Introduction

There has always been a strong debate about alternative macroeconomic schools of thought (see e.g. Greenwald et al. 1988; Greenwald & Stiglitz 1993) 1, but, at the dawn of 2008, a new consensus emerged: the New Neoclassical Synthesis (NNS) (see e.g. Goodfriend 2007; Woodford 2009), grounded upon Dynamic Stochastic General Equilibrium (DSGE) models2. A large number of NNS contributions claimed indeed that monetary – and, more generally, economic – policy was finally becoming more of a science (Mishkin 2007; Galí & Gertler 2007; Goodfriend 2007; Taylor 2007), and macroeconomic policies could finally resort on the application of a core set of "scientific principles" (Mishkin 2007, p.1).

Furthermore, the available toolbox of economic policy rules was deemed to work exceptionally well not only for normative purposes, but also for descriptive ones. For example, Taylor (2007) argued that "while monetary policy rules cannot, of course, explain all of economics, they can explain a great deal" (p.1) and also that "although the theory was originally designed for normative reasons, it has turned out to have positive implications which validate it scientifically" (abstract). Given these Panglossian premises, scientific discussions on economic policy seemed therefore to be ultimately confined to either fine-tuning the "consensus" model, or assessing the extent to which elements of art (appropriable by the policy maker) still existed in the conduct of policies (Mishkin 2007)3.

The DSGE model hegemony was not just confined to the academia — "an aphorism among macroeconomists today is that if you have a coherent story to propose, you can do it in a suitably elaborate DSGE model" (Chari et al. 2009) — but it reached policy makers and central banks (without surprise the finance industry was the only exception, Smith 2014). Unfortunately, as it happened with two famous statements made, respectively, by Francis Fukuyama (1992) about an alleged "end of history", and by many physicists in the recent debate on a purported "end of physics" (see, e.g., Lindley 1994), these positions have been proven to be substantially wrong by subsequent events. Indeed, the "perfect storm" that followed the bankruptcy of Lehman Brothers on September 15, 2008 brought financial markets on the edge of collapse causing in turn the worst recession developed economies have ever seen since the Great Depression, and is still threatening the stability of many world countries.

What is worse, mainstream DSGE-based macroeconomics appears to be badly equipped to deal with the big turmoil we have been facing. As Krugman (2011) points out, not only orthodox macroeconomists did not forecast the crisis, but they did not even admit the possibility of such event and, even worse, they did not provide any useful advice to policy makers to put back the economy on a steady growth path (see also Stiglitz 2011, 2015). On the same line, DeLong (2011) reports that when the former U.S. secretary Lawrence Summers was asked what economics can offer to understand the crisis, he quoted the works of Bagehot, Minsky and Kindleberger, appeared more than 30 years ago. This is so because the DSGE approach "has become so mesmerized with its own internal logic that it has begun to confuse the precision it has achieved about its own world with the precision that it has about the real one" (Caballero 2010, p. 85).

In that respect, the Great Recessions turned out to be a "natural experiment" for economic analysis, showing the inadequacy of the predominant theoretical frameworks. DSGE scholars have reacted to such a failure trying to amend their models with e.g. financial frictions, homeopathic doses of agent heterogeneity and exogenous fat-tailed shocks (see e.g. Lindé et al. 2016). At the same time, an increasing number of leading economists have claimed that the 2008 "economic crisis is a crisis for economic theory" (Kirman 2010, 2016; Colander et al. 2009; Krugman 2009; Farmer & Foley 2009; Krugman 2011; Caballero 2010; Stiglitz 2011, 2015; Kay 2011; Dosi 2012; De-Long 2011; Romer 2016). Their view, which we fully share here, is that the basic assumptions of mainstream DSGE models, e.g. rational expectations, representative agents, perfect markets etc., prevent the understanding of basic phenomena underlying the current economic crisis and, more generally, macroeconomic dynamics4.

In order to better articulate these points, we extend and update here the discussion presented in Fagiolo & Roventini (2012). We argue that new developments and extensions of DSGE models are certainly welcome, but instead of performing such a Ptolemaic exercise (Stiglitz 2011, 2015; Dosi 2012; Caballero 2010) —adding a plethora of new "epicycles" to fix flawed models— economists should consider the economy as a complex evolving system, i.e. as an ecology populated by heterogeneous agents whose far-from-equilibrium interactions continuously change the structure of the system (more on that in Farmer & Foley 2009; Kirman 2010, 2016; Dosi 2012; Rosser 2011; Battiston et al. 2016). This is indeed the methodological core of agent-based computational economics (ACE) (e.g. Tesfatsion 2006a; LeBaron & Tesfatsion 2008), a stream of research whose keywords are heterogeneity, bounded rationality, endogenous out-of-equilibrium dynamics, and direct interactions among economic agents. In this article, we discuss how this approach allows to build models that, from a descriptive perspective, are able to reproduce many features of the 2008 economic crisis, such as, e.g., asset bubbles, resilience of interbank networks, self-organized criticality, financial accelerator dynamics (see Section 5 for more details).

Furthermore, on the normative side, due to the extreme flexibility of the set of assumptions regarding agent behaviors and interactions, ACE models (often called agent-based models, ABMs) represent an exceptional laboratory to design policies and to test their effects on macroeconomic dynamics. Indeed, as Section 6 shows, an increasing number of macroeconomic policy applications have been already devised and explored concerning fiscal and monetary policies, bank regulation, structural reforms in the labor market, and climate change policies.

