© Copyright JASSS

Wolfgang Kerber and Nicole J. Saam (2001)

Competition as a Test of Hypotheses:

Simulation of Knowledge-generating Market Processes

Journal of Artificial Societies and Social Simulation

vol. 4, no. 3,

<https://www.jasss.org/4/3/2.html>

To cite articles published in the Journal of Artificial Societies and Social Simulation, please reference the above information and include paragraph numbers if necessary

Received: 14-Jun-00

Accepted: 30-Mar-01

Published: 30-Jun-01

Abstract

Abstract

-

Hayek's well-known evolutionary concept of "competition as a discovery procedure" can be characterized as a parallel process of experimentation, in which rivalrous firms generate and test hypotheses about the best way to fulfill the consumers' preferences. Through this permanent process of variation and selection of hypotheses (innovation / imitation) a process of knowledge accumulation can take place. The central aim of our paper is to model the basic Hayekian learning mechanism, which consists of experimentation and mutual learning, and to ask for determinants of the rapidity of knowledge accumulation. In our multilevel simulation model, on the micro level, firms create new hypotheses through mutation. On the macro level, on the market, these hypotheses meet and the best firm is determined. All firms then imitate the best firm. In our model, 100 of these periods which consist of an innovation and an imitation phase are simulated. We presume that decentrality is crucial for the working of the knowledge-generating process, because a larger number of independently innovating firms leads to more experimentation. We investigate into the impact of firm concentration, the impact of the decentralization of firms, as well as the impact of impediments in imitation like lock-ins on the growth rate of knowledge accumulation. Our simulation results show that the number of firms is positively correlated with the rapidity of knowledge accumulation suggesting a new argument for a critical assessment of mergers in competition policy.

- Keywords:

- Competition, Hayek, knowledge, innovation, merger control, concentration, simulation, lock-in, evolutionary economics

Introduction

Introduction

- 1.1

- The theoretical background of the simulation models in this paper is an evolutionary concept of knowledge-generating competition, which can be understood as an attempt to integrate different evolutionary approaches to market competition (Kerber 1994 and Kerber 1997):

- Austrian market process theories, particularly Hayek's concept of "competition as a discovery procedure", which conceives competition as a process of experimentation, in which new knowledge is generated and spread (Hayek 1948 and Hayek 1978; Kirzner 1997).

- Schumpeterian approaches, which conceive competition as a dynamic, rivalrous process, in which entrepreneurs advance with new innovations and rival competitors follow by imitation, implying the enhancement of economic development (Schumpeter 1934; Heuss 1965).

- Evolutionary theories in innovation economics, which explicitly use the biological analogy of variation and selection for analysing innovation-imitation processes as processes of knowledge accumulation (Nelson/Winter 1982; Dosi/Nelson 1994; Nelson 1995).

- 1.2

- The basic idea of the evolutionary concept of knowledge-generating competition is the Hayekian notion that market competition should be seen as a parallel "trial and error"-process of experimentation, in which the competing firms create and test new hypotheses about the best ways to fulfill the preferences of the customers in the market. Although Hayek's article (1978)"Competition as a Discovery Procedure" is well-known and found as reference in numerous articles and books, there have been surprisingly few attempts to elaborate on this concept in more detail. This paper will model central aspects of Hayek's notion of competition as a process of experimentation and mutual learning. With our model we do not want to analyse all kinds of processes that change and accumulate knowledge in market competition, rather we restrict our analysis on the specific learning effects of the Hayekian discovery procedure "market competition". But we contend that this Hayekian concept of competition can contribute crucial insights into the working of market processes and therefore also into the understanding of innovation processes in market economies.

- 1.3

- Beyond our intention to contribute to the general research on Hayek's concept of "competition as a discovery procedure", our simulation studies want to shed some light on one of the main issues in industrial economics and competition policy, i.e. the importance of decentralization - or vice versa: concentration - for the working of markets and competition processes. Whether (horizontal, vertical or conglomerate) firm concentration is a crucial problem for market economies has been discussed highly controversially since the nineteenth century and has been the most important issue in competition policy in the last few decades. As a consequence of this discussion, all important industrialized states have established sophisticated merger policies to tackle with the potential dangers of concentration. In this paper we want to contribute to this discussion by attempting to analyse the impact of more or less decentralization on the knowledge-generating effects of competition as an evolutionary process of parallel experimentation. The basic idea is that in a more decentralized economy more firms search independently from each other for innovations implying a higher degree of experimentation and therefore more positive or negative experiences as feedback from the market. So the firms can learn more from each other leading to a more rapid process of accumulation of knowledge.

- 1.4

- The thesis that decentralization allows for more experimentation and therefore more learning is well-known, but so far its implications for the assessment of firm concentration in competition policy have not been analysed thoroughly. We show that a higher degree of centralization might have negative effects on the extent and rapidity of the knowledge generation that takes place in the Hayekian discovery procedure "market competition". Due to the specific assumptions of the Hayekian evolutionary approach we can only use a simulation model for our analysis. In our simulations two basic hypotheses will be tested:

- The higher the firm concentration is, the lower is the rapidity of the knowledge accumulation process.

- The more activities are performed within one firm and simultaneously tested in the market, the lower is the rapidity of the knowledge accumulation process.

We show that hypotheses I and II can be confirmed, but that the results depend considerably on specific assumptions, as is shown, for example, for the assumption of the imitability of the activities of the leading firm.

- 1.5

- Our paper is organised as follows. In section 2, we present the general theoretical background, dealing particularly with the theories of Hayek and Popper, and outline the basic ideas of the concept of knowledge-generating competition as an evolutionary process of experimentation and mutual learning. We present and explain our two basic hypotheses I and II about the importance of decentralization for the process of knowledge generation in competition processes and argue that imitability can be a crucial condition for these knowledge-generating effects (hypothesis III). In section 3, it is shown how we have designed our simulation model, including the specific information and learning assumptions we make from an Hayekian market process perspective. The results of the simulation experiments are presented and discussed in section 4. At the end of the paper some conclusions and further research perspectives can be found (section 5).

The Approach: Competition as a Process of Experimentation

The Approach: Competition as a Process of Experimentation

Theoretical Background: Basic Ideas of Hayek and Popper

- 2.1

- Hayek's most important contribution to economic theory is his careful elaboration of the role of knowledge in economics and his insistence that dealing with knowledge problems is the most important issue in economics.[1] From this perspective he attacked the neoclassical model of perfect competition with its assumption of perfect knowledge as fundamentally flawed: "The real problem in all this is not whether we will get given commodities and services at given marginal costs but mainly by what commodities and services the needs of the people can be satisfied most cheaply. The solution of the economic problem of society is in this respect always a voyage of exploration into the unknown, an attempt to discover new ways of doing things better than they have been done before" (Hayek 1948, 100f.). Due to epistemological reasons nobody (neither the firms nor the state nor science) knows what the "best" solutions are to the problems of the consumers. What the preferences of the consumers are (and how they can be fulfilled best) "cannot be properly regarded as given facts but ought rather to be regarded as problems to be solved by the process of competition" (Hayek 1948, 96). Therefore Hayek's basic idea is that competition should primarily be seen as a "discovery procedure" (Hayek 1978), in which new knowledge is generated. By comparing this discovery process with experimentation in science, Hayek emphasized its character as an experimental process of trial and error, whose outcome is inherently unpredictable (Hayek 1979, 68). Crucial for Hayek's approach to competition is that the ultimate test for the question which competitors have the superior products or services in regard to the preferences of the consumers can only be the market itself (profit/loss-feedback). Therefore only the market process can reveal which of the innovations of the competitors are the superior problem solutions that should be imitated and spread by other firms. This is the meaning of Hayek's contention that competition should be seen as a procedure for the discovery of facts which without its existence would have remained unknown (Hayek 1978, 179). In his theory of cultural evolution Hayek (Hayek 19791979) argued that the present rules in a society can be seen as the result of an evolutionary process of variation and selection, in which the successful rules survived and the less successful ones were eliminated. Since in Hayek's view rules incorporate knowledge the Hayekian theory of cultural evolution can be interpreted as an evolutionary process of the development of institutions, in which knowledge is accumulated.

