Riccardo Boero, Marco Castellani and Flaminio Squazzoni (2004)

Micro Behavioural Attitudes and Macro Technological Adaptation in Industrial Districts: an Agent-Based Prototype

Journal of Artificial Societies and Social Simulation

vol. 7, no. 2

<https://www.jasss.org/7/2/1.html>

To cite articles published in the Journal of Artificial Societies and Social Simulation, please reference the above information and include paragraph numbers if necessary

Received: 07-Feb-2004 Accepted: 21-Feb-2004 Published: 31-Mar-2004

Abstract

Abstract| Table 1: "Change Matrix" shows costs needed to implement a new technology, that is to shift to a more complex technological paradigm, (first line) or to improve the techno-organisational asset, that is to say to change number/factors combination (second line). Along the column, there are all the three paradigms impacting ID firms over time. Costs gradually increase over time. | |||

| T1 | T2 | T3 | |

| Technological Paradigm Change | 200 | 400 | |

| Production Factors Combination Change | 50 | 100 | 200 |

| Table 2: "Info Matrix" shows costs that firms must pay in order to achieve different type of information. Information concerns both technological strategies (innovation and imitation), and partnership selection mechanisms. The second case refers to different information criteria by which final firms organise their production chains, aggregating a team of sub contracted firms. Final firms continuously need information about economic, technological and organisational features of sub contracted firms in order to choose between stabilising or destabilising their inter-organisational contexts (production chains). | |||

| T1 | T2 | T3 | |

| Technology Imitation | 40 | 70 | |

| Production Factor Imitation | 30 | 20 | 10 |

| Technology Innovation | 100 | 250 | |

| Production Factor Innovation | 80 | 50 | 30 |

| Best Sub | 5 | 5 | 5 |

| Table 3: "Tech Matrix" shows data about costs and performance of firms in all the different learning steps undertaken by firms. As it is mentioned above, technology costs and economic performance gradually increase as well as market requests over time. Column A shows technology costs, B shows levels of achievable performance, and C shows decreasing costs for the usage of the same combination of number/factors for more than one simulation/production cycle. All costs and performance values are expressed by a continuum between the "worst" and the "best" techno-organisational levels, with an average on the degree of distance/nearness of the combination of number/factors implemented by firms with respect to the range just mentioned. | |||||||||

| T1 | T2 | T3 | |||||||

| Techno- Organis. Asset | A | B | C | A | B | C | A | B | C |

| Worst | 5 | 6 | 0.01 | 6.65 | 9.12 | 0.01 | 8.86 | 13.87 | 0.01 |

| Best | 7.32 | 10.49 | 0.01 | 9.74 | 15.96 | 0.01 | 12.97 | 24.26 | 0.01 |

|

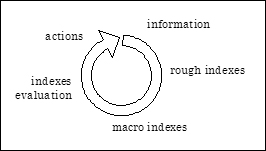

| Figure 1. Information-Action Loop |

|

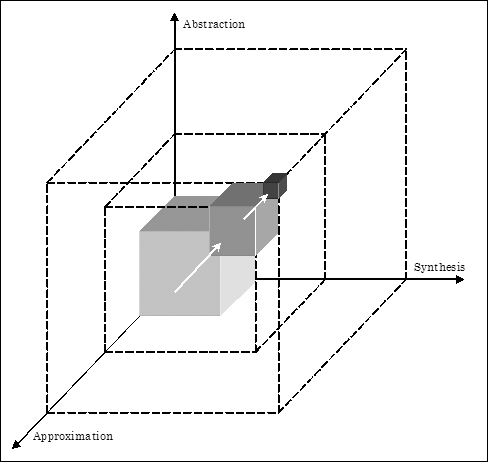

| Figure 2. From information to indexes, by means of an "approximation-abstraction-synthesis mechanism". In order to transform information data (the lightest solid), into rough indexes (the middle one) and then into macro indexes (the darkest solid), agent-based cognitive operations face a trade-off between the increase in the degree of the three dimensions (abstraction, synthesis, approximation) and the decrease of the volume of information to be considered. |

Ma = Wa1Ra1 + Wa2Ra2 + ... + WanRan,where Ma , Wa1 , Ra1 , etc.. ∈ [0,1] and Ma represents a macro index, Wa1 is the weight of the first rough index Ra1, and so on. ID firms are heterogeneous and hence they have different values for weighting rough indexes in the macro ones.