Certainly, given its relatively young age, also in the ACE approach there are still open issues that should be addressed. The most important ones concern empirical validation, over-parametrization, estimation and calibration, and comparability between different models. Nevertheless, papers addressing such issues have blossomed in recent years (cf. Section 5). Furthermore, the success of ACE models in delivering policy implications, while simultaneously explaining the observed micro and macro stylized facts, are encouraging for the development of a new way of doing macroeconomic theory.

The structure of this paper essentially mimics its predecessor (Fagiolo & Roventini 2012), whilst extending and updating all sections with new material coming from recent methodological improvements and new applications in both the DSGE and ABM camps. In particular, Section 2 surveys the approach to policy of the New Neoclassical Synthesis. In Section 3, we discuss the main theoretical and empirical difficulties of DSGE models. Section 4 reviews the recent developments in DSGE macroeconomics. In Section 5, we instead introduce the ACE paradigm and in Section 6 we review some policy macroeconomic applications in this field. Section 7 concludes by telegraphically accounting for some methodological issues related to policy in ACE models and the ensuing research avenues that these problems open up.

DSGE Models and Economic Policy

Let us begin by presenting how policy analysis is usually carried out in DSGE models, which are at the center of the New Neoclassical Synthesis (Goodfriend & King 1997). The canonical DSGE model has a real-business-cycle (RBC) core supplemented with monopolistic competition, nominal imperfections and a monetary policy rule (for a more detailed exposition of the DSGE model, cf. Clarida et al. 1999; Woodford 2003; Galí & Gertler 2007).

In line with the RBC tradition, the backbone of DSGE models is the standard stochastic neoclassical growth model with variable labor supply: the economy is populated by an infinitely-lived representative household, and by a representative firm, whose homogenous production technology is hit by exogenous shocks. All agents form their expectations rationally (Muth 1961). The New Keynesian flavor of the model is provided by money, monopolistic competition and sticky prices. Money has usually only the function of unit of account and the nominal rigidities incarnated in sticky prices allow monetary policy to affect real variables in the short run. The RBC scaffold of the model allows the computation of the "natural" level of output and real interest rate, which is the equilibrium values of the two variables under perfectly flexible prices. In line with the Wickselian tradition, the "natural" output and interest rate constitute a benchmark for monetary policy: the central bank cannot persistently push the output and the interest rate away from their "natural" values without creating inflation or deflation. Finally, imperfect competition and possibly other real rigidity imply that the "natural" level of output is not socially efficient.

The plain vanilla version of the DSGE model is represented by three equations: the expectation-augmented IS equation, the New Keynesian Phillips (NKP) curve, and a monetary policy rule. The expectation-augmented IS equation constitutes the aggregate-demand building block of the NNS model and it stems from the goods market-clearing condition and the Euler equation of the representative household (under the assumption of perfect capital markets):

| $$\tilde{y_{t}}=E_{t}\tilde{y}_{t+1}-\sigma(i_{t}-E_{t}\pi_{t+1}-r_{t}^{n}), $$ | (1) |

The aggregate-supply building block of the NNS model boils down to a New Keynesian Phillips curve. By combining the Dixit & Stiglitz (1977) model of monopolistic competition and the Calvo (1983) model of staggered prices, one obtains that in any given period firms allowed to adjust prices fix them as a weighted average of the current and expected future nominal marginal cost. The NKP curve can be obtained by combining the log-linear approximation of the optimal price-setting choice, the price index and the labor-market equilibrium:

| $$ \pi_{t}=\kappa \tilde{y}_{t} + \beta E_{t}\pi_{t+1}+u_{t}, $$ | (2) |

The model is closed with the monetary policy rule. The derivation of the optimal monetary policy rule is carried out adopting a welfare criterion: taking a second-order Taylor series approximation of the utility of the representative household, one can derive a welfare loss function for the central bank that is quadratic in inflation and in deviations of output from its socially efficient level (see Woodford 2010). Alternatively, one can plug a "simple" rule such as the Taylor (1993) rule (see Howitt 1992 and Taylor & Williams 2010, for a survey; more detail below)

| $$ i^{\tau}_{t}=r_{t}^{n} + \phi_{\pi} \pi_{t} + \phi_{y}\tilde{y}_{t}, $$ | (3) |

Before performing policy exercises with DSGE models, one ought to assess their empirical performance and calibrate their parameters. At this stage, in medium-scale DSGE model (see e.g. Christiano et al. 2005; Smets & Wouters 2003, 2007) different type of shocks (e.g. government spending and private consumption disturbances) are usually added to improve the estimation. Moreover, as the assumption of forward-looking agents prevents DSGE models to match the econometric evidence on the co-movements of nominal and real variables (e.g., the response of output and inflation as to a monetary policy shock is too fast to match the gradual adjustment showed by the corresponding empirical impulse-response functions), a legion of "frictions" – often not justified on the theoretical ground – such as predetermined price and spending decisions, indexation of prices and wages to past inflation, sticky wages, habit formation in preferences for consumption, adjustment costs in investment, variable capital utilization, etc. However, in almost all DSGE models the labor market is not explicitly modeled and unemployment is not contemplated (a notable exception is Blanchard & Galí 2010, who introduce a search and matching model of labor market).

From an econometric perspective, DSGE models are naturally represented as a vector auto-regression (VAR) model. The estimation of the resulting econometric model is usually carried out either with a limited information approach or by full-information likelihood-based methods (see Fernandez-Villaverde et al. 2016, for a detailed description of solution and estimation methods for DSGE models).