- 2.2

- Another strand of thought, which can be used to make Hayek's evolutionary concept of competition as a process of experimentation more precise, is Popper's theory of the "growth of knowledge" that is directly linked to his ideas of an evolutionary epistemology (Popper 1972). For Popper, too, the starting-point is the knowledge problem: All human knowledge is fallible, i.e. human knowledge is essentially conjectural and very often erroneous and false. For fundamental epistemological reasons human beings can never know whether their knowledge is true even if they had found truth (Harper 1996, 20-21). Consequently, Popper claimed that learning has to be seen as a permanent process of experimentation and elimination of errors. For Popper this general "Darwinian theory of growth of knowledge" can be applied both to biological evolution and to the development of human knowledge: " ... there is a natural selection of hypotheses: Our knowledge consists, at every moment, of those hypotheses which have shown their (comparative) fitness by surviving so far in their struggle for existence; a competitive struggle which eliminates those hypotheses which are unfit" (Popper 1972, 261). From this perspective, we can interpret Popper's evolutionary theory of "growth of knowledge" as a problem-solving process of variation and selection, in which new conjectures (or hypotheses) permanently are tried out, tested and selected by the relevant selection environment. The improving of the fitness of the problem solutions can be interpreted as a learning process or as a process of knowledge accumulation.[2]

- 2.3

- From this perspective, Hayek's competition as a discovery procedure can be interpreted as a parallel process of experimentation, in which the firms as suppliers primarily compete for searching the best solutions to the customers' problems. Consequently, competing firms generate new hypotheses (conjectures) about the best way to solve the customers' problems (or to fulfill the consumers' preferences). Since it is not known what the best problem solution is, it is a crucial part of the role of the entrepreneur to develop new hypotheses about promising problem solutions and test them in the market ("entrepreneurial conjectures", Harper 1996; "problem-solving entrepreneurs", Mantzavinos 2001, 193). Therefore competition can be seen as a process in which rivalrous firms generate and test different hypotheses about good problem solutions. The customers on the demand side of the market are the "reality", who assess the "quality" of the competing problem solutions through their buying decisions. Therefore they decide, which of these hypotheses are corroborated or refuted. Therefore the market system can be seen as "a means of organizing the search for knowledge, [which] operates by a system of conjecture, criticism ... and testing ..." (Loasby 1993, 213). Since the new hypotheses of the firms, e.g. new inventions, cannot be predicted due to the creativity of human beings, these competition processes have to be seen as never-ending open evolutionary processes.

Competition as an Evolutionary Process of Parallel Experimentation and Mutual Learning

- 2.4

- From these basic ideas an evolutionary theory of knowledge-generating competition can be developed, in which competition can be interpreted as a parallel process of experimentation, in which the firms generate and test different (and therefore competing) hypotheses, make experiences and learn mutually from each other. [3] In the following we present the basic assumptions and learning mechanisms of the Hayekian concept of competition as an experimental process, which will be the basis of our formal simulation model in section 3.

- 2.5

- In this evolutionary theory of competition[4] it is assumed that all market participants (on the supply and demand side) have subjective and fallible knowledge, which changes due to cognitive processes encompassing learning and creativity. The products (or services) offered by firms are based upon their hypotheses or conjectures on how to solve the problems of consumers (or firms in intermediate markets) best. These products can be described as a complex bundle of traits of performance, as e.g. the technical features and quality of the product, its image, service, warranties, price etc.. Each firm has to perform a set of particular activities to develop, design, produce, administer, finance, advertise and sell its products, which again requires the corresponding knowledge, skills and capabilities.[5] In the evolutionary theory of Nelson/Winter (1982) the knowledge of a firm is represented by its set of routines, which can be interpreted as the "genes" of the firm. Crucial is that the entire knowledge of the firms, be it explicit or tacit knowledge, skills or routines, has to be seen as fallible and therefore has the character of conjectures or hypotheses. It may turn out as success or failure. An important consequence of the subjective character of knowledge and the creative cognitive processes is that in different firms different hypotheses are developed on what the consumers want and on how their problems can be solved as good and efficient as possible. This heterogeneity of firms is crucial for the working of these knowledge-generating processes of competition as parallel processes of experimentation.

- 2.6

- By choosing among the different problem solutions of the firms the consumers decide on the basis of their own fallible knowledge about the relative quality of the performances of the firms for the solution of their problems. In that respect, the buying decisions of the consumers can be interpreted as the test of the hypotheses of the firms about the attractiveness of their offers for the consumers and therefore as selection decisions. The choices of the consumers translate in market shares, revenues, and ultimately - after taking the costs into account - in profits and losses of the firms. If these competition processes are working in a satisfactory way, the size of the profits or losses can be interpreted as an indicator of the relative success or failure of the hypotheses of the firms in comparison with their competitors. It is important to note that in competition it is not the absolute performance which is important for making profits or losses, but the relative performance compared to other competitors (Alchian 1950).

- 2.7

- The emergence of profits and losses according to the relative performance of the firms has to be seen as the crucial feedback mechanism in these competition processes in two different ways:

- Information feedback: The size of profits indicates the relative quality of the hypotheses of the different firms, revealing which set of hypotheses has turned out as being the superior knowledge. In this way new knowledge is being revealed, which has not been known before.

- Motivation feedback: Profits and losses have to be seen as incentives which trigger off the search for new and better knowledge and simultaneously exert pressure on the relatively less efficient firms to imitate their successful competitors which tends to lead to the diffusion and general use of this new knowledge.

- 2.8

- The Hayekian process of experimentation can be integrated with the Schumpeterian notion that competition is a process of innovation and imitation (Schumpeter 1934), in which some firms advance in competition with successful innovations, which are subsequently imitated by others. Hence we can analytically separate the process of experimentation in sequences of innovation phases, in which new hypotheses are generated, tested and the superior hypotheses are revealed, and subsequent imitation phases, in which the superior hypotheses of the leading firm are imitated by the non-leading firms. Therefore, competition can be seen as an innovation-imitation process in which firms experiment with new hypotheses on how to solve problems best and learn mutually from the positive and negative experiences of their competitors. Consequently, these competition processes can be interpreted as processes of knowledge accumulation.

- 2.9

- In modern evolutionary innovation economics parallel processes of experimentation in competition have also be seen as evolutionary processes of variation and selection (Alchian 1950; Nelson/Winter 1982). If we apply the approach of "population thinking",[6] we may assume that the relevant population consists of all firms in a particular industry. They differ in their knowledge, which can be defined as their sets of hypotheses which they are using to carry out their activities. Population thinking now asks, in which way the frequency distribution of such hypotheses in this population, e.g. the frequency distribution of the applied production technologies in this industry, is changing over time. This frequency distribution can be changed (1) through the generation of new hypotheses (e.g. new technologies) and (2) through different probabilities of reproduction for different hypotheses. The first mechanism of change represents variation. The second mechanism of "differential reproduction" can be interpreted as the result of selection. It reveals the different fitness or adaptedness of the hypotheses to the relevant conditions of selection, as e.g. the suitability of the performances of the firms for the solution of the consumers' problems. Now the basic idea is that through variation-selection-processes the traits of the entities in the population, i.e. here the knowledge of the firms in that industry, systematically develops in the direction of an increasing adaptedness to the relevant conditions of selection, as here e.g. the preferences of consumers. This can be interpreted as a systematic process of accumulation of knowledge about how to carry out the activities of the firms to be successful in the market.[7]

- 2.10

- But certainly these knowledge-generating competition processes cannot be expected to run smoothly and without problems:

- Since also the consumers have only fallible knowledge they might initially make wrong decisions with regard to new products until they have made enough experience. This may imply difficulties and lags concerning the quality of the information feedback about the performances of the firms for solving the problems of the consumers.

- Imitation of other successful firms might be difficult, because often it is a time-consuming, complex and sometimes risky activity. Its success is not guaranteed (Dosi 1988).

- Another important problem is that the profit/loss-feedback can only be interpreted as an overall evaluation of the entire bundle of hypotheses for carrying out all the activities of the firms. Therefore firms often do not really know on what particular knowledge their success or failure is based (see section 2.11 - 2.20).