|

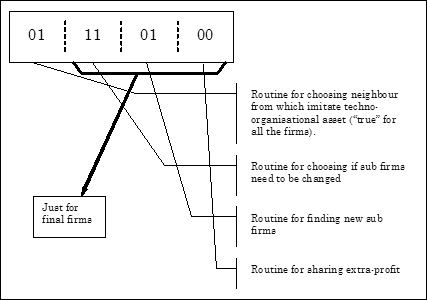

| Figure 3. Action Code of ID Firms (according to features of ID prototype, just final firms have the complete action code) |

| Table 4: Relations amongst operation fields, behavioural attitudes and action recipes | ||

| Action Recipes | Behaviour Attitudes | Operation Fields |

| look at the first agent with different technology/techno-organisational asset you meet | self centred | Technology imitation in the sub-fields of technology and techno-organisation asset |

| look at the first agent with different technology/techno-organisational asset you meet, which has sold its product | ||

| look at the agent with different technology/techno-organisational asset you meet, which has a percentage of extra-profit better than yours and the highest available | ||

| look at the agent with different technology/techno-organisational asset you meet, which has a behavioural attitude higher than yours and the highest available | ||

| look at the agent with different technology/techno-organisational asset you meet, which has a level of cost higher than yours and the highest available | social centred | |

| look at the agent with different technology/techno-organisational asset you meet, which has a level of effectiveness of techno-organisational asset better than yours and the highest available | ||

| look at the agent with different technology/techno-organisational asset you meet, which has a level of investment on technology/techno-organisational asset better than yours and the highest available | ||

| look at the first agent with different technology/techno-organisational asset you meet, which has a level of performance better than yours and the highest available | ||

| keep your team of sub firms if time compression Δt, t-1 >= 0 | self centred | Keep strategy of partnership stabilization |

| Keep your team of sub firms if profit Δt, t-1 >= 0 | ||

| keep your team of sub firms if resources Δt, t-1 >= 0 | ||

| keep your team of sub firms if you have sold your product | self centred & social centred | |

| social centred | ||

| keep your team of sub firms if time compression Δt, t-5 >= 0 | ||

| Keep your team of sub firms if profit Δt, t-5 >= 0 | ||

| keep your team of sub firms if resources Δt, t-5 >= 0 | ||

| search for a new team of sub firms randomly | self centred & social centred |

Search strategy of partnership definition |

| search for a new team of sub firms focusing on who has the highest investment on techno-organisational asset | ||

| search for a new team of sub firms focusing on who has the highest performance | ||

| search for a new team of sub firms focusing on who has the most similar technology and techno-organisational asset configuration | ||

| give to your partners the 0% extra-profit | self centred | Share policy of chain extra- profit management and distribution |

| give the 5% extra-profit to each partner | ||

| give the 10% extra-profit to each partner | ||

| give the 13.3% extra-profit to each partner | ||

| give the 23.3% extra-profit to each partner | social centred | |

| give 25% extra-profit to each partner | ||

| give the 70% extra-profit to partners, distributed proportionally according to their needs | ||

| distribute proportionally the 100% extra-profit according to the needs of each member of the chain | ||

