1.5), which indicates that indirect effects (i.e., a change

in compliance behavior of audited taxpayers in subsequent time periods

and "contagion" effects via social networks) account for a relatively

small share of the total compliance impact. Finally, Strategy 3 allows

up to a 10 percent coverage rate within an audit class but also

requires a minimum of five audits for each audit class to ensure a

minimum level of coverage for all taxpayers. This strategy results in

somewhat lower direct effects and higher no change rate (compared to

Strategy 2) but a higher overall reduction in misreported tax. The

larger reduction in misreported tax for Strategy 3 is due to a larger

indirect effect since this strategy affects a broader segment of the

taxpayer population.

Table 1: Comparing Alternative Audit Allocation Strategies

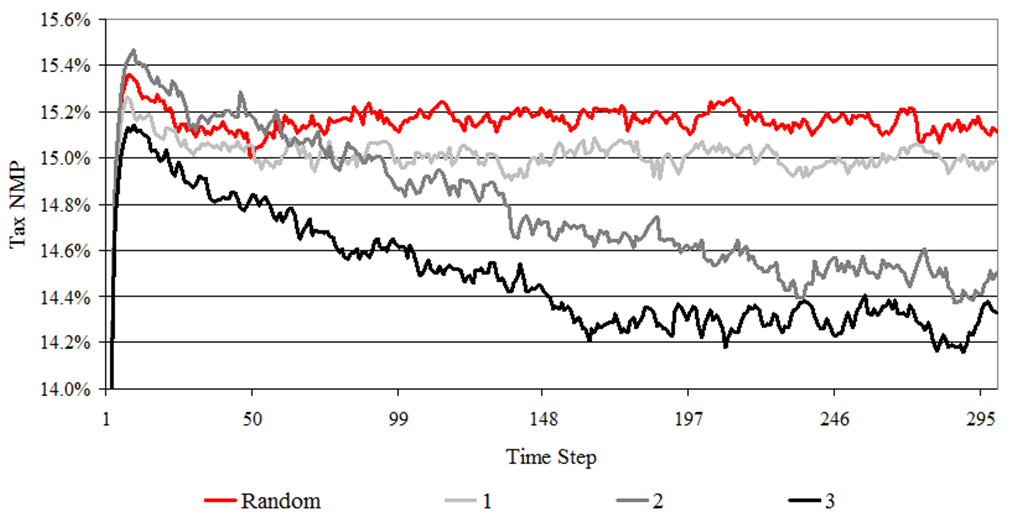

- 3.3

- Figure 6 displays

the time series of the average tax Net Misreporting Percentage (NMP) --

defined as the net amount misreported in the taxpayer's favor divided

by the sum of the absolute values of the amounts that should have been

reported -- of these five simulation runs for the four audit selection

strategies. Based on visual inspection, the model reaches a

stochastically stable solution for all strategies after about 250 time

steps.[1]

Using the simulation output for the last 50 time steps, the random

audit selection strategy has the highest tax NMP at 15.1 percent.

Strategy 1 is the next highest with a tax NMP of 15.0 percent. The NMP

for the Strategy 2 is 14.5 percent. Strategy 3 has the lowest average

tax NMP (highest voluntary compliance) at 14.3 percent.

Figure 6. Model Time Series of Tax NMPs for Alternative Audit Selection Strateg

Conclusion

and Future Research

Conclusion

and Future Research

- 4.1

- The development of the IRCM demonstrates that agent-based

simulation is able to model the complexities of real-world tax systems,

such as differences in reporting compliance at the line item level and

taxpayers' heterogeneous response behaviors, which researchers have

found difficult to incorporate in analytical models of taxpayer

reporting behavior (Alm 1999).

The value of having a model like the IRCM grows as our knowledge of

taxpayer behavior improves. Therefore, an important component to future

development and use of ABMs for tax administration is an ongoing

program of research to further identify and restrict, as appropriate,

the behavioral parameters used in such models. Such a research program

must necessarily employ a range of data collection methodologies as

appropriate including laboratory experiments, field studies, and

surveys.

- 4.2

- The IRCM has undergone independent verification and validation testing by analysts at The MITRE Corporation. The model has been ported successfully to both Windows and Mac-OS platforms running Repast 2.0 and MASON. In addition, researchers from the MITRE Corp., in collaboration with the authors, are porting the IRCM to a multi-processor computing environment using Repast HPC to build a national-scale ABM (~108 U.S. taxpayers). Cline et al. (2014) describes the initial stage of this research to port the IRCM from Repast to Repast HPC.

Acknowledgements

Acknowledgements

- Kim Bloomquist is especially grateful to Professors Robert L. Axtell and Claudio Cioffi-Revilla for their guidance and encouragement on this project, which was done in partial fulfillment of his PhD in Computational Social Science at George Mason University, Fairfax, Virginia. The views expressed herein do not necessarily reflect those of the Internal Revenue Service.

Notes

Notes

- 1Having to perform a simulation for 250 time steps to achieve a stochastically stable solution is an artifact of the optimization routine which reallocates a single audit from the least to the most productive audit strategy at each time step. Without this optimization feature selected (i.e. using the default option of random audit selection) a stochastically stable solution is achieved in 10 to 15 time steps. This can be seen in Figure 6 for the Random Audit Selection Strategy.