- Beyond that path dependences can occur, which might lead to lock-in effects (Arthur 1989). This implies a wrong selection of knowledge.

This is only a small selection of potential problems, and only two of them (imitability problems and the bundle problem) will be discussed in this paper.

Variety, Firm Concentration and the Growth of Knowledge in Evolutionary Competition Processes

- 2.11

- In contrast to neoclassical competition theory, in which heterogeneity among firms has always been seen as an indicator of the imperfection of competition and therefore as an example of market failure, in evolutionary approaches to competition the heterogeneity of firms and their knowledge are seen as an important positive resource that stimulates economic evolution. Without variety in the population of hypotheses, selection cannot perform its role of identifying and selecting the relatively best problem solutions, sifting out the less good ones and therefore systematically lead to a better adaptedness to the relevant selection environment (here: the consumer preferences). But: "While innovation enhances variety, imitation and competition consume variety so that continued economic progress depends on there being a balance between the different mechanisms ..." (Metcalfe 1989, 55). Therefore, it is crucial for the maintenance of the knowledge-generating processes of competition that new variety is permanently reproduced in the market by the innovative activities of firms.[8] The existence of many independent and heterogeneous sources of innovation seems to be a crucial determinant for the extent of the knowledge-generating effects of market competition. From this perspective, the question arises, whether the concentration of firms on markets can be a problem for the working of these knowledge-generating competition processes. The basic question is, whether a reduction of the number of firms, which innovate independently,[9] will lead to an impeding or slowing down of these knowledge-accumulating competition processes and will therefore also slow down economic and technological progress.

- 2.12

- Up to now the main argument against high concentration is that concentration increases individual or collective (oligopolistic) market power and therefore leads to too high prices, which damage the consumers and impair efficient allocation (dead weight-losses). The discussion about concentration and therefore about the assessment of mergers is still dominated by the question, whether the disadvantages from a merger with high market shares, i.e. potential market power and allocative inefficiencies, are outweighed by potential advantages of the mergers, namely productive efficiencies as economies of scale (see e.g. the Trade off-model of Williamson 1968).[10] Therefore, the main criteria for the assessment of mergers are the market shares of the merging firms, the market share of the remaining competitors, entry barriers, buying power, financial resources and the question of efficiencies, which arise from the merger (efficiency defense in U.S antitrust).[11] But, up to now, the effects of mergers on innovations and particularly on the knowledge-generating character of competition as an experimentation process via the reduction of variety in the market are not taken into account in merger control, neither in Germany, not in the U.S., and not in the EC.[12] If it can be shown that a reduction of the number of firms implies a slowing down of the knowledge-accumulating process in competition, an entirely new criterion for the assessment of mergers can be suggested.

- 2.13

- Therefore, with our simulation model, we want to test the following hypothesis:

Hypothesis I: The average growth rate of the knowledge accumulation process in

competition increases with the number of independently innovating firms.

- 2.14

- This hypothesis implies that mergers, which, per definionem, reduce the number of independent firms in the market, would reduce the knowledge-generating effect of evolutionary competition and therefore slow down the knowledge accumulation processes in market competition. Our intuition is that a smaller number of competing firms will generate less different hypotheses, make less experiments and therefore less experiences, which would lead to a slower discovery of new innovations, to a lower level of mutual learning from competing firms, and therefore to a slower accumulation of knowledge. Or in other words: A lower number of experiences through fewer innovating firms contributes less to the common pool of knowledge, from which all firms can improve their performance by imitation. There are, of course, counter-arguments which also have to be taken into account in an overall appraisal of a reduction of the number of firms. If, for example, larger firms have advantages in the innovation process, e.g. through larger financial or technological resources, then these effects can outweigh the negative effects of a reduction of the number of the firms.[13] But in a first step we want to assume that no such effects exist.

- 2.15

- But decentralization does not only mean the number of competing firms on a particular relevant market (horizontal firm concentration). If we argue from the perspective of transaction cost theory in the tradition of Coase and Williamson (1985), the extent of decentralization also depends on the question, whether certain activities are performed within the firm or bought from the market (coordination by market or hierarchy). Vertical integration and conglomerate concentration are two additional dimensions of the size of the firm beyond the criterion of the market share (horizontal concentration). So, the extent of decentralization in a market economy also depends on the number of activities, which are performed within one firm.

- 2.16

- In what way does the number of activities in one firm relate to the evolutionary knowledge-generating competition processes in the Hayekian sense? The decisive point is that from a Hayekian point of view only the profit-loss feedback from the market test renders information about the relative quality of the hypotheses of the firms. The more activities a firm performs within its own boundaries, the larger is the bundle of hypotheses, which simultaneously are tested in the market. Since we assume that each firm gets only one profit/loss feedback from the market, the informational feedback from the market is much less specific, if this bundle of hypotheses is large because of a large number of activities within the firm, than in the case of small firms. In the latter case only a few activities are carried out and therefore only a small bundle of hypotheses is tested simultaneously in the market. Since the profit/loss feedback gives only information on the average quality of all activities a firm carries out, firms with many activities get less information on the quality of particular activities from the market test than firms with fewer activities.[14]

- 2.17

- Compare, for example, the case of multi-product firms - each firm sells 20 products and gets one overall profit/loss feedback from the market -, with the case of one-product firms. If in the first case a firm makes a larger profit than their multi-product competitors, it can only conclude that its products (and therefore its hypotheses), on average, are superior to those of their competitors. But it is highly probable that in this set of 20 products there are relatively weak products too, which are inferior to some products of their competitors. But the weakness of these products is compensated by the strength of very good other products. Since the firm - due to the unspecific profit/loss feedback - does not really know which products are the strong and which the weak ones, these firms have difficulties to improve their own set of products. In the same way the other competitors also have difficulties to imitate the superior hypotheses of the leading firm, since - due to their lacking knowledge - they cannot imitate selectively. So both the firm itself and its competitors learn less from the profit/loss feedback, if the number of activities is large. But if only firms with one product compete, the profit/loss feedback to these firms gives much more specific information feedback on the quality of their products. Therefore, we can expect that in competition processes between firms with many activities the knowledge accumulation process is slower than in the case that firms with fewer activities compete.[15] Therefore, we want to test the following hypothesis:

Hypothesis II: The average growth rate of the knowledge accumulation process in

competition decreases with the number of activities of the firms, which are

simultaneously tested in the market.

- 2.18

- In the last section we mentioned some problems, why we cannot expect that competition processes will always lead to a process of knowledge accumulation, as e.g. knowledge problems of consumers, problems of imitation, or path dependences due to dynamic economies of scale or technological external effects, all of which might imply deficiencies or distortions of market selection. Since all of these problems influence the process of knowledge-generation in competition, they are candidates for further research. In this paper we want to focus on how problems of imitability can influence the process of knowledge accumulation in competition. In contrast to neoclassical economics it is well-known in the evolutionary branch of innovation economics that imitation can be a difficult process, which might take considerable time or can even fail at all. The reasons are that often the imitating firm cannot observe the successful activity of the leading firm (non-observability e.g. due to a policy of secrecy) or is not allowed to imitate because of intellectual property rights. Additional reasons are that the superior knowledge of the leading firm might have the character of tacit knowledge, which cannot be transmitted to others by definition, or that the imitating firms do not have the necessary complementary knowledge to use the superior hypotheses of the leading firm. The existence of problems of limited imitability is empirically well confirmed (Dosi 1988).

- 2.19

- We are interested in the consequences of limited imitability on the Hayekian competition as a process of experimentation. What happens if - e.g. due to tacit knowledge problems - not all activities can be imitated in competition? Since in our concept of evolutionary competition processes the accumulation of knowledge is based upon processes of mutual learning, we suggest that the non-imitability of at least one activity will have considerable effects on the whole process of knowledge accumulation, both on the overall growth rate and perhaps also on the dynamic pattern of the accumulation process. It is particularly interesting whether large fluctuations might emerge or even lock-in effects, e.g. in the case that the leading firm is superior because of its non-imitable activity. So we want to suggest the following hypothesis:

Hypothesis III: The non-imitability of at least one activity will have a considerable impact

on the pattern of the knowledge accumulation process and particularly

decrease its average growth rate.