|

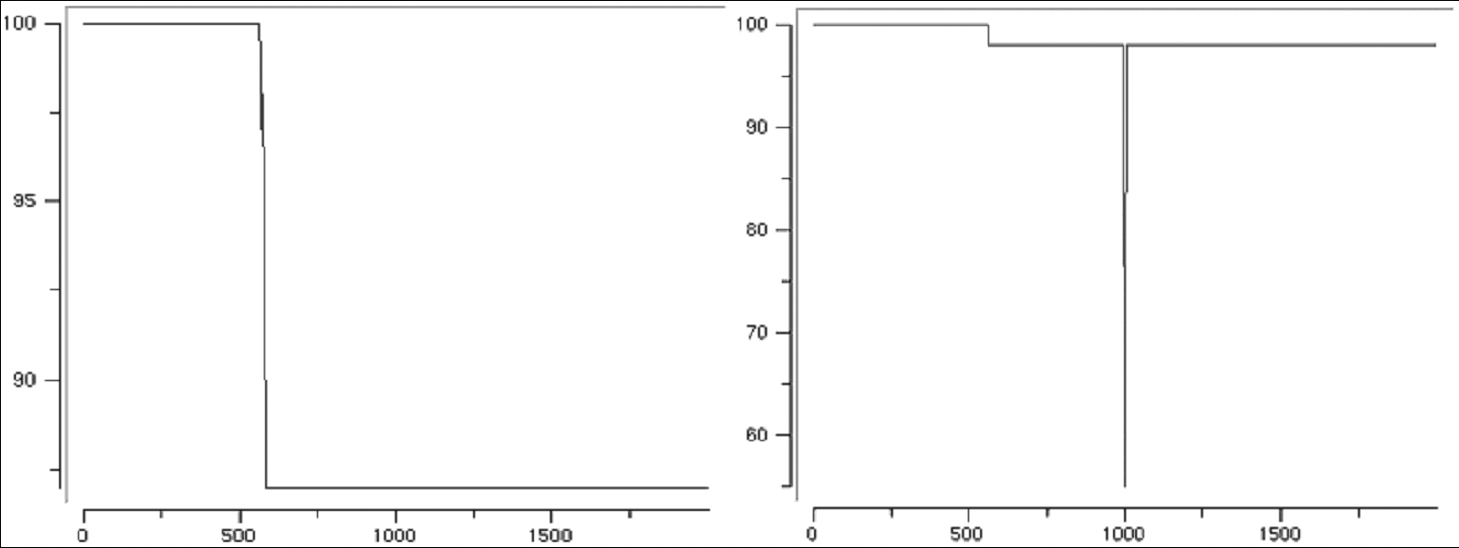

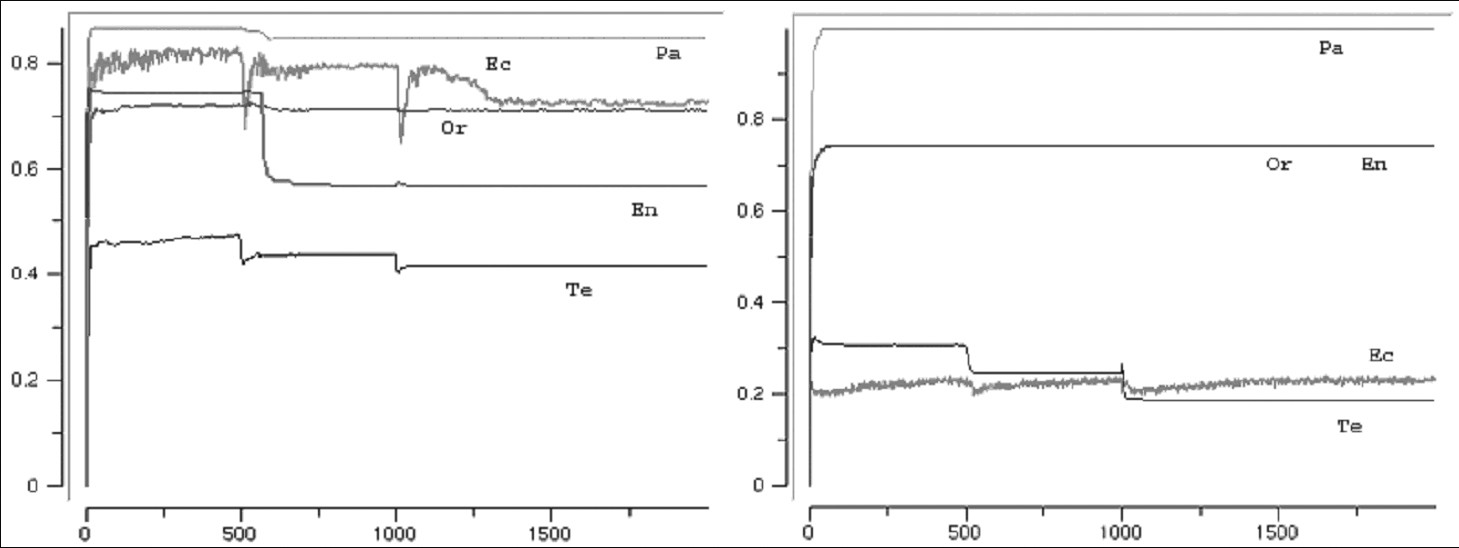

| Figure 4. Final firms matching market request over time (on the left set 1 and on the right set 2) |

|

| Figure 5. Evolution of macro indexes over time (on the left set 1, while on the right set 2). Pa depicts the partnership index, Te the technology one, Or the organisation one, En the environment one, and Ec the economic one |