Limited information approach. The strategy of the limited information approach to estimate and evaluate DSGE models is usually the following (e.g., Rotemberg & Woodford 1999; Christiano et al. 2005):

- Specify the monetary policy rule and the laws of motion for the shocks.

- Split the parameters in two sets and calibrate the parameters in the first set providing some theoretical or empirical justifications for the chosen values.

- After having fixed the timing of the endogenous variables, estimate via OLS the coefficients of the monetary policy rule and obtain the impulse-response functions as to a monetary policy shock.

- Recover the second set of parameters by minimizing the distance between the model-generated and empirical impulse-response functions.

- Finally, given the structural parameter values and the VAR, identify the other structural shocks by imposing, if necessary, additional restrictions.

The empirical performance of the model is then measured by comparing the impulse-response functions generated by the model with the empirical ones.

Full information approach. The full information approach was initially discarded to estimate DSGE models because maximum likelihood methods deliver implausible estimates. However, with the introduction of Bayesian techniques, the full information approach regained popularity and it is now commonly employed (see e.g. Smets & Wouters 2003, 2007). Bayesian estimation is carried out according to the following steps:

- Place if necessary some restrictions on the shocks in order to allow later identification. For instance Smets & Wouters (2003) assume that technology and preference shocks follow an independent first-order autoregressive process with i.i.d. Gaussian error terms, whereas "cost-push" and monetary policy shocks are i.i.d. Normal white noise processes.

- Employ the Kalman filter to compute the likelihood function of the observed time series.

- Form the prior distribution of the parameters by choosing their initial values through calibration, preliminary exploratory exercises, and/or to get some desired statistical properties.

- Combine the likelihood function with the prior distribution of the parameters to obtain the posterior density, which is then used to compute parameter estimates.

One can then assess the empirical performance of the estimated DSGE model comparing its marginal likelihood with the one of standard VAR models (i.e. the Bayes factor) and the model-generated cross-covariances vis-á-vis the empirical ones.

Policy analysis. Once one has recovered the parameters of the model by estimation or calibration and has identified the structural shocks, policy-analysis exercises can finally be carried out. More specifically, after having derived the welfare loss function, one can assess the performance of the subset of "simple" policy rules that guarantee the existence of a determinate equilibrium or the more appropriate parametrization within the class of optimal monetary policy rules. This can be done via simulation, by buffeting the DSGE model with different structural shocks and computing the resulting variance of inflation and the output gap and the associated welfare losses of the different monetary policy rules and parameterizations employed (see e.g. Rotemberg & Woodford 1999; Galí & Gertler 2007). In practice, assuming that the DSGE model is the "true" data generating process of the available time series, one is evaluating how the economy portrayed by the model would react to the same structural shocks observed in the past if the monetary policy followed by the central bank were different. Adding the public sector to the plain-vanilla DSGE model, one can also study the effects of fiscal policies. More specifically, one can compute the impulse response functions to analyze the impact on GDP dynamics of government spending and tax shocks (see e.g. Cogan et al. 2009).

Policy with DSGE Models: A Safe Exercise?

There are three types of problems which undermine the usefulness of DSGE models for policy analyses. Such problems are theoretical, empirical and related to the political economy of DSGE models. Let us discuss each of them in turn.

Theoretical issues

As DSGE models are general equilibrium models (GE) rooted in the Arrow-Debreu tradition with some minor non-Walrasian features (e.g., sticky prices), they are plagued by the same well-known problems of GE models (see Kirman 1989, for a classical reference).

First, the well-known Sonnenschein (1972), Mantel (1974), Debreu (1974) theorems prove that the uniqueness and stability of the general equilibrium cannot be attained even if one places stringent and unrealistic assumptions about agents. Moreover, Saari & Simon (1978) show that an infinite amount of information is required to reach the equilibrium for any initial price vector.

Given such nihilist conclusions, neoclassical economists took the short-cut of the representative agent (RA) to obtain stable and unique equilibrium. Indeed, if the choices of heterogeneous agents collapse to the RA ones, one can circumvent all the aggregation problems and develop GE macroeconomic models with rigorous Walrasian micro-foundations grounded on rationality and constrained optimization.

However, the RA assumption is far from being innocent: there are (at least) four reasons for which it cannot be defended (Kirman 1992)6. First, individual rationality does not imply aggregate rationality: one cannot provide any formal justification to support the assumption that at the macro level agents behave as a maximizing individual. Second, even if one forgets the previous point, one cannot safely perform policy analyses with RA macro models, because the reactions of the representative agent to shocks or parameter changes may not coincide with the aggregate reactions of the represented agents. Third, even if the first two problems are solved, there may be cases where given two situations a and b, the representative agent prefers a, whereas all the represented individuals prefer b. Finally, the RA assumption introduces additional difficulties at the empirical level, because whenever one tests a proposition delivered by a RA model, one is also jointly testing the very RA hypothesis. Hence, the rejection of the latter hypothesis may show up in the rejection of the model proposition that is being tested. Forni & Lippi (1997, 1999) show that basic properties of linear dynamic micro-economic models are not preserved by aggregation if agents are heterogeneous (see also Pesaran & Chudik 2011). For instance, micro-economic co-integration does not lead to macroeconomic co-integration, Granger-causality may not appear at the micro level, but it may emerge at the macro level, aggregation of static micro-equations may produce dynamic macro-equations. As a consequence, one can safely test the macroeconomic implications of micro-economic theories only if agents’ heterogeneity is explicitly and carefully modeled.