- 2.20

- The investigation of the impact of non-imitability is one example, how modifications of our basic assumptions influence the knowledge accumulation process.

The Model

The Model

Basic Model: Introduction

- 3.1

- Since we are only interested in the basic learning mechanism of the Hayekian concept of competition we have restricted our model to the analysis of this process of mutual learning in competition. We assume that several firms exist in a market which by improving their performance compete for customers on the demand side in order to increase their profits. But we do not model the whole market with an explicit demand function, cost functions, prices, quantities, and profits, but concentrate on the basic learning mechanism. Therefore, in this basic model, it is sufficient to represent the performance of each firm and therefore its knowledge by a fitness parameter. The fitness parameter represents the relative competitiveness of the firm in comparison to other competing firms. Differences in the fitness of firms imply different profits and losses of the firms. Although we assume that regularly new ideas emerge due to the creativity of the agents, nobody is able to anticipate them in detail. Therefore, innovations are modelled by a stochastic process.[16] The knowledge accumulation process emerges from the sequence of innovation-imitation processes which take place every period. We have developed a multilevel simulation model[17] to analyse this process. Beyond that, we use the very specific information assumptions and learning mechanisms which stem from our Hayekian approach.

- 3.2

- Let us assume that in a market n firms exist. Each of them produces one product which consists of a complex bundle of traits and can be produced and marketed by using a set of m activities. Each of these activities can be performed in a different way. It depends on the specific knowledge of the firms, i.e. their hypotheses about the effects of these activities, how they deem best to apply these activities. Each of these m activities contributes to the total performance of a firm which is decisive for its competitiveness and success on the market. From an evolutionary perspective we can call the total performance of a firm its total fitness and the contribution of a particular activity to the total performance the fitness of this activity. Furthermore, we assume that the total fitness of a firm can be calculated as the arithmetical mean of the fitnesses of all activities.

- 3.3

- If fijt denotes the fitness of activity aj (j = 1 ... m) of firm i at time t and Fit the total fitness of firm i (i = 1 ... n) at time t, it follows:

|

|

(1)

|

Let Gt denote the average total fitness of all firms in the market at time t:

|

|

(2)

|

- 3.4

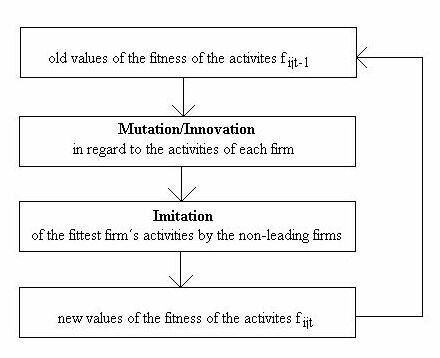

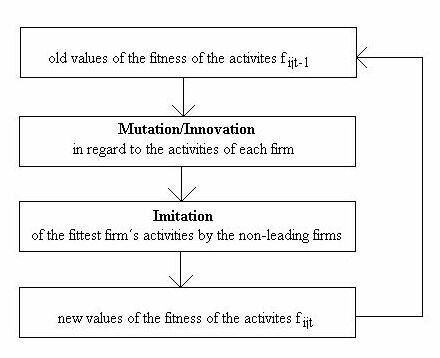

- In the model the development of the fitness of the firms is analysed over a number of periods in which the firms attempt to improve the fitness of their activities by innovation and imitation. Every period can be seen as consisting of two phases, an innovation phase and an imitation phase, through which the old values of the fitness parameters fijt are transformed into the new ones fijt+1(see Figure 1).

|

|

Figure 1. Graphic representation of the formal model

|

Basic Model: Innovation Phase

- 3.5

- During the innovation phase, it is assumed that all firms search for new and better hypotheses for applying their m activities in order to improve their fitness. These innovations are modelled as stochastic processes of drawing from sets of potential routines for each activity. The existence of m activities implies m independent stochastic innovation processes. It is assumed that the fitness of the newly drawn routines of the activities are normally-distributed with a variance σ2 and an expected value E(f 'ijt). f 'ijt denote the fitness of the activities and F'it the total fitness of a firm i after innovation but before imitation in time period t. In order to isolate the effect of mutual learning in the competition process, we assume that the expected value of the stochastic innovation process is identical with the fitness value of that activity in the last period:

|

|

(3)

|

- 3.6

- This assumption implies that the probability of improving or worsening the fitness of activities by innovation is the same. Consequently, an isolated firm which cannot learn from others cannot expect to improve its fitness values in the long run.

- 3.7

- According to our Hayekian approach, we use very specific knowledge assumptions. Since we assume that knowledge about the superiority of the newly drawn routines can only stem from the market feedback, the firms are not able to assess the fitness of their activities directly, i.e. they do not know the values of fijt or f 'ijt. Consequently, they are not able to compare the fitness of their old routines with the fitness of their new ones. Therefore, we assume that they try out the new routines and wait for the feedback from the market. All n firms innovate at the same time in the same stochastic way. This leads to a variety of performances (fitness values) of the m activities of all n firms and therefore also to a variety of total fitness values F'it for these n firms. Each firm innovates by chance and each mutated routine of an activity of a firm is a normally distributed random number with expected value E(f 'ijt) and variance σ2. The standard deviation σ can be interpreted as mutation rate (σ > 0). It is an important parameter in our model, whose effects on the simulation results will be analysed by sensitivity analyses in further studies.

- 3.8

- What is the feedback of the firms from the market, i.e. what kind of knowledge is revealed by the market process? Since, in competition, only those firms succeed and make profits which are superior to their competitors the firms with the highest total fitness will make profits and those with lower ones losses (or smaller profits). It is assumed that the firms are only informed about the profits (or losses) of all firms, i.e. their own profits and those of all other firms. From the ranking of the profits they deduce the ranking of the total fitness values F'it of all firms because both kinds of rankings are assumed to be identical.[18] But, they do not know the real values of the total fitness F'it, not even their own. Particularly, they do not get any feedback about the fitness of their single activities f 'ijt (or fijt). All information the market does feed back to them via profits/losses is whether their total fitness is larger or smaller than that of their competitors. This is the logical consequence of the Hayekian notion that only the market feedback by profits and losses can be seen as the real test of the superiority / inferiority of the performance of the firms. They do not get any feedback about the fitness of their activities in detail, but, only about the average fitness of the routines of the whole bundle of all activities. Therefore, the firms are faced with the difficult problem that they do not really know why they are successful or why they fail. They do not know which of their activities (e.g. the quality or design of the product, the marketing, the service or the price policy) are responsible for the observable fact that they are better or worse than their competitors. They can only conclude that their set of routines (and therefore the quality of their knowledge) is on average better or worse than those of their competitors. This is the starting-point for the second phase, the imitation phase.

Basic Model: Imitation Phase

- 3.9

- Since the ranking of the total fitness of the firms is revealed by the market test all firms are able to identify the best firm. Beyond that, it is also assumed in this first version of the model that all firms are able to observe the way in which all other firms use their activities, i.e. they know their products, production technologies, marketing strategies etc. Since we also assume that all firms have sufficient competence to imitate the activities of the other firms, one strategy for improving one's fitness is to imitate the activities of the best firm. Therefore, in the imitation phase, we assume that the non-leading firms imitate the activities of the best firm. But since we know from innovation economics that imitation is not an easy task - imitation takes time and may even fail - we assume that the non-leading firms are only able to imitate the activities of the best firm to a certain extent. Therefore, we introduce an imitation rate λ (0 < λ < 1) which indicates the percentage by which the non-leading firms are able to catch up the difference between their own fitness values and those of the best firm. For example, an imitation parameter value of 0.5 implies that each non-leading firm can catch up 50% of the difference between its fitness values and those of the best firm.