|

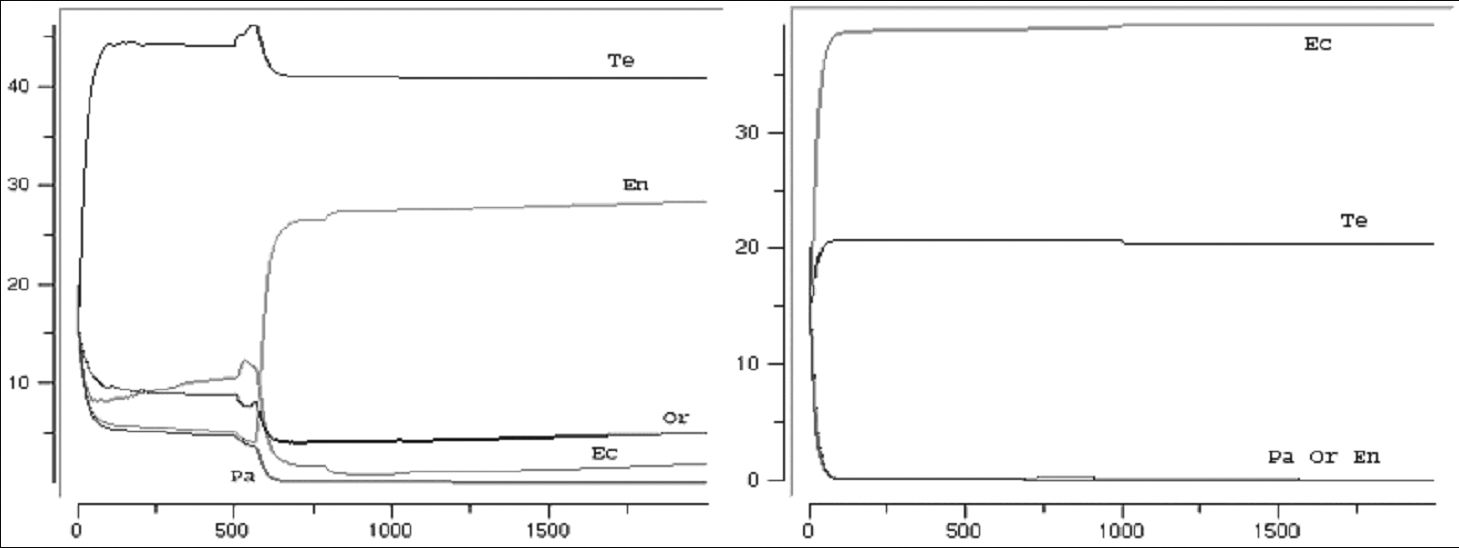

| Figure 6. Dynamics of distribution of attention (on the left set 1, on the right set 2). Pa depicts the partnership index, Te the technology one, Or the organisation one, En the environment one, and Ec the economic one |