More generally, the representative agent assumption implies that there is a one-to-one correspondence between the micro and macro levels. In particular, macroeconomic dynamics is compressed into microeconomics. Below we will see that this simplification prevents DSGE models to account for complex phenomena.

The last theoretical issue concerns the existence and determinacy of the system of rational-expectation equilibrium conditions of DSGE models. If the exogenous shocks and the fluctuations generated by the monetary policy rule are "small", and the "Taylor principle" holds (i.e., \(\phi_{\pi}>1\), see eq. 3), the rational-expectation equilibrium of the DSGE model presented in Section 2 (Woodford 2003)7 exists and is locally determinate. This result allows one to compute impulse-response functions in presence of "small" shocks or parameter changes and to safely employ log-linear approximations around the steady state. Unfortunately, the existence of a local determinate equilibrium does not rule out the possibility of multiple equilibria at the global level (see e.g. Schmitt-Grohé & Uribe 2000; Benhabib et al. 2001; Ascari & Ropele 2009). This is a serious issue because there is always the possibility, e.g. if the laws of motion of the shocks are not properly tuned, that the DSGE model enters in an explosive path, thus preventing the computation of impulse-response functions and the adoption of the model for policy analysis exercises.

Empirical issues

The second stream of problems concern the empirical validation of DSGE models. The estimation and testing of DSGE models are usually performed assuming that they represent the true data generating process (DGP) of the observed data (Canova 2008). This implies that the ensuing inference and policy experiments are valid only if the DSGE model mimics the unknown DGP of the data8.

As mentioned in Section 2, DSGE models can be represented as a VAR of the form:

| $$A_{0}(\phi)x_{t} = H_{1}(\phi)x_{t-1}+H_{2}({\phi})E_{t},$$ | (4) |

Following Fukac & Pagan (2006), the econometric performance of DSGE models can be assessed along the identification, estimation and evaluation dimensions. Before going in depth with this type of analysis, two preliminary potential sources of problems must be discussed. First, the number of endogenous variables contemplated by DSGE models is usually larger than the number of structural shocks. This problem may lead to stochastic singularity and it is typically solved by adding measurement errors or increasing the number of structural shocks (see Fernandez-Villaverde et al. 2016). Second, \(H_{1}\) and \(H_{2}\) are reduced rank matrixes. This problem is circumvented by integrating variables out of the VAR (eq. 4) as long as \(H_{1}\) and \(H_{2}\) become invertible. This process leads to a VARMA representation of the DSGE model. This is not an innocent transformation for two reasons: i) if the moving average component is not invertible, the DSGE model cannot have a VAR representation; ii) even if the VAR representation of the DSGE model exists, it may require an infinite number of lags (more on that in Fernandez-Villaverde et al. 2005, 2016; Ravenna 2007; Alessi et al. 2007).

Identification. Given the large number of non-linearities present in the structural parameters (\(\theta\)), DSGE models are hard to identify (Canova 2008). This leads to a large number of identification problems, which can affect the parameter space either at the local or at the global level. A taxonomy of the most relevant identification problems can be found in Canova & Sala (2009)9. To sum them up: i) different DSGE models with different economic and policy implications could be observationally equivalent (i.e., they produce indistinguishable aggregate decision rules); ii) some DSGE models may be plagued by under or partial identification of their parameters (i.e., some parameters are not present in the aggregate decision rules or are present with a peculiar functional form); iii) some DSGE may be exposed to weak identification problems (i.e., the mapping between the coefficients of the aggregate decision rules and the structural parameters may be characterized by little curvature or by asymmetries), which could not even be solved by increasing the sample size.

Identification problems lead to biased and fragile estimates of some structural parameters and do not allow to rightly evaluate the significance of the estimated parameters applying standard asymptotic theories. This opens a ridge between the real and the DSGE DGPs, depriving parameter estimates of any economic meaning and making policy analysis exercises useless (Canova 2008). For instance, Schorfheide (2008) finds that the parameters of the New Keynesian Phillips curve estimated in 42 DSGE models published in academic journals range from zero to four. In most of the cases, identification problems can only be mitigated by appropriately re-parameterizing the model10.

Estimation. The identification problems discussed above partly affect the estimation of DGSE models. DSGE models are very hard to estimate by standard maximum likelihood (ML) methods, because ML estimator delivers biased and inconsistent results if the system is not a satisfying representation of the data. This turns out to be the case for DSGE models (see the evaluation section) and it helps to explain why ML estimates usually attain absurd values with no economic meaning and/or they are incompatible with a unique stable solution of the underlying DSGE model.

A strategy commonly employed when the DSGE model is estimated following the limited-information approach (cf. Section 2) consists in calibrating the parameters hard to identify and then estimating the others. Given the identification problems listed above, Canova (2008) argues that this strategy works only if the calibrated parameters are set to their "true" values. If this is not the case, estimation does not deliver correct results that can be used to address economic and policy questions (see also Canova & Sala 2009).

Bayesian methods apparently solve the estimation (and identification) problems by adding a prior function to the (log) likelihood function in order to increase the curvature of the latter and obtain a smoother function. However, this choice is not harmless: if the likelihood function is flat – and thus conveys little information about the structural parameters – the shape of the posterior distribution resembles the one of the prior, reducing estimation to a more sophisticated calibration procedure carried out on an interval instead on a point (see Canova 2008; Fukac & Pagan 2006). Unfortunately, the likelihood functions produced by most DSGE models are quite flat (see e.g. the exercises performed by Fukac & Pagan 2006). In this case, informal calibration is a more honest and internally consistent strategy to set up a model for policy analysis experiments (Canova 2008).