- 3.10

- Let k denote the fittest firm and f 'kjt* and F'kt* the fitness value of the activity j and the total fitness of the best firm k after innovation:

|

|

(4)

|

- 3.11

- Then, the imitation process is described by equation (5):

|

|

(5)

|

- 3.12

- Whether a firm imitates another firm's activities is a discrete problem. If the total fitness of firm i after the innovation in period t is smaller than the total fitness of the fittest firm F'kt, firm i will try to imitate all activities of the fittest firm k. As a consequence, all fitness values of its activities will increase by a certain percentage of the difference between the fitness values of its activities and those of the leading firm (imitation rate λ). However, the fittest firm will not change its activities (fijt = f 'ijt ).

- 3.13

- Our information assumptions have an important implication. We cannot conclude that the fitness values of the activities of the non-leading firms are always smaller than those of the leading firm. The leading firm has only a higher value of the total fitness. This implies that in regard to specific activities non-leading firms might have higher fitness values than the leading firm. For example, a non-leading firm may have a better marketing strategy than the best firm, but may have an inferior total performance because of the low quality of the product it sells. This implies that in regard to particular activities the non-leading firms might reduce their fitness by imitating the best firm. And the larger the number of the activities, the higher is the probability for this case. But, since they do not know which of their activities are better or worse, they will definitely improve their total fitness only by imitating all activities of the best firm.

Basic Model: Simulation Process

- 3.14

- After the imitation phase of the first period, the second period begins, in which again all firms innovate by a stochastic process, the overall best firm is being revealed, and the non-leading firms try to imitate the best one. In our model, 100 of these periods which consist of an innovation and an imitation phase are simulated. Table 1 gives an overview of all variables and parameters of the model as well as their meaning and initialization. The basic model cannot be analysed analytically. Therefore, we developed a simulation model. The model was implemented in MIMOSE (Möhring/Ostermann 1996).[19]

|

| Table 1: Variables and parameters of the formal model |

|

| Variable | Meaning | Initialization at time t = 0 |

| fijt | fitness of activity j of firm i at time t ( = the end of period t ) | 1.0 for each activity |

| Fit | total fitness of firm i at time t | 1.0 for each firm |

| Gt | average total fitness of all firms at time t | 1.0 |

| f 'ijt | fitness of activity j of firm i at time t (after innova-tion but before imitation) | |

| F'it | total fitness of firm i at time t (after innovation but before imitation) | |

| F'kt* | total fitness value of the best firm k at time t (after innovation but before imitation) | |

| f 'kjt* | fitness value of activity j of the fittest firm k at time t (after innovation but before imitation) |

|

| Parameters | Interpretation | |

| λ | imitation rate ( 0 < λ < 1) | λ = 0.5 |

| σ | mutation rate | σ = 0.05 |

|

A Modification of the Basic Model: Limited Imitability

- 3.15

- In section 2, we argued that imitability of all activities can be a critical assumption which need not be fulfilled in competition processes. For analysing the impact of the non-imitability of activities of firms on the average fitness of the firms after 100 periods we modify our basic simulation model by differentiating between imitable and non-imitable activities. For simplicity, we assume that only one of the activities, e.g. the organisation culture of a firm, cannot be imitated.[20] Let mv denote the number of the imitable and ms the number of the non-imitable activities (mv + ms = m). Then in our modified simulation model we analyse the impact of one non-imitable activity (ms = 1, mv = m - 1) on the knowledge accumulation process. As in our basic model, we analyse this impact for different numbers of firms n and different numbers of activities m. In each period innovation takes place both for imitable and non-imitable activities. The only difference to our basic model is that the non-imitable activity of the best firm cannot be imitated by the competing firms (fiqt = f 'iqt for the non-imitable activity aq).

Experiments and Results

Experiments and Results

- 4.1

- In our experiments we test the three hypotheses about the Hayekian mechanism of knowledge-generating competition which have been elaborated in section 2. In section 4.3 - 4.6, we use our basic model in which all activities can be imitated by the non-leading firms. We analyse the impact of the number of competing firms n and the number of activities m on the extent of the knowledge accumulation process in the industry. The rapidity of knowledge accumulation is represented in our model by the average total fitness of all firms in the industry after 100 periods:

Gt=100.[21] In section 4.7 - 4.17, we analyse the impact of imperfect imitability on the Hayekian knowledge-generation process by using a modified model in which we assume that one of the activities of the firms cannot be imitated. In both cases, we are not only interested in the impact on the average growth of knowledge, but also in the question whether the process of knowledge accumulation is a predominantly monotonous one or whether also smaller or larger fluctuations in this process can be observed. In both simulation models, we use the imitation rate λ = 0.5 and the mutation rate σ = 0.05.

Results of the Basic Model: The Dependence of the Knowledge Accumulation on the Number of Firms and the Number of Activities

|

|

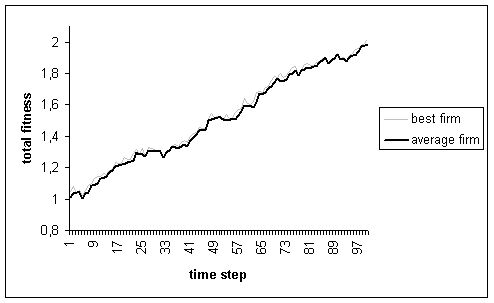

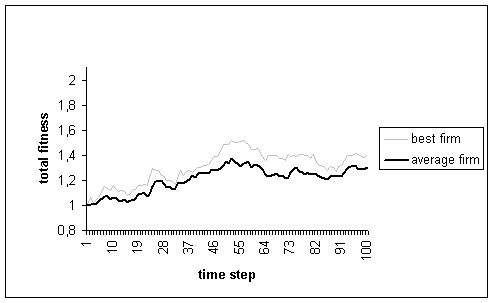

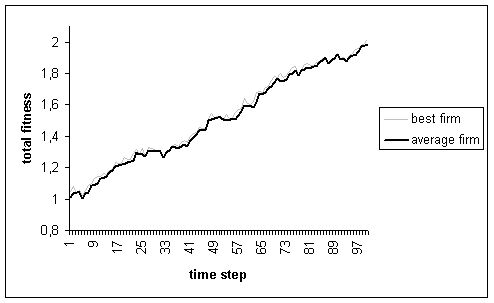

Figure 2. Time series of one simulation run: growth of the fitness of the firms

(n = 2; m = 3: mv = 3, ms = 0; full imitability)

|

- 4.2

- In Figure 2, we give a representation of the results of one realisation of our basic simulation model in which we assume the existence of two firms (n = 2) and three activities (m = 3) all of which can be imitated (mv = 3; ms = 0). Since we have a stochastic simulation model Figure 2 can only give an impression of the potential outcome of these knowledge-accumulating processes. In this simulation run, the average total fitness of all firms in the industry almost doubles within the simulated 100 periods. It increases almost continuously, but we can also observe different growth rates and even small relapses, but only brief ones.

- 4.3

- Since by mutation all firms can worsen the fitness of their activities it is not surprising that brief decreases of the average fitness are possible, but that in the long run the systematic effects of the imitation of the best firm are much stronger than the random mutations which are responsible for the small relapses. Without imitation, the process would be a random walk process which, on average, would have no long-run tendency to larger or smaller fitness. The difference between the total fitness of the best firm and the average fitness of the industry is small and remains small throughout the whole simulation run.