|

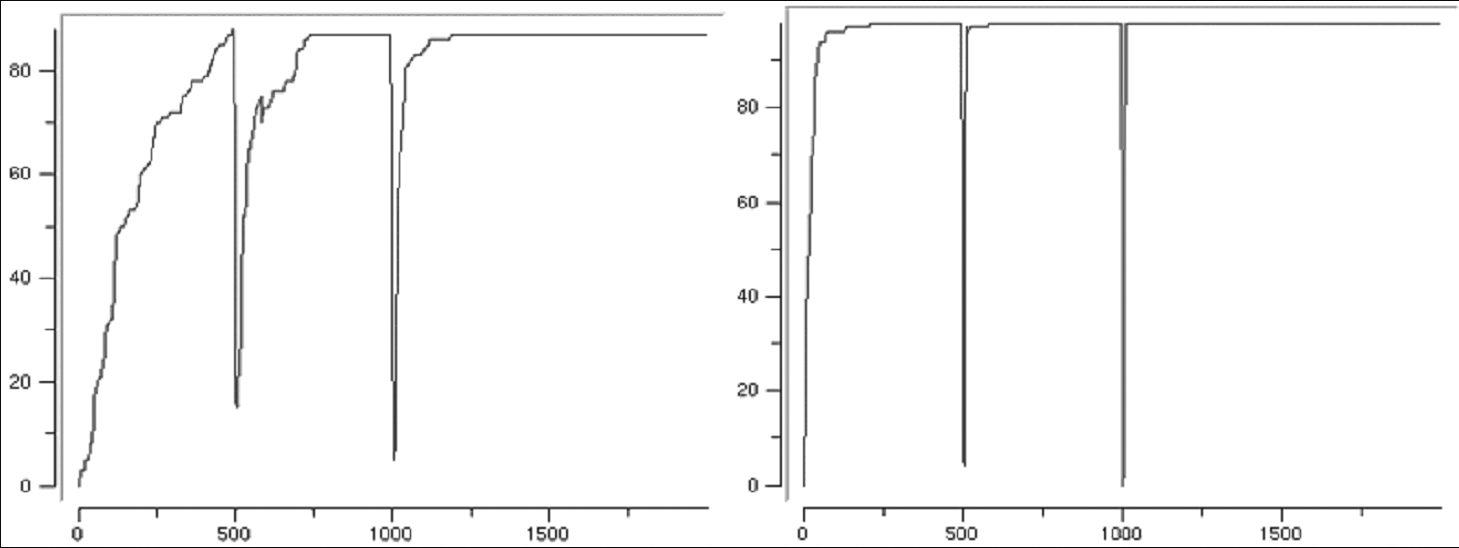

| Figure 7. Final firms matching market requests that reach the top level of techno-organisational asset, over time (on the left set 1, on the right set 2) |

2 The identification between agents (“computational units”) and firms is a quite strong assumption, even if it is a standard practice both in the literature on agent-based models and in evolutionary economics. But, in the case of IDs, such a reduction seems less strong, since ID firms exhibit a close identification amongst entrepreneurship, ownership and management (i.e., see other simulation models: Brenner 2001; Fioretti 2001; i.e., see behavioural analysis in Moran 1998).

ALBINO V, GARAVELLI A C, SCHIUMA G (1999) Knowledge Transfer and Inter-Firm Relationships in Industrial Districts: The Role of the Leader Firm. Technovation, 19. pp. 53-63

BECATTINI G (1990) "The Marshallian Industrial District as a Socioeconomic Notion". In Pyke F, Becattini G and Sengenberger W (Eds.), Industrial Districts and Inter-Firm Cooperation in Italy, Geneva: International Institute for Labour Studies. pp. 37-51.

BELLANDI M (2002) Italian Industrial Districts: An Industrial Economics Interpretation. European Planning Studies, Volume 10, No. 4. pp. 425-437.

BELUSSI F (1999) Path Dependency vs. Industrial Dynamics: An Analysis of Two Heterogeneous Districts. Human System Management, 18. pp. 161-174.

BELUSSI F and GOTTARDI G (Eds.) (2000) Evolutionary Patterns of Local Industrial Systems: Towards a Cognitive Approach to Industrial Districts, Aldershot Brookfield Singapore Sidney: Ashgate.

BELUSSI F and PILOTTI L (2002) Knowledge Creation, Learning and Innovation in Italian Industrial Districts. Geografiska Annaler, 84 B, 2. pp. 125-139.

BIGGIERO L (1999) Markets, Hierarchies, Networks, Districts: A Cybernetic Approach. Human System Management, 18. pp. 71-86.

BOARI C and LIPPARINI A (1999) Networks within Industrial Districts: Organising Knowledge Creation and Transfer by means of Moderate Hierarchy. Journal of Management and Governance, 3. pp. 339-360.

BOERO R, CASTELLANI M, SQUAZZONI F (2002) "Cognitive Identity and Social Reflexivity of the Industrial District Firms. Going Beyond the 'Complexity Effect' with an Agent-Based Computational Prototype". In Lindemann G, Modt D, Paolucci M, Yu B (Eds.), Proceedings of the International Workshop on Agent-Based Social Systems: Theories and Applications, Hamburg: Hamburg University. pp. 1-29.

BORRAI M, MINOJA M and SINATRA A (1998) The Relationship between Cognitive Maps, Industry Complexity and Strategies Implementations: The Case of the Carpi Textile. Clothing Industrial System. Journal of Management and Governance, 2. pp. 233-266.

BRENNER T (2001) Simulating the Evolution of Localized Industrial Clusters- An Identification of the Basis Mechanisms. Journal of Artificial Societies and Social Simulation, Vol. 4, No. 3. https://www.jasss.org/4/3/4.html.

