Francesca Borrelli, Cristina Ponsiglione, Luca Iandoli and Giuseppe Zollo (2005)

Inter-Organizational Learning and Collective Memory in Small Firms Clusters: an Agent-Based Approach

Journal of Artificial Societies and Social Simulation

vol. 8, no. 3

<https://www.jasss.org/8/3/4.html>

For information about citing this article, click here

Received: 12-Jan-2005 Accepted: 30-May-2005 Published: 30-Jun-2005

Abstract

Abstract| Table 1: Examples of simulation models applied to IDs, firms' networks and supply chains | |||

| Authors | |||

| Boero, Squazzoni (2001) | Péli, Nootebom (1997) | Strader et al. (1998) | |

| Building blocks | |||

| 1. Entities | Firm's classes (final firms and sub-contracting firms) of an industrial district | User firms and supplier firms | Supplier, manufacturers, assemblers, distributors, and customers |

| 2. Agents (algorithms and goals) | Technology absorption, learning dynamics | Learning dynamics: learning by doing and learning by interacting | Decision making rules. Demand management policies (MTO, ATO, MTS) |

| 3. Environment structure (exogenous laws) | Technology and market as selection mechanism | Technology and market structure | Demand structure |

| 4. Interaction context | Production chain, spatial and organisational proximity | Supply partnership | Divergent assembly supply network |

| 5. Information flow | External environment/agents; agents/agents | External environment/agents; agents/agents | External environment/agents; agents/agents |

| 6. Purpose of simulation | To analyse firm's adaptation and system evolution with respect to market and technology environment challenges | To explore the trade-off between a single or multiple sourcing | To study the impact of information sharing on order fulfilment in divergent assembly supply networks |

|

| Figure 1. The role of collective memory in agent-based models of ID |

|

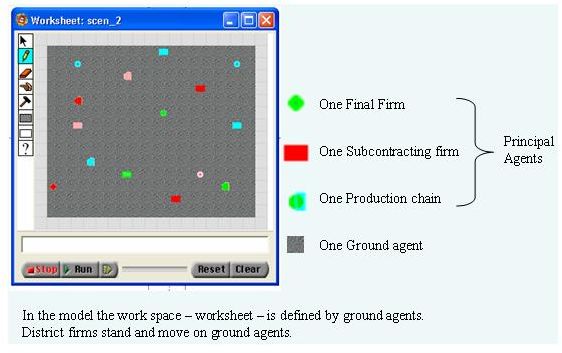

| Figure 2. The simulation work space - AgentSheets worksheet |

| IS(Si)= f (mi, ti , pi , oppi , riski , bdgi) |

where:

Market competencies group all the skills, knowledge and capabilities of the firm to sell its product to the market. Production chains with higher levels of mi have more probabilities to sell their product to the market. For final and subcontracting firms improving mi levels means increasing their probabilities to be approached by a potential partner.

Technical competencies are strictly related to product quality. Firms with higher level of ti are able to manufacture better products (as we identify market requirements with quality standards). Technical competencies are related to the specific production routines firms implement, so their level has to be measured accordingly.

Relational competencies gather several competencies, like partner selection, alliances creation, organizational competencies within production phases, information exchange. Final and subcontracting firms with higher levels of pi show better capabilities to cope with other firms to generate a production chain; while, for production chains, high levels of pi indicate that the firms belonging to the chain can cooperate fairly well, in order to generate a good outcome.

Competencies variables (mi, ti, pi) are measured on a discrete point scale ranging between 1 and 9, where 1 indicates the worst value. Competencies are part of the collective memory of the ID; so their levels and their descriptions have to be represented by keeping into account the characteristics of the specific ID being modeled.

When the simulation starts we assume that ID is populated only by final and subcontracting firms having certain initial values of competencies levels (m0, t0, p0). Instead, for production chains the initial values (m0_pch, t0_pch, p0_pch) are determined when the chain is built up. We assume that when a production chain is formed, it inherits the highest levels of competencies between the firms that generate the chain. In detail:

Another element of the collective memory is given by values representing shared beliefs about what is considered good and desirable both from an ethical and practical point of view. For the sake of simplicity, in our model, we consider only two values: opportunism and risk propensity. Firms' attitudes towards these two behavioral dimensions are recognized as main determinants of economic behavior (Williamson 1985; Schumpeter 1934). Thus they can be used to model in a general way a large range of situations. However, the structure of the model is such that it is possible to include other value variables by keeping into account the specificity of the collective memory of a given ID.

The Opp variable affects final and subcontracting firms' aptitude in building up a production chain; while, for production chain this variable influences its aptitude in breaking up the chain. This is a binomial variable, assuming values (0, 1). "Zero value agents" have a low degree of opportunism, while "unit value agents" have a high value.