- 4.4

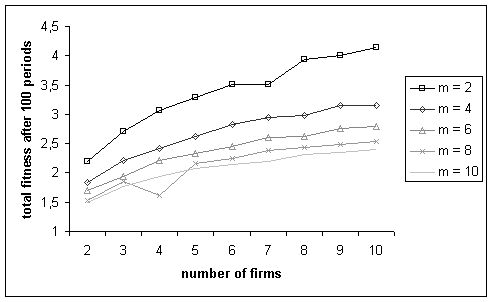

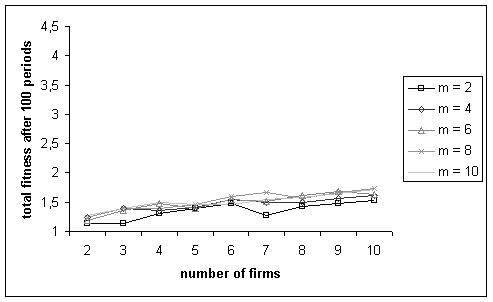

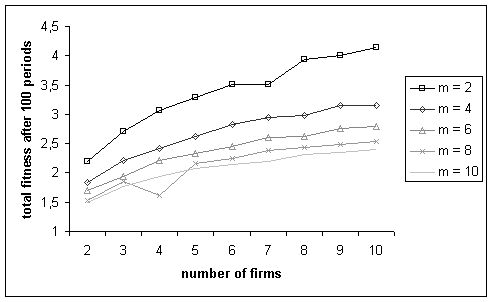

- In the following, we concentrate on the average (total) fitness of all firms after the completion of 100 periods, which simultaneously indicates the growth of knowledge or the rapidity of knowledge accumulation in the industry. Figure 3 gives an overview on the average fitness of firms on the market in dependence on the number of firms and the number of activities all of which we assume to be imitable.[22] The results are mean values of 20 simulation runs which start from different random seeds all else being equal.

|

|

Figure 3. Average fitness of all firms after 100 periods in dependence on the number of

firms n and number of activities m (mv = m, ms = 0; full imitability; mean

values of the results of 20 simulation runs)

|

- 4.5

- As can be seen from Figure 3, the results confirm our first hypothesis I:[23] The average fitness of the industry increases with the number of firms n on the market. As more firms innovate independently, they generate a broader variety of routines and therefore, on average, the best firm has a higher total fitness. Since the non-leading firms imitate the activities of the best firm, also the gains from imitation are on average larger than in case of fewer firms. This result is independent from the number of activities m. We also see that the higher the number of activities m the smaller is the impact of a higher number of firms on the extent of knowledge accumulation in competition.

- 4.6

- This leads to our second hypothesis II which is also confirmed by our simulation results: The average fitness of the industry decreases with the number of activities of the firms m (all else being equal). As was argued in section 2, our explanation is that the information feedback of the market through profits and losses is less specific the larger the number of activities m is. This implies that a larger bundle of hypotheses is tested simultaneously. Consequently, the firms get fewer information about the fitness of their particular activities from the market. Therefore, the probability increases that the non-leading firms also imitate activities of the best firms whose fitness is inferior to their own activities (bundle problem). The simultaneous test of a large bundle of hypotheses leads to a large-meshed selection of the market whereas a smaller bundle of hypotheses allows for a much finer market selection. Consequently, in the latter case, the market reveals more information leading to a more rapid process of knowledge accumulation.

The Impact of Limited Imitability and the Problem of Lock-ins

- 4.7

- In the second part of our simulation analysis, we limit the firm's ability to imitate the activities of other firms. We assume that one of the m activities of the firms cannot be imitated at all whereas the other activities can again be imitated with the imitation rate λ = 0.5. As briefly discussed in section 2, reasons for the non-imitability of an activity can be patents as a legal prohibition for imitation, or the unique personality of a CEO who creates an outstanding organization culture. Therefore, we have rerun our simulations with the same numbers of firms n and the same number of activities m, but now one of these activities cannot be imitated.

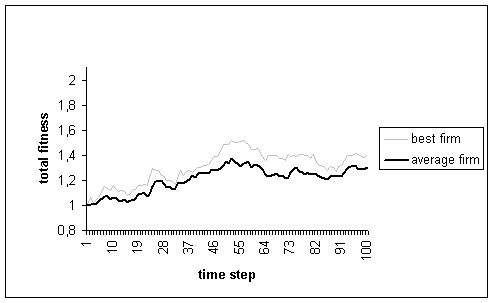

|

|

Figure 4. Time series of one simulation run: growth of the fitness of the firms

(n = 3; m = 3: mv = 2, ms = 1; limited imitability)

|

- 4.8

- A typical example of one simulation run can be seen in Figure 4. An important result is that a non-imitable activity not only leads to a slower growth of the average fitness of the firms as it is shown in more detail below, but also that the fitness of the firms does no more increase as continuously as in our basic model. Instead, several and longlasting relapses can emerge as is shown in Figure 4. There can also be long-lasting phases of stagnation as well as short phases with considerable increases. One conclusion is that in the case of limited imitability the process of knowledge accumulation can be much more complex than in the case of full imitability. Therefore, we presume that the process of knowledge accumulation is not only determined by short-term random effects. There are also mechanisms with long-term effects on the development of the average fitness of the industry. The difference between the fitness of the best firm and the average fitness of the industry is higher and changes considerably throughout the whole simulation run. An analysis of the results of 20 simulation runs with different initial random numbers shows a wide variety of possible time series with quite different dynamic patterns from a purely phenomenological point of view. This is particularly interesting for the understanding of the knowledge accumulation effects with limited imitability. From our results three types of patterns can be differentiated: (1) "growth with phases of stagnation and relapses", (2) "overall stagnation" and (3) "flat, middle or high steady growth". But before we analyse the dynamics of the knowledge accumulation process in more detail the general impact of a non-imitable activity on the average growth of fitness of the industry is analysed.

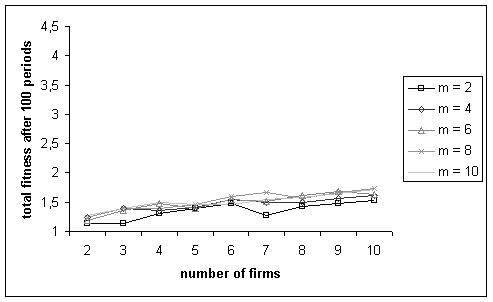

|

|

Figure 5. Average fitness of firms in dependence on the number of firms n and number

of activities m (mv = m - 1; ms = 1; limited imitability; mean values of the

results of 20 simulation runs)

|

- 4.9

- In Figure 5, we see how the average fitness of all firms in the industry after 100 periods depends on the number of firms n and the number of activities m if one activity cannot be imitated. The numerical results of our simulation runs can also be found in Table 4 in the appendix. The most striking result is that the impact of only one non-imitable activity on the extent of knowledge accumulation is tremendous as shows a comparison between Figure 3 and 5 or between Table 3 and 4: Independent from the number of the firms n and the number of activities m, the average fitness of the industry after 100 periods is considerably lower in comparison to our basic model in which all activities can be imitated. In Table 2, a direct comparison of the results of both models can be found for the case of 7 activities (mv = 6, ms = 1) and different n. In this case, the growth of the average fitness in the industry is almost reduced to one-third in comparison to the case of full imitability.[24] Therefore, our hypothesis III of section 2 has been confirmed, i.e. that non-imitability has an important impact on the extent of knowledge accumulation in the Hayekian concept of competition as a discovery procedure.

|

| Table 2: Comparison of the average fitness of firms between (1) the case of full

imitability (m = 7) and (2) the case of limited imitability (mv = 6, ms = 1) for

different numbers of firms (n = 2 ... 10; mean values of 20 simulation runs) |

|

| n | m = 7 | m v = 6; m s = 1 |

| 2 | 1,6272445 | 1,20672445 |

| 3 | 1,9063265 | 1,37796878 |

| 4 | 2,064597 | 1,3458796 |

| 5 | 2,2569785 | 1,3794245 |

| 6 | 2,3468415 | 1,561882 |

| 7 | 2,480952 | 1,56107785 |

| 8 | 2,533157 | 1,588989 |

| 9 | 2,591838 | 1,549409 |

| 10 | 2,6656365 | 1,606455 |

|

- 4.10

- Before we analyse this impact more closely and try to explain the mechanisms for the general slowing-down of the growth of knowledge we ask another question: What is the impact of the non-imitability of one activity on our hypotheses I and II? Figure 5 and Table 4 (in the appendix) clearly show:

- Hypothesis I - the positive correlation between the number of firms which innovate independently and the rapidity of knowledge accumulation - still seems to be true[25], but the average growth rate has slowed down tremendously. The slowing down is larger for small m and smaller for large m.

- The negative correlation between the rapidity of knowledge accumulation and the number of activities m - Hypothesis II - which we have clearly observed in the case of full imitability does no longer exist if one activity cannot be imitated. On the contrary, there even seems to be a small positive correlation, i.e. the higher the number of activities the larger the growth of knowledge in competition.