Evaluation. DSGE models should be capable to reproduce as many empirical stylized facts as possible. For instance, following Fukac & Pagan (2006), one can check: i) whether variables with deterministic trend cotrend; ii) whether I(1) variables co-integrate and the resulting co-integrating vectors are those predicted by the model; iii) the consistency (with respect to data) of the dynamic responses (e.g., autocorrelation, bivariate correlations); iv) the consistency of the covariance matrix of the reduced form errors with the one found in the data; v) the discrepancies between the time series generated by the model and real-world ones. In light of the Great Recession, the last point is particularly important: can DSGE models jointly account for the occurrence of mild and deep downturns (Stiglitz 2015)?

Fukac & Pagan (2006) perform such exercises on a popular DSGE model. First, they find that co-trending behaviors cannot be assessed because data are demeaned (a practice commonly followed by DSGE modelers). However, the computation of the technology growth rates compatible with the observed output growth rates shows that the possibility of technical regress is very high. Second, there are no co-integrating vectors, because output is the only I(1) variable. Third, the model is not able to successfully reproduce the mean, standard deviations, autocorrelations, bivariate correlations observed in real data. In addition, the DSGE model predicts the constancy of some "great" ratios (in line with the presence of a steady state of the economy), but this is not confirmed by real data. For instance, Fernandez-Villaverde et al. (2016) find a discrepancy between U.S. and DSGE-generated data, as DSGE models are not able to catch the increasing upward trend in the consumption-output ratio and the falling labor share. Fourth, many o -diagonal correlations implied by the covariance matrix of the errors are significantly different from zero, contradicting the DSGE model assumption of uncorrelated shocks. Fifth, the tracking performance of the model depends heavily on the assumed high serial correlation of the shocks.

Recent empirical evidence has found that non-linearities in the economic system can lead to different impact of macroeconomic policies according to the state of the economy (see e.g. Auerbach & Gorodnichenko 2012) and financial markets (Mittnik & Semmler 2013; Ferraresi et al. 2014). In DSGE models, the effects of monetary and fiscal policies are time invariant, even if the economy is trapped in a depression. More generally, DSGE models can do well in "normal" time, but they cannot account for crises and deep downturns (Stiglitz 2015), as well as for the size and duration of recessions (Ormerod 2004, 2010). This is not surprising since macroeconomic time series distributions are well approximated by fat tail densities (Fagiolo et al. 2008) and DSGE models typically assume Gaussian distributed shocks11. Moreover, Ascari et al. (2015) find that even fat-tailed Laplace shocks are assumed, the distributions of the time series generated by DSGE models have much thinner tails than those observed in real data. The propagation mechanism of DSGE models appears to work in the wrong direction, smoothing instead of magnifying shocks.

The results just described seem to support Favero (2007) in claiming that modern DSGE models are exposed to the same criticisms advanced against the old-fashioned macroeconometric models belonging to the Cowles Commission tradition: they pay too much attention to the identification of the structural model (with all the problems described above) without testing the potential misspecification of the underlying statistical model (see also Johansen 2006; Juselius & Franchi 2007)12. In DSGE models, "restrictions are made fuzzy by imposing a distribution on them and then the relevant question becomes what is the amount of uncertainty that we have to add to model based restrictions in order to make them compatible not with the data but with a model-derived unrestricted VAR representation of the data" (Favero 2007, p. 29). If the statistical model is misspecified, policy analysis exercises loose significance, because they are carried out in a "virtual" world whose DGP is different from the one underlying observed time-series data.

More generally, the typical assertion made by DSGE modelers that their theoretical frameworks are able to replicate real world evidence seems at odds with a careful scrutiny of how empirical evaluation of DSGE models is really done. DSGE modelers, indeed, typically select ex-ante the set of empirical criteria that their models should satisfy in such a way to be sure that these restrictions are met. However, they usually restrain from confronting their models with the wealth of fundamental features of growth over the capitalist business cycle, which DSGE are not structurally able to replicate.

Political-economy issues

Given the theoretical problems and the puny empirical performance of DSGE models, one cannot accept the principles of the positive economics approach summarized by the "as if" argument of Milton Friedman (1953). The assumptions of DSGE models can no longer be defended invoking arguments such as parsimonious modeling or data matching. This opens a Pandora’s box as one should study how the legion of assumptions of DSGE models affect their policy conclusions.

DSGE models presume a very peculiar framework, where representative agents endowed with rational expectations (RE) take rational decisions by solving dynamic programming problems. This implies that: i) agents perfectly know the model of the economy; ii) agents are able to understand and solve every problem they face without making any mistakes; iii) agents know that all other agents behave according to the first two points. In practice, agents are endowed with a sort of "Olympic" rationality and have free access to the whole information set13.