Final and subcontracting firms with high values of opportunism will search for a partner with competencies levels greater or equal than their ones; while, low values indicate that firms will form chains without comparing the competencies levels. For production chain, instead, high values of opportunism indicate that it is less durable.

Risk propensity variable indicates agent's inclination to carry out investments. Firms with high values of this variable will set competencies improvements as primary objectives. Risk is a binomial variable, where values equal to one are defined as high.

This function computes the amount of economic resources of the firm. For each cycle, the function output (budget value) increases or decreases accordingly to firms choices; the function is defined as follows:

| bdgi = bdgi-1 - Cexp - Cinv + PFTi |

where:

At the beginning of the simulation, we settle the value of economic resources for all the final and subcontracting firms (bdg0_fin, bdg0_sub); for production chains this value is computed when the chain is formed, as follows:

| bdg0_pch = (bdgi_fin + bdgi_sub)/2 + PPch - Cint - Crisk - Copp |

where:

In the same way, when a chain breaks up the budget value of the new firms is computed as follows:

| bdgi_fin = bdgi_sub = (bdgi-1_pch)/2 - Cbk |

where:

|

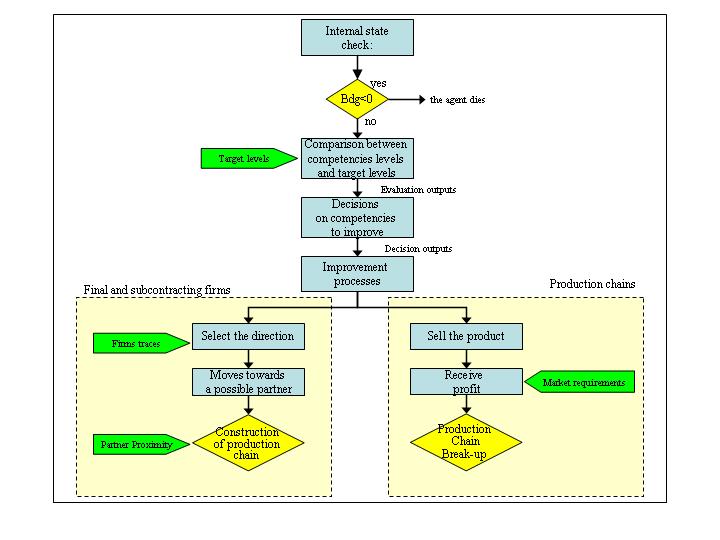

IF mi < Mi THEN eval (mi) is positive ELSEIF eval (mi) is negative |

where:

| IF imp(mi ) is positive THEN mi = mi-1 + 1 ELSEIF mi = mi-1 |

A positive improvement of market competencies (imp(mi ) > 0) is converted in an increase of the related competence level (mi = mi-1 + 1). Likewise, technological or relational competency improvements mean increases in technological or relational levels respectively. We make the simplistic assumption that when firms invest economic resources for competencies improvements they always get a higher level for their competencies. Moreover, each ID agent sets the "direction" (up, down, left, right) to move in the worksheet (step 4); principal agents use tracking mechanisms to accomplish this action (see paragraph 4.13).

| PFTi = PFTiMAX - f(gap_mi; gap_ti; gap_pi) |

where:

|

| Figure 3. Principal events of the simulation |

| Table 2: Agents' values | ||

| Risk | H/L | H/H |

| 0.5 | L/L | L/H |

| 0.5 | Opp | |

|

| Table 3. Starting Populations. The percentages indicate the portion of agents that take value in that quadrant |

| Table 4: Average values for N and P on the 50 runs | ||||

| Environment | Stable Case | Turbulent Case | ||

| Experimental Set | N | P | N | P |

| I - Intermediate | 11.96 | 79.25 | 7.40 | 31.03 |

| II - Intermediate | 11.66 | 79.78 | 8.20 | 40.42 |

| III - Closed | 11.34 | 66.86 | 6.42 | 19.10 |

| IV- Closed | 10.94 | 88.57 | 6.98 | 33.63 |

|

| Table 5. Comparison between HCD and LCD results |

| Table 6: Frequency Analysis of the results of the fifty runs performed for each experimental set | |||||

| Segments based on P | Experimental Set I - Stable Case | Experimental Set I - Turbulent Case | |||

| Min | max | Frequency | Relative Fr. | Frequency | Relative Fr. |

| 0 | 25000 | 0 | 0% | 12 | 24% |

| 25000 | 50000 | 4 | 8% | 38 | 76% |

| 50000 | 75000 | 18 | 36% | 0 | 0% |

| >75000 | 28 | 56% | 0 | 0% | |

| Segments based on P | Experimental Set II - Stable Case | Experimental Set II - Turbulent Case | |||