CANTNER U and HANUSCH H (2001) "Heterogeneity and Evolutionary Change: Empirical Conception, Findings and Unresolved Issues". In Foster J and Metcalfe J S (Eds.), Frontiers of Evolutionary Economics. Competition, Self-Organization and Innovation Policy, Chentelham, UK, Northampton, Massachussets, USA: Edward Elgar. pp. 228-269.

CONTE R (1999) Social Intelligence among Autonomous Agents. Computational and Mathematical Organization Theory, 5, 3. pp. 203-228.

CONTE R and CASTELFRANCHI C (1995) Cognitive and Social Action, London: University College London.

CONTE R. and CASTELFRANCHI C. (1996) "Simulating Multi-Agent Interdependencies: A Two-Way Approach to the Micro-Macro Link". In Troitzsch K G, Mueller U, Gilbert N and Doran J (Eds), Social Science Microsimulation, Berlin: Springer-Verlag. pp. 394-415.

CONTE R, EDMONDS B, SCOTT M, SAWYER R K (2001) Sociology and Social Theory in Agent-Based Social Simulation: A Symposium. Computational and Mathematical Organization Theory, 7. pp. 183-205.

CONTE R, HEGSELMANN R, TERNA P (1997) "Social Simulation- A New Disciplinary Synthesis". In (Eds.), Simulating Social Phenomena, Berlin: Springer-Verlag. pp. 1-17.

COOKE P and MORGAN K (1998) The Associational Economy. Firms, Regions, and Innovation, New York: Oxford University Press.

DEI OTTATI G (1994) Co-operation and Competition in the Industrial Districts as an Organisational Model. European Planning Studies, No.4.

DOPFER K (2001) "History-Friendly Theories in Economics: Reconciling Universality and Context in Evolutionary Analysis". In Foster J and Metcalfe S J (Eds.), Frontiers of Evolutionary Economics. Competition, Self-Organization and Innovation Policy, Chantelham, UK, Northampton, Massachussets, USA: Edward Elgar. pp. 160-187.

DOSI G (2000) Innovation, Organisation and Economic Dynamics. Selected Essays, Cheltelham, UK, Northampton, Massachussets, USA: Edward Elgar.

EMIRBAYER M and MISCHE A (1998) What is Agency?. American Journal of Sociology, 103, 4. pp. 962-1023

ESPTEIN J M (1999) Agent-Based Models and Generative Social Science. Complexity, 4, 5. pp. 41-60.

EPSTEIN J M and AXTELL R (1996) Growing Artificial Societies. Social Science from the Bottom-Up, Cambridge, Massachusetts: The MIT Press.

FIORETTI G (2001) Information Structure and Behaviour of a Textile Industrial District. Journal of Artificial Societies and Social Simulation, Vol. 4, No. 4. https://www.jasss.org/4/4/1.html.

GIDDENS A (1986) The Constitution of Society. Outline of a Theory of Structuration, Berkeley and Los Angeles: University of California Press.

GIGERENZER G, SELTEN R (Eds.) (2001) Bounded Rationality. The Adaptive Toolbox, Cambridge, Massachusetts, USA: The MIT Press.

GILBERT N (1996) "Holism, Individualism and Emergent Properties. An Approach from the Perspective of Simulation". In Hegselmann R, Mueller U and Troitzsch K G (Eds), Modelling and Simulation in the Social Sciences from the Philosophy of Sciences Point of View, Dordrecht/Boston/London: Kluwer Academic Publishers. pp. 1-27.

HALEY R I (1971) Beyond Benefit Segmentation. Journal of Advertising Research, 11. pp. 3-8.

HOLLAND J, HOLYOAK K J, NISBETT R, and THAGARD P (1986) Induction: Processes of Inference, Learning, and Discovery, Cambridge, Massachussets: MIT Press.

LANE D (2002) "Complexity and Local Interactions: Towards a Theory of Industrial Districts". In Curzio Quadrio A and Fortis M (Eds.), Complexity and Industrial Clusters, Berlin: Springer Verlag.

LAZERSON M H and LORENZONI G (1999) The Firms that Feed Industrial Districts: A Return to the Italian Source. Industrial and Corporate Change, vol. 8, N. 2.

LOCKHART R S and CRAIK F I M (1990) Levels of Processing: A Retrospective Commentary on a Framework for Memory Research. Canadian Journal of Psychology, 44, 1. pp. 87-112.