Rational expectation is the short-cut employed by DSGE model to deal with uncertainty. Such strong assumption rises many issues14. First, rational expectations are a property of the economic system as a whole, individual rationality is not a sufficient condition for letting the system converge to the RE fixed-point equilibrium (Howitt 2011). Moreover, it is unreasonable to assume that agents possess all the information required to attain the equilibrium of the whole economy (Caballero 2010), especially in periods of strong structural transformation, like the Great Recession, that require policies never tried before (e.g. quantitative easing, see Stiglitz 2011, 2015). Agents can also have the "wrong" model of the economy and available data are not sufficient to refute it (see the seminal contribution of Woodford 1990, among the rich literature on sunspots). Hendry & Minzon (2010) point out that when "structural breaks" affect the underlying stochastic process that governs the evolution of the economy, the learning process of agents introduce further non-stationarity into the system, preventing the economy to reach an equilibrium state. In such a framework, predictors grounded on robust devices performs better. More generally, in presence of Knightian uncertainty (Knight 1921; Keynes 1936, 1937), "rational" agents should follow heuristics as they always outperform more complex expectation formation rules (Gigerenzer 2007; Gigerenzer & Brighton 2009). Assuming that agents behaving according to what suggested by the psychological and sociological evidence allow then to build models which better account for macroeconomic phenomena (Akerlof 2002) including the current crisis (Akerlof & Shiller 2009). Finally, given such premises, no wonder that empirical tests usually reject the full-information, rational expectation hypothesis (see e.g. Guzman 2009; Coibion & Gorodnichenko 2011; Gennaioli et al. 2015).

The representative-agent (RA) assumption prevent DSGE models to address distributional issues, which are one of the major cause of the Great Recession and they are fundamental for studying the effects of policies. Indeed, increasing income (Atkinson et al. 2011) and wealth (Piketty & Zucman 2014) inequalities induced households to indebt more and more over time paving the way to the subprime mortgage crisis (Fitoussi & Saraceno 2010; Stiglitz 2011). In this framework, redistribution matters and different policies have a different impact on the economy according to the groups of people they are designed for (e.g. unemployed benefits have large multipliers than tax cuts for high-income individuals, see Stiglitz 2011). The study of redistributive policies require then models with heterogeneous not representative agents.

The RA assumption coupled with the implicit presence of a Walrasian auctioneer, which sets prices before exchanges take place, rule out almost by definition the possibility of interactions carried out by heterogeneous individuals. This prevents DSGE model to study the dynamics of credit and financial markets accurately. Indeed, the assumption that the representative agent always satisfies the transversality condition, removes the default risk from DSGE models (Goodhart 2009). Therefore, agents face the same interest rate (no risk premia) and all transactions can be undertaken in capital markets without the need of banks15. The abstraction from default risks does not allow DSGE models to contemplate the conflict between price and financial stability that Central Banks always face (Howitt 2011): they just care about the nth-order distortions caused by price misalignments which can eventually result in inflation without considering the huge costs of financial crisis (Stiglitz 2011, 2015). No surprise that DSGE models work fine in normal time but they are unequipped not only to forecast but also to explain the current crisis (Goodhart 2009; Krugman 2011).

In the same vein, DSGE models are not able to account for involuntary unemployment. Indeed, even if they are developed to study the welfare effects of macroeconomic policies, unemployment is not present or it only stems from frictions in the labor market or wage rigidities. Such explanations are especially hard to believe during deep downturns like e.g. the Great Recession. In DSGE models, the lack of heterogeneous, interacting firms and workers/consumers prevents to study the emergence of coordination failures (Cooper & John 1988), which could lead to an insufficient level of aggregate demand and to involuntary unemployment.

The "as if" methodology implies that the macroeconomics of DSGE models does not seem to be truly grounded on microeconomics (Stiglitz 2011, 2015). For instance, DSGE models do not take into account the micro and macro implications of imperfect information. Moreover, the behavior of agents is often described with arbitrary specification of the functional forms. The common employed (Dixit & Stiglitz 1977) utility function provides a bad description of agents’ behavior toward risk. Similarly, the Cobb-Douglas production function is not suited for studying income distribution issues.

More generally, within the Neoclassical-DSGE paradigm there is a sort of internal contradiction. On the one hand, strong assumptions such as rational expectations, perfect information and complete financial markets are introduced ex-ante to provide a rigorous and formal mathematical treatment of the problems and to allow for policy recommendations. On the other hand, many imperfections (e.g., sticky prices, rule-of-thumb consumers) are introduced ex-post without any theoretical justification only to allow DSGE model to match the data. This process is far from being innocuous: Chari et al. (2009) point out that the high level of arbitrariness of DSGE models in the specifications of structural shocks may leave them exposed to the Lucas critiques, preventing them to be usefully employed for policy analysis. Adopting less stringent – but in tune with the microeconomic statistical evidence – assumptions may contribute to jointly solve many empirical puzzles without introducing an army of ad-hoc imperfections.

Another possible issue concerns how business cycles arise in the DSGE framework. More specifically, the theory of business cycles embedded in DSGE models is exogenous: the economy rests in the steady state unless it is hit by a stream of exogenous stochastic shocks. As a consequence, DSGE models do not explain business cycles, preferring instead to generate them with a sort of deus-ex-machina mechanism. This could explain why even in normal times DSGE models are not able to match many business cycle stylized facts or have to assume serially correlated shocks to produce fluctuations resembling the ones observed in reality (cf. Zarnowitz 1985, 1997; Cogley & Nason 1993; Fukac & Pagan 2006). Even worse, the subprime mortgage crisis clearly shows how bubbles and, more generally, endogenously generated shocks are far more important for understanding economic fluctuations (Stiglitz 2011, 2015). How policymakers can assess the impact of policies in models not explaining business cycles is an open issue. For instance, the Great Recession revealed that the FED’s doctrine about cleaning up afterward asset bubbles bursts was patently wrong.