| Min | max | Frequency | Relative Fr. | Frequency | Relative Fr. |

| 0 | 25000 | 0 | 0% | 19 | 38% |

| 25000 | 50000 | 3 | 6% | 27 | 54% |

| 50000 | 75000 | 17 | 34% | 3 | 6% |

| >75000 | 30 | 60% | 1 | 2% | |

| Segments based on P | Experimental Set III - Stable Case | Experimental Set III - Turbulent Case | |||

| Min | max | Frequency | Relative Fr. | Frequency | Relative Fr. |

| 0 | 25000 | 0 | 0% | 6 | 12% |

| 25000 | 50000 | 3 | 6% | 32 | 64% |

| 50000 | 75000 | 17 | 34% | 12 | 24% |

| >75000 | 30 | 60% | 0 | 0% | |

| Segments based on P | Experimental Set IV - Stable Case | Experimental Set IV - Turbulent Case | |||

| Min | max | Frequency | Relative Fr. | Frequency | Relative Fr. |

| 0 | 25000 | 0 | 0% | 35 | 70% |

| 25000 | 50000 | 9 | 18% | 15 | 30% |

| 50000 | 75000 | 23 | 46% | 0 | 0% |

| >75000 | 18 | 36% | 0 | 0% | |

| Segments based on P | Experimental Set V - Stable Case | Experimental Set V - Turbulent Case | |||

| Min | max | Frequency | Relative Fr. | Frequency | Relative Fr. |

| 0 | 25000 | 0 | 0% | 9 | 18% |

| 25000 | 50000 | 2 | 4% | 37 | 74% |

| 50000 | 75000 | 9 | 18% | 4 | 8% |

| >75000 | 39 | 78% | 0 | 0% | |

|

| Figure 4. Graphical representation of the results of the fifty runs performed for each experimental set |

AYDALOT P. (ed. by) (1986) Milieux Innovateurs en Europe - Innovative Environments in Europe, Paris, Université de Paris I Sorbonne, GREMI - Groupement de Recherche sur les Milieux Innovateurs en Europe.

BECATTINI G. (1979) "Dal settore industriale al distretto industriale. Alcune considerazioni sull'unità di indagine dell'economia industriale", L'Industria, n. 1.

BECATTINI G. (1989) "Riflessioni sul distretto industriale marshalliano come concetto socio economico", Stato e Mercato, n. 25, pp. 111-128.

BECATTINI G. (2000) "Le vie del cambiamento", in Becattini G., Il distretto industriale, Torino, Rosenberg & Sellier, pp. 117-132.

BERGER P.L., Luckmann T. (1966) The Social Construction of Reality: A Treatise in the Sociology of Knowledge, New York, Doubleday .

BOERO R., Squazzoni F. (2001) "A computational prototype of industrial district", Workshop on "Complexity and Industrial Districts", Università di Modena e Reggio Emilia.

BRUSCO S. (1982) "The Emilian Model: Productive decentralisation and social integration", Cambridge Journal of Economics, vol. 6, pp. 167-184.

CAMAGNI R. (1989) "Cambiamento tecnologico, milieu locale e reti d'imprese: verso una teoria dinamica dello spazio economico", Economia e Politica Industriale, n.64, pp. 209-236.

CAMAGNI R. (1991) "Local milieu, uncertainty and innovation networks: towards a new dynamic theory of economic space", in Camagni R. (ed. by), Innovation networks: spatial perspectives, London, Belhaven Press.

COASE R. (1937) "The Nature of the Firms", Economica, vol. 4(16), pp. 386-405.

CONTE, R. (1999) "Social Intelligence Among Autonomous Agents". Journal of Computational & Mathematical Organization Theory 5(3), 203-228.

CREVOISIER O., Maillat D., Vasserot J.Y. (1989) "L'apport du milieu dans le processus d'innovation", in Maillat D., Perrin J. (eds), Entreprises innovatrice et reseaux locaux , Paris, Universit. de Paris I Sorbonne, GREMI - Groupement de Recherche sur les Milieux Innovateurs en Europe.

De ROSA M., Turri E. (2002) "L'analisi territoriale tra riduzionismo ed esaustività:modelli teorici e strumenti empirici", Convegno 'Storicità e Attualità della Scuola Economico-Agraria Italiana: Il pensiero di Mario Bandini', Università di Perugia, Facoltà di Agraria, 12 Dicembre.

Fransman M. (1994) "Information, Knowledge, Vision and Theories of the Firm", Industrial and Corporate Change 3 (2), pp: 1-45.