References

References

- ALLINGHAM, M.G. &

Sandmo, A. (1972). Income Tax Evasion: A Theoretical Analysis. Journal

of Public Economics 1, 323–338. [doi:10.1016/0047-2727(72)90010-2]

ALM, J. (2010). Testing Behavioral Public Economics Theories in the Laboratory. National Tax Journal 63, 635–658. [doi:10.17310/ntj.2010.4.02]

ALM, J., Martinez-Vazquez, J., & Torgler, B. (2010). Developing Alternative Frameworks for Explaining Tax Compliance. Routledge, New York.

ANDREI, A.L., Comer, K., & Koehler, M. (2014). An Agent-Based Model of Network Effects on Tax Compliance and Evasion. Journal of Economic Psychology 40 (C): 119-133.

ALM, J. (1999). Tax Compliance and Administration. In: Hildreth, W.B. and Richardson, J.A. (eds.), Handbook on Taxation. Mercel Dekker, New York.

ANTUÑES, L., Balsa, J., Respicio, A., & Coelho, H. (2007). Tactical Exploration of Tax Compliance Decisions in Multi-Agent Based Simulation. In: Antuñes, L, and Takadama, K. (eds.), Multi-Agent Based Simulation VII. Springer-Verlag, Berlin.

AXTELL, R.L. (2000). Why Agents? On the Varied Motivations For Agent Computing in the Social Sciences. Center on Social and Economic Dynamics Working Paper No. 27. Brookings Institution, Washington, D.C.

AXTELL, R.L. & Epstein, J. M. (1994). Agent-Based Modeling: Understanding Our Creations. Bulletin of the Santa Fe Institute: 28–32.

BLOOMQUIST, K.M. (2004). Multi-Agent Based Simulation of the Deterrent Effects of Taxpayer Audits. National Tax Association Proceedings: 159–173.

BLOOMQUIST, K.M. (2006). A Comparison of Agent-Based Models of Income Tax Evasion. Social Science Computer Review 24, 411–425. [doi:10.1177/0894439306287021]

BLOOMQUIST, K.M. (2012). Agent-Based Simulation of Tax Reporting Compliance. Doctoral dissertation in Computational Social Science, George Mason University, Fairfax, Virginia. http://digilib.gmu.edu/dspace/bitstream/1920/7927/1/Bloomquist_dissertation_2012.pdf.

CLINE, J, Bloomquist, K.M., Gentile, J.E., Koehler, M., & Marques, U. From Thought to Action: Creating Tax Compliance Models at National Scales. Paper presented at the 11th International Conference on Tax Administration, Sydney, Australia, April 14–15, 2014.

DAVIS, J.S., Hecht, G., & Perkins, J.D. (2003). Social Behaviors, Enforcement and Tax Compliance Dynamics. Accounting Review 78, 39–69. [doi:10.2308/accr.2003.78.1.39]

GEMMELL, N. & Ratto, M. (2012). Behavioral Responses to Taxpayer Audits: Evidence from Random Taxpayer Inquiries. National Tax Journal 65, 33–58. [doi:10.17310/ntj.2012.1.02]

GHALLAB, M., Nau, D., & Traverso, P. (2004). Automated Planning: Theory and Practice. Morgan Kaufmann Publishers Inc., San Francisco, California.

HOKAMP, S. & Pickhardt, M. (2010). Income Tax Evasion in a Society of Heterogeneous Agents – Evidence from an Agent-Based Model. International Economic Journal 24, 541–553. [doi:10.1080/10168737.2010.525994]

JANSSEN, M.A. & Ostrom, E. (2006). Empirically Based, Agent-Based Models. Ecology and Society 11, 37. http://www.ecologyandsociety.org/vol11/iss2/art37/.

KOROBOW, A., Johnson, C., & Axtell, R.L. (2007). An Agent-Based Model of Tax Compliance with Social Networks. National Tax Journal 60, 589–610. [doi:10.17310/ntj.2007.3.16]

MITTONE, L. & Patelli, P. (2000). Imitative Behaviour in Tax Evasion. In: Stefansson, B. and Luna, F. (eds.), Economic Modelling with Swarm. Kluwer, Amsterdam.

NORTH, M.J., Tatara, E., Collier, N.T., & Ozik, J. (2007) Visual Agent-based Model Development with Repast Simphony. Proceedings of the 2007 Conference on Complex Interaction and Social Emergence, Argonne National Laboratory, Argonne, IL USA. https://cc.ist.psu.edu/BRIMS2013/archives/2008/Tutorials/08-BRIMS-001.pdf. Archived at http://www.webcitation.org/6LIwtrn5z.

SZABÓ, A. Gulyÿs, L., & Tóth, I.J. (2008). TAXSIM Agent Based Tax Evasion Simulator. Paper presented at the European Social Simulation Association Conference (ESSA).

WEBER, M. (2004). General Description Booklet for the 2001 Public Use Tax File. Individual Statistics Branch, Statistics of Income Division, Internal Revenue Service.

ZAKLAN, G., Westerhoff, F., & Stauffer, D. (2009). Analysing Tax Evasion Dynamics via the Ising Model. Journal of Economic Interaction and Coordination 4, 1–14. [doi:10.1007/s11403-008-0043-5]