Moving to the normative side, one supposed advantage of the DSGE approach is the possibility to derive optimal policy rules. However, policymakers adopting optimal policy rules face certain costs – the strict assumptions at the root of DSGE models – but uncertain benefits. As argued by Galí (2008), optimal monetary policy rules cannot be used in practice, because they require the knowledge of the "true" model of the economy, the exact value of every parameter, and the real time value of every shocks. Moreover, when the "true" model of the economy and the appropriate loss function are not know, rule-of-thumb policy rules can perform better than optimal policy rules (Brock et al. 2007; Orphanides & Williams 2008). Indeed, in complex worlds with pervasive uncertainty (e.g. financial markets), regulation should be simple (Haldane 2012).

Recent Developments in DSGE Modeling: Patches or New Clothes?

The failure of DSGE models to account for the Great Recessions sparked new research avenues, which were also partly trying to address the critiques we reported inSection 3. More specifically, researchers in the DSGE camp have tried to include a financial sector to the barebone model, consider agents’ heterogeneity and bounded rationality, and explore the impact of rare shocks on the performance of DSGE models. In this Section, we provide a bird’s eye view of such recent developments.

The new generation of DSGE model with financial frictions are mostly grounded on the financial accelerator framework (Bernanke et al. 1999), which provides a straightforward explanation why credit and financial markets can affect real economic activity. The presence of imperfect information between borrowers and lenders introduces a wedge between the cost of credit and those of internal finance. In turn, the balance-sheets of lenders and borrowers can affect credit and the real sector via the supply of credit and the spread on loan interest rates (see Gertler & Kiyotaki 2010, for a survey). In Curdia & Woodford (2010), the presence of both patient and impatient consumers justify the existence of a stylized financial intermediary, which copes with default risk charging a spread on its loan subject to exogenous, stochastic disturbances. They find that optimal monetary policy does not change and the Central Bank should keep on controlling the short-term interest rate (see also Curdia & Woodford 2015). In the model of Gertler & Karadi (2011), households can be (randomly) workers or bankers. In the latter case, they provide credit to firms, but as they are constrained by deposits and the resources they can raise in the interbank market, a spread emerges between loan and deposits interest rates (see Christiano et al. 2011, 2013, for a similar framework where interest rate spread arises from exogenous firms’ failure risk). They find that during crises, unconventional monetary policy (i.e. Central Bank providing credit intermediation) is welfare enhancing (see also Curdia and Woodoford 2011; and Gertler and Kiyotaki, 2010 for an extended analysis of credit policies)16.

The foregoing papers allow for some form of mild heterogeneity among agents. The introduction of two types of agents allow DSGE models to explore new issues such as debt deflations or inequality (most of DSGE models with heterogeneous agents are grounded on Krusel and Smith 1998). For instance, Eggertsson & Krugman (2012) introduce patient and impatient agents and expose the latter to exogenous debt limit shocks, which force them to deleverage. They find that the model can account for Fisher debt deflations, liquidity traps, and support expansionary fiscal policies, as multipliers can be higher than one. Kumhof et al. (2015) study the link between rising inequality, household leverage and financial crises employing a DSGE model where top earner house-holds (5% of the income distribution) lend to the bottom ones (95% of the income distribution). They show that an exogenous inequality shock induces low-income households to increase their indebtedness, raising their rational willingness to default and, in turn, the probability of a financial crisis.

An increasing number of DSGE models allow for various forms of bounded rationality (see Dilaver et al. 2016, for a survey). In one stream of literature, agents know the equilibrium of the economy and form their expectations as if they were econometricians, by using the available observation to compute their parameter estimates via ordinary least square (the seminal contribution is Evans and Honkapohja 2001; see also Deak et al. 2015, for a DSGE model with individual rationaltiy). Building on the Brock & Hommes (1997), in an increasing number of DSGE models (see e.g. Branch & McGough 2011; De Grauwe 2012; Anufriev et al. 2013; Massaro 2013), agents can form their expectations using an ecology of different learning rules (usually fundamentalist vs. extrapolative rules). As the fraction of agents following different expectations rules change over time, "small" shocks can give raise to persistent and asymmetric fluctuations and endogenous business cycles may arise17.

Finally, a new generation of DSGE models try to account for deep downturns and disasters. Curdia et al. (2014) estimate the Smets & Wouters (2007) model assuming that Student’s t-distributed shocks. They find that the fit of the model improves and rare deep downturns are relevant (see also Fernandez-Villaverde & Levintal 2016, for a DSGE model with exogenous time-varying rare disaster risk). A similar strategy is employed to Canzoneri et al. (2016) to allow the effects of fiscal policies to change over time. By adding countercyclical exogenous bank intermediation costs to the Curdia & Woodford (2011) model, they obtain state-dependent fiscal multipliers, which can be abundantly higher than one in recessions.

Taking stock of new DSGE developments. The recent advances in DSGE models are impressive and seem to solve many of the problems mentioned in Section 3. Nevertheless, can they be truly considered real improvements in the DSGE research paradigm? We do think that the answer is negative.

Let us consider first DSGE models with financial frictions. They certainly performs better than standard DSGE models, but the way they introduce finance is completely ad-hoc resorting to exogenous shocks and pre-determined categories of agents (patient vs. impatient or random probability to become "banker"). In that, they just scratch the surface of the impact of credit and finance on real economic dynamics without explicitly modeling the behavior of banks (e.g. endogenous risk-taking), accounting for the role of network interactions, and studying the implications of endogenous money. Moreover, also DSGE models with financial frictions avoid to explicitly consider the interactions occurring among heterogeneous agents, which is a pervasive feature of credit (and real) markets.