- 4.11

- How can our findings be explained? What are the effects that are responsible for the slowing down of the learning process in competition resulting in a lower average fitness of the firms after 100 periods if one activity cannot be imitated? One explanation is that the growth of the average fitness is slower because no mutual learning can take place with regard to one activity. But does this limited imitation effect explain the whole difference? Let us analyse in more detail our example in Table 2 in which we compare the results of a model with m = 7 imitable activities with the results of one with 6 imitable and one non-imitable activities. Whereas, in the full imitation case, learning covers each activity (i.e. 7/7 = 1), in the limited imitation case learning can take place only with regard to 6 of 7 activities. So 1/7 of learning possibilities is lost in each time step. In the first time step 1/7 of learning is lost. In the second time step 1/7 plus 1/7 from the loss of the last time step is lost which amounts to 1/7 + 1/72. In the third time step 1/7 + 1/72 + 1/73 is lost, and so on. Finally, after 100 time steps, the loss in learning possibilities adds up to 1/6 which is the sum of this geometric series. Therefore, limited learning possibilities can explain 1/6 of the decrease in fitness. However, the decrease in average fitness is more than 1/6. Take, for example, the case of 6 firms. Full imitability leads to the average fitness of 2.35, whereas limited imitability leads to 1.56. The difference to the initial average fitness of 1.0 is 1.35 in the overall imitation case. 1/6 from 1.35 amounts to 0.225. Consequently, the effect of limited learning possibilities can only explain a decrease to an average fitness of 2.125, but not a decrease to 1.56 as in our simulation results. Although this effect explains the decrease in fitness, we have to look for additional systematic effects that can explain the remaining difference.[26]

- 4.12

- We presume that there is an additional systematic effect, which is caused by a kind of lock-in situation which can emerge under certain conditions in the knowledge-generating competition processes. Let us assume again the case of 7 activities one of which is non-imitable (as in Table 2). After the innovation phase, the non-leading firms imitate the firm with the highest total fitness. Now, the leading firm may have the highest total fitness because the fitness of its non-imitable activity is the highest among all activities - whether imitable or not - of all firms. Assume, for example, the leading firm is best because of its superior organisation culture, which might be an activity that cannot be imitated by the other firms. We can call such a situation a "lock-in situation", because it can hamper knowledge-generating in the Hayekian competition processes. The problem is that in this case the other firms have no possibility to catch up through imitation because the best firm is the leading one due to the non-imitable activity. This problem can be aggravated by the effect that the non-leading firms imitate all the imitable activities of the leading firm which even on average may have an inferior fitness than those of the competitors. If this case turns up, the whole process of mutual learning is severely hampered.

- 4.13

- Note that the Hayekian mechanism of mutual learning in competition need not stop completely: The non-leading firms cannot learn the superior hypothesis of the leading firm. But, they can go on catching up the imitable activities of the leading firm. Always, the development of the knowledge of the leading firm is a pure random process because the leading firm can learn from nobody. Whenever the leading firm innovates on an imitable activity the non-leading firms will catch up. However, they will also catch up in the wrong direction if the leading firm has an innovation that reduces the fitness of this activity. A lock-in does not necessarily imply that there is no improvement in the average fitness of the firms. Yet, the improvements will only be the results of pure random effects.

- 4.14

- There is another effect which hampers the Hayekian mechanism of mutual learning in competition: As the superior hypothesis of the leading firm cannot be imitated it is much more difficult to switch the leading firm. Only when the leading firm changes frequently this firm has the chance to learn from its competitors. Take, for example, firm A which has been the leading firm at the time before, but has been caught up by firm B. Whereas, at the time before, firm B (and also firms C, D etc.) learnt from firm A, now, firm A will learn from firm B, may even catch up firm B within this time step, and therefore may be the leading one again during the next time step. Then, firm B will learn again from firm A and may catch up again within the next time step. As a consequence, the Hayekian mechanism of mutual learning in competition works best if the leading firm changes frequently. The change is hampered in case of lock-ins: The leading firm's removal is much more difficult although it is not impossible. Since stochastic innovation processes still take place with all imitable and non-imitable activities, it is not probable that the best firm will be leading permanently due to its superior non-imitable activity. Consequently, lock-in situations will also terminate. But, during all those consecutive periods when firm A is leading, yet not caught, it will only improve their fitness by chance. The knowledge accumulation process of the whole industry will slow down because firm A gets no more chance to learn.

- 4.15

- In sum, lock-in effects help to explain why the growth of the average fitness of the firms with one non-imitable activity is on average much slower than in the case of full imitability. Additionally, we conclude that if m is small the probability that the best firm will be leading because of its non-imitable activity is higher than if m is large. Therefore, in cases of only very few activities, the probability of lock-ins and therefore of the break-down of the knowledge accumulation process is higher than in cases of more activities. This may explain why Hypothesis II does not hold any more in case of one non-imitable activity and even seems to be reversed.[27]

|

|

Figure 6. Effect of Lock-ins on the average fitness of firms (selected results from 20

simulation runs; n = 6 firms, m = 7 activities: mv = 6, ms = 1)

|

- 4.16

- The lock-in effect also helps to explain why the variation of the results of the simulation runs is much higher than in the basic model. Both the frequency and the duration of lock-in effects vary. For a more detailed analysis of the impact of the lock-in effect, we inspected the time series of 20 simulation runs with n = 6 firms and m = 7 activities one of which is non-imitable. In Figure 6, three time series of these simulation runs are presented. To indicate the lock-in effect we have defined a dummy variable η: η = 1 indicates that at time t the fitness of the non-imitable activity of the best firm is the highest among all activities - whether imitable or not - of all firms. It is very probable that the best firm is the leading one due to its superior fitness of the non-imitable activity; in all other cases: η = 0. The inspection of all 20 simulation runs shows that the number and duration of lock-in effects vary to a large extent which can explain the wide variety of patterns of knowledge accumulation processes in the case of limited imitability. Since not all of the 20 simulation runs can be presented here, we made three clusters of similar patterns which in our sample turned up with a different frequency. As can be seen from Figure 6 (with the depiction of run 1 as an example), in 15 of 20 runs there was either no lock-in effect at all or there were few, short-term lock-ins which led to a mean of the average fitness of firms of 1.65 at time t = 100. In 5 of 20 runs, frequent and / or long-lasting lock-ins turn up which have serious negative effects on the knowledge accumulation processes. In 4 of these 5 cases, there are frequent lock-ins which are sometimes lasting for longer periods (as for example in run 13). This leads to a reduction of the average fitness after 100 periods to 1.45. In one simulation run (run 9), we observe that in most periods the lock-in effect does prevail. It cannot been shown in the graph, that the leading firm does only change once during the consecutive lock-ins - at time step 91. The systematic knowledge accumulation process by mutual learning is severely hampered for most of the 100 periods. Therefore it is not surprising that the average fitness of the firms after 100 periods is lowest: 1.28.[28] This confirms our above-mentioned considerations that such lock-in effects impede the knowledge-generating effects of Hayekian competition processes.

- 4.17

- But also this kind of lock-in effect does not seem to explain all the remaining difference of the decrease of the average fitness, because also in the case of no or only short-term lock-ins the average fitness of firms was only 1.65 at time t = 100 on average. One explanation is that in the case of limited imitability there are additional systematic effects, which impede the knowledge-generating process. Those have to be investigated more thoroughly.[29] Another explanation is that we might have defined our "lock-in situation" too narrowly and therefore have underestimated the number and duration of lock-ins. According to our definition a lock-in situation exists, if the fitness of the non-imitable activity of the leading firm is higher than the fitness of all other (imitable and non-imitable) activities of all firms. But in order that the leading firm is the best firm because of its non-imitable activity, it is not necessary that the fitness value of its non-imitable activity is higher than the fitness values of all other activities of all firms. Presumably there is a considerable number of additional cases, which also lead to the consequence that the leading firms is the best firm because of the high fitness value of its non-imitable activity, and therefore to the consequence of the above-mentioned lock-in effect. Therefore, it can be suggested that - due to our narrow definition of a lock-in situation - we have underestimated the number and duration of lock-in effects in Figure 6. Hence we presume that we have underestimated the contribution of the lock-in effect for the explanation of the decrease in average fitness in the case of limited imitability.