LOMBARDI M (2003) The Evolution of Local Production Systems: The Emergence of the "Invisible Mind" and the Evolutionary Pressures Towards More Visible "Minds". Research Policy, Volume 32, No. 8. pp. 1443-1462.

LUNA F, STEFANSSON B (Eds.) (2000) Economic Simulation in Swarm: Agent-Based Modelling and Object-Oriented Programming, Boston/Dordrecth/London: Kluwer Academic Publishers.

LUNA F, PERRONE A (Eds.) (2001) Agent-Based Methods in Economic and Finance: Simulations in Swarm, Boston/Dordrecth/London: Kluwer Academic Publishers.

MARCH J G (1994) A Primer on Decision Making, New York: The Free Press.

MORAN P (1998) Personality Characteristics and Growth-Orientation of the Small Business Owner-Manager. International Small Business Journal, 16, 3. pp. 17-39.

MORGAN M S (2001) Models, Stories and the Economic World. Journal of Economic Methodology, Volume 8, No. 3. pp. 361-384.

OCASIO W (1997) Towards an Attention-Based View of the Firm. Strategic Management Journal, Vol. 18 (Summer). pp. 187-206.

PANICCIA I (1998) One, Hundred, Thousand of Industrial Districts: Organisational Variety in Local Network of Small and Medium Enterprises. Organisation Studies, 19, 4.

PORTER M E (1998) On Competition, Boston: Harvard Business Review Books.

RABELLOTTI M (1995) Is there an "Industrial District Model"? Footwear Districts in Italy and Mexico Compared. World Development, 23, 1. pp. 29-41.

RATNESHWAR S, WARLOP L, MICK D G and SEEGER G (1997) Benefit Salience and Consumers' Selective Attention to Product Features. International Journal of Research in Marketing, 14. pp. 245-249.

RULLANI E (2002) "The Industrial District (ID) as a Cognitive System". In Curzio Quadrio A and Fortis M (Eds.), Complexity and Industrial Districts, Berlin: Springer Verlag.

SAMMARRA A and BIGGIERO L (2001) Identity and Identification in Industrial Districts. Journal of Management and Governance, 5. pp. 61-82.

SAVIOTTI P P (1996) Technological Evolution, Variety and the Economy, Chentelham, UK, Northampton, Massachussets, USA: Edward Elgar.

SAVIOTTI P P (2003) (Eds.) Applied Evolutionary Economics. New Empirical Methods and Simulation Techniques, Chentelham, UK, Northampton, Massachussets, USA: Edward Elgar.

SELTEN R (1998) Aspiration Adaptation Theory. Journal of Mathematical Psychology, 42. pp. 191-214.

SIMON H (1987) "Rationality in Psychology and Economics". In Hogart R M and Reder M W (Eds.), Rational Choice, Chicago: Chicago University Press.

SIMON H A (2000) Bounded Rationality in Social Science: Today and Tomorrow. Mind & Society, vol. 1. pp. 25-39.

SPELLMAN B A and HOLYOAK K J (1996) Pragmatics in Analogical Mapping. Cognitive Psychology, 31. pp. 307–346.

SQUAZZONI F and BOERO R (2002) Economic Performance, Inter-Firm Relations and Local Institutional Engineering in a Computational Prototype of Industrial Districts. Journal of Artificial Societies and Social Simulation, Vol. 5, No. 1. https://www.jasss.org/5/1/1.html.

STABER U (2001) The Structure of Networks in Industrial Districts. International Journal of Urban and Regional Research, Vol. 25, No. 3. pp. 537-552.

THOMAS J B, CLARK S M and GIOIA D A (1993) Strategic Sensemaking and Organizational Performance: Linkages among Scanning, Interpretation, Action, and Outcomes. Academy of Management Journal, 36. pp. 239-270.

TERNA P (1998) Simulation Tools for Social Scientists: Building Agent-Based Models with Swarm. Journal of Artificial Societies and Social Simulation, Vol. 1, No. 2. https://www.jasss.org/1/2/4.html.

WALSH J P (1995) Managerial and Organizational Cognition: Notes from a Trip-Down Memory Lane. Organization Science, 6. pp. 280-321.

WHITFORD J (2001) The Decline of a Model? Challenge and Response in the Italian Industrial Districts. Economy and Society, Vol. 30, No. 1. pp. 38-65.

Return to Contents of this issue

© Copyright Journal of Artificial Societies and Social Simulation, [2004]