FUÀ G., Zacchia C. (1983) Industrializzazione senza fratture, Bologna, Il Mulino.

GAROFOLI G. (ed. by) (1978) Ristrutturazione industriale e territorio, Milano, Franco Angeli.

GRANOVETTER M. (1985) "Economic Action and Social Structure: The problem of embedded-ness", American Journal of Sociology, vol. 91(3), pp. 481-510.

GRANT R.M. (1996) "Toward a Knowledge-Based Theory of the Firm", Strategic Management Journal, Vol 17: pp.109-122.

HERRIOT, S.R., Levinthal, D, March, J.G. (1975) "Learning from Experience in Organizations", American Economic Review, 75, pp: 298 - 302.

MARSHALL A. (1919) Industry and Trade, London, MacMillan.

NELSON R.R., Winter S.G. (1982) An Evolutionary Theory of Economic Change, Cambridge (MA), The Belknap Press of Harvard University Press.

PÉLI G., Nooteboom B. (1997) "Simulation of Learning in Supply Partnership", Computational & Mathematical Organization Theory, vol. 3(1), pp. 43-66.

PENROSE E.T. (1959) The Theory of the Growth of the Firm, Oxford, Basil Blackwell.

PIORE M.J., Sabel C.F. (1984) The Second Industrial Divide: Possibilities for Prosperity, New York, Basic Books.

POWELL W.W. (1991) "Expanding the Scope of Institutional Analysis", in Powell W.W., Di Maggio P.J. (eds), The New Institutionalism in Organisational Analysis, Chicago, The University of Chicago Press, pp. 183-203.

RATTI R., D'Ambrogio F. (1989) "Processus d'innovation et integration au milieu local", in Maillat D., Perrin J. (eds), Entreprises innovatrice et reseaux locaux, Paris, Università de Paris I Sorbonne, GREMI - Groupement de Recherche sur les Milieux Innovateurs en Europe.

REPENNING A., Ioannidou A., Zola J. (2000) "AgentSheets: End User Programmable Simulations". Journal of Artificial Societies and Social Simulation, vol.3, no.3. https://www.jasss.org/3/3/forum/1.html

RULLANI E. (1989) "Economia delle reti: i linguaggi come mezzi di produzione", Economia e Politica Industriale, n. 64, pp.125-164.

RULLANI E. (1992) "Divisione del lavoro e reti di impresa: il governo della Complessità", in Belussi F., (a cura di), Nuovi Modelli D'Impresa, Gerarchie Organizzative e Imprese Rete, Milano, Franco Angeli, pp. 139-194.

Rullani E. (2002) "Il distretto industriale come sistema adattivo complesso", in Quadrio Curzio A., Fortis M. (a cura di), Complessità e Distretti Industriali, Bologna, Il Mulino.

SABA A. (1995) Il modello italiano. La "specializzazione flessibile" e i distretti industriali, FrancoAngeli, Milano.

SAKO M. (1992) "La cooperazione competitive: il sistema giapponese e lo sviluppo delle relazioni inter-impresa", in Belussi F. (a cura di), Nuovi Modelli D'Impresa, Gerarchie Organizzative e Imprese Rete, Milano, Franco Angeli, pp. 239-257.

SCHEIN E. (1985) Organizational Culture and Leadership, San Francisco, Jossey Bass.

SCHUMPETER J. A. (1934) The Theory of Economic Development, Nova York, Oxford University Press.

SCOTT W.R. (1995) Institutions and Organizations, Foundations for Organizational Science, Thousand Oaks (CA), Sage Publications.

SIMON H.A. (1961) Administrative Behavior, 2nd edition, New York, John Wiley & Son

SQUAZZONI F. (2001) Simulazione di un prototipo di distretto industriale. Un modello computazionale basato su agenti, University of Brescia, Doctoral Thesis in Economic Sociology, Cycle XIV.

STRADER T. J., Lin F., Shaw M. J. (1998) "Simulation of Order Fulfillment in Divergent Assembly Supply Chain", Journal of Artificial Societies and Social Simulation, vol. 1(2). https://www.jasss.org/1/2/5.html

UZZI B. (1996) "The sources and consequences of embeddedness for the economic performance of organizations", American Sociological Review, 61, pp: 674-698.

WALSH J.P., Ungson G.R. (1991) "Organizational Memory", Academy of Management Review, vol. 16, n. 1, pp: 57-91.

WILLIAMSON, O. E. (1975) Markets and Hierarchies: Analysis and Antitrust Implications New York: The Free Press.

WILLIAMSON, O. E. (1985) The Economic Institutions of Capitalism. New York: The Free Press.

Return to Contents of this issue

© Copyright Journal of Artificial Societies and Social Simulation, [2005]