Conclusions

Conclusions

- 5.1

- The central aim of this paper was to contribute to the analysis of the Hayekian concept of "competition as a discovery procedure", in which market competition is seen as a process of experimentation and mutual learning by the competing firms. By integrating basic ideas of Popper's theory of "growth of knowledge", market competition can be interpreted as the rivalrous search process of firms for new and better solutions to the problems of customers. Therefore it is conceived as a never-ending open process of the generating and testing of hypotheses on appropriate problem solutions and their diffusion through imitation. In our simulation model the experimentation process was modelled in the following way: The non-predictable new hypotheses (innovations) are represented by the random variation of the fitness of the activities of the firms. The superior bundle of hypotheses is revealed by the market test through identifying the "best" firm with the highest total fitness. The second part of these competition processes, the mutual learning, was implemented as learning of the non-leading firms from the leading firm (imitation). The knowledge accumulating effect of these experimental competition processes emerges through the combination of both mechanisms, the variation and the selection / imitation mechanism. Although our simulation model is a very simple one, we are convinced that it reflects the essence of Hayek's concept of "competition as a discovery procedure".

Discussion of the Model Design

- 5.2

- Admittedly, our basic simulation model suffers from many shortcomings and can only be seen as a first attempt at analysing market competition as a process of experimentation and mutual learning. In the following we want to deal with some objections that might be raised:

- 5.3

- (1) Our model does not include prices, costs and profits. Why not? Our main intention was to model the process of the accumulation of knowledge by variation and imitation of hypotheses. It is sufficient to model these processes by representing the "quality" of knowledge by the fitness variable. We accept that without an explicit modelling of the whole market, only limited conclusions can be drawn from our model, but it was not our intention to model a whole market. We think that it will be possible to integrate this basic Hayekian learning process also in traditional economic models for analysing specific problems.

- 5.4

- (2) We also accept that this knowledge-generating effect is only one mechanism, by which in competition and market processes the knowledge of the firms changes. Beyond the Hayekian mechanism - learning from experimentation by the feedback from the market - other effects do also exist, as, e.g., knowledge accumulation by investment in R&D, learning-by-doing effects leading to dynamic economies of scale, synergetic effects from complementary stocks of knowledge or other kinds of spill-overs, e.g. from scientific research in universities to the knowledge base of the firms or from spill-overs within innovation networks (Pyka 1999). An all-encompassing model of the knowledge accumulation process in markets should take all these effects into account. But from our Hayekian and Popperian perspective we do contend: (a) This Hayekian mechanism is a very important determinant for knowledge accumulation processes in market economies. (b) All kinds of knowledge have the character of fallible knowledge implying that also the other mechanisms of knowledge accumulation have to deal with the problem of erroneous knowledge and the specific consequences of experimentation.

- 5.5

- (3) A major inconsistency can be found in our basic model: While we took the knowledge problems of the firms on the supply side very seriously, the knowledge problems on the demand side have not been taken into account. By assuming that the firms with the highest total fitness are identified in the market and subsequently imitated by the non-leading firms, we implicitly assumed that the customers on the demand side do not make wrong assessments with regard to the relative performance of the firms. As we already emphasized in section 2, all agents have fallible knowledge, implying that the customers are prone to make wrong decisions. Therefore, there may also be wrong feedbacks to the suppliers, feedbacks as to which hypotheses of the firms are relatively best - at least temporarily. The impact of potential errors on the demand side would imply an additional complication for the working of the knowledge accumulation process. Since we deem these knowledge problems of the customers as very important, we intend to extend our simulation model in order to analyse their impact on the knowledge accumulation process.

- 5.6

- (4) The non-existence of erroneous decisions of customers is not the only precondition for a correct selection process in the market. If, for example, the products of firms are connected with negative technological external effects (environmental damages), not all costs of these products are "internalized", which leads to a systematical distortion in the selection of products in the markets. In those cases it is the task of the institutional framework of the market economy to provide for incentives to internalize external effects (e.g. by tort law) in order to ensure a non-distorted market selection. It is crucial to emphasize that the market selection and thus the profit/loss-feedback only works properly if market competition takes place under an appropriate institutional framework of (legal) rules. The latter has the task to impede systematic distortions of the market selection. In our simulations, we have implicitly assumed that such an appropriate legal framework does exist.

- 5.7

- (5) An important objection is that we treat both the number of firms and the number of activities as exogenous variables. It can be argued that through the entry and exit of firms and through different make-or-buy decisions both variables are determined endogenously in competition processes. On the one hand, this is a major shortcoming of our model, because market entries and exits are important elements of competition processes.[30] It is certainly possible to extend the model for entry and exit mechanisms. On the other hand, our research interest are the implications of firm concentration for the knowledge generation in competition. From the perspective of merger policy, it is an interesting question, whether a larger or smaller number of competing firms leads to a higher growth of knowledge through parallel experimentation. Please note that in our concept of competition as a test of hypotheses potential competitors cannot be a complete substitute for incumbent competitors, because only incumbents experiment with new hypotheses and therefore contribute to the common pool of knowledge.

- 5.8

- (6) In our model we implicitly assumed that the length of one period (with the two phases of innovation and imitation) does not depend on the number of competitors. For example, a larger number of competitors might lead to more intense competition and therefore to a shortening of the innovation-imitation cycle. This consideration also hints to the many different possibilities in modelling the interaction between the competitors.

- 5.9

- (7) Beyond these more general objections, the specific assumptions of our basic model can also be discussed critically. Although the information and feedback assumptions seem to be very specific and are certainly disputable, we strongly contend that these assumptions are strictly in accordance with the essential idea of the Hayekian conception, i.e. that all knowledge is fallible and that the feedback from the market is the most relevant test for the "quality" of the knowledge of firms. This does not exclude other possibilities of the firms to pre-test their hypotheses before launching them on the market, as e.g. "test marketing".[31] Also in that respect, several possibilities exist for the extension of our model. As already indicated in section 4 with regard to our modified model with limited imitability, it would be very interesting to ask for the impact, if more than one activity is non-imitable.

- 5.10

- (8) Independently from changing basic assumptions of the model, it is certainly necessary to investigate the impact of a variation of the parameters "innovation rate" (σ) and "imitation rate" (λ), both on the knowledge accumulation process and on the hypotheses I, II and III. Such a sensitivity analysis is still lacking. From a theoretical perspective (a) we would expect that a higher innovation rate, which implies a larger variation, will lead - as well as a higher imitation rate - to a more rapid knowledge accumulation process. But if either σ = 0 or λ = 0, no systematic knowledge accumulation can be expected, because both variation and imitation is a necessary precondition for the Hayekian process of knowledge generation. (b) We also expect that a variation of both parameters (for σ > 0 or λ > 0) will not change the qualitative result with regard to the hypotheses I, II and III in our basic model with full imitability. But we are more reluctant with regard to the expected results for our modified model with limited imitability.

Results and Suggestions for Further Research

- 5.11

- Finally, we want to turn to the results of our simulations about the impact of firm concentration on the Hayekian process of knowledge accumulation. Our hypothesis I, i.e. that the average growth rate of the knowledge accumulation process in competition increases with the number of independently innovating firms, has been clearly confirmed. The larger the number of independently innovating firms, i.e. the more parallel experimentation takes place, the larger is the accumulated common pool of knowledge from experience that is generated by the competing firms. But we should be reluctant in jumping to conclusions for the assessment of mergers in competition policy. As in any model, our statement does only hold, if all else remains equal ("ceteris paribus"). We certainly cannot conclude from our findings that, in general, the process of technological and economic progress is the quickest, if we have a very large (exactly: an infinite) number of (very small) firms that innovate independently.[32] There can be no doubt that e.g. economies of scale and scope exist in most industries, both with regard to production and the innovation process itself. These effects can counterbalance the knowledge-generation effect by the experimental processes of competition.

- 5.12