The same critiques can be applied to the other streams of research. Every time heterogeneity is taken into account, there are two types of agents exogenously determined (e.g. rich and poor), facing exogenous shocks and no possibilities of interactions. DSGE models can now encompass both mild and deep downturns, but they only assume them, increasing the degrees of freedom of the models. Indeed, business cycles are still triggered by exogenous shocks, which come from a fat-tailed distribution or they have massive negative effects18. When bounded rationality is present, agents can be either rational or non-rational or, in alternative, they estimate the parameters of the shared model of the economy. In the latter case, interactions is not relevant, while in the first case, it affects the dynamics of the economy only indirectly via the evolving proportion of agents adopting different expectation rules.

In light of the foregoing discussion, we think that the new developments in DSGE camp are certainly welcome, but they are just patches added to torn clothes. The relevant question then is: How many patches can one add before trashing it? For instance, Lindé et al. (2016), after having expanded the benchmark DSGE model to account for the zero-lower bound, non-Gaussian shocks, and the financial accelerator, conclude that such ex-tensions "do not suffice to address some of the major policy challenges associated with the use of non-standard monetary policy and macroprudential policies"19. We do think that the emperor has no clothes, and macroeconomics should be grounded on the recent developments in complexity science. In that, agent-based computational economics (ACE) (Tesfatsion & Judd 2006; LeBaron & Tesfatsion 2008; Farmer & Foley 2009) represents a valuable tool. We present the ACE paradigm in the next section.

Agent-Based Models and Economic Policy

From DSGE to agent-based models

Given the theoretical and empirical problems of DSGE models discussed above, the positive economics approach advocated by Milton Friedman would suggest to remove or change the plethora of underlying assumptions in order to improve the performance of the model.

This recommendation is reinforced by two related observations. First, the assumptions underlying DSGE models become a sort of strait jacket that preclude the model to be flexible enough to allow for generalizations and extensions. Second, the unrealism of these assumptions prevent policymakers to fully trust the policy prescriptions developed with DSGE models.

It is far from clear why within the mainstream DSGE paradigm there is a widespread conservative attitude with no significant attempts to substitute the "Holy Trinity" assumptions of rationality, greed and equilibrium (Colander 2005) with more realistic ones. For instance, Akerlof (2007) argues that a broader definition of agents’ preferences which take into account the presence of realistic norms can violate many neutrality results of neoclassical economics without recurring to imperfections. Moreover, introducing heterogeneous agents or substituting the rationality assumption with insights coming from behavioral economics could substantially change the working of DSGE models. This position is also advocated in a recent work by Sinitskaya & Tesfatsion (2015), who explore models where economic agents are "locally constructive", that is they are constrained by their interaction networks, information, beliefs, and physical states when making decisions.

In any case, if neoclassical economists truly enlist themselves among those advocating an instrumentalist approach to scientific research, they should agree that when models display estimation and validation (descriptive) problems such as those exhibited by DSGE ones, the only way out would be to modify the models’ assumptions. As Wren-Lewis (2016) argues, the neo-classical revolution, which ultimately paved the way to the development of DSGE models, was mainly based on ideas and not events. In other words, he argues that models based on mainstream economics "focus on explaining only partial properties of the data" and share "an obsession with internal consistency", which "comes straight from the methodology". Given this lack of attention to explaining the events, experimenting with alternative sets of assumptions, supported by empirical data and experimental evidence, would be the recommendation that an instrumentalist researcher itself would pro-vide. A fortiori, this should become an urgent research project to pursue if, in addition, the model, as happens in the DSGE case, would also display problems on the normative side.

This is exactly the research avenue that a growing number of scholars have been pursuing in the last two decades. Dissatisfied with standard macroeconomic, micro-founded, general- equilibrium-based neoclassical models like those discussed above, they have begun to devise an entirely new paradigm labeled as "Agent-Based Computational Economics" (ACE). The philosophical underpinnings of ACE largely overlap with those of similar, complementary, approaches known in the literature as "Post Walrasian Macroeconomics" (Colander 2006b) and "Evolutionary Economics" (Nelson & Winter 1982; Dosi & Nelson 1994). The overlap is often so strong that one might safely speak of an emerging "heterodox synthesis". Such a large supply of heterodox models is exactly the basin which Setterfield (2016) argues central bankers and policy makers should draw from, in order to "entertain more eclectic views of how the economy functions".

The basic exercise ACE tries to perform is building models based on more realistic assumptions as far as agent behaviors and interactions are concerned, where more realistic here means rooted in empirical and experimental micro-economic evidence (Kirman 2016). For example, following the body of evidence provided by cognitive psychologists (see for example, among a vast literature, Kahneman & Tversky 2000; Gigerenzer 2007; Gigerenzer & Brighton 2009), the assumptions of perfect rationality and foresight are replaced with those of bounded rationality and adaptive behavior. More generally, ACE scholars share the view that agents in the model should have "the same information as do the economists modeling the economy" (Colander 2006a, p. 11). Similarly, insights from network theory (e.g., Albert & Barabasi 2002) and social interactions (e.g., Brock & Durlauf 2001) suggest to move away from the unrealistic and oversimplifying assumptions concerning agents interactions typically employed in neoclassical models and allow for direct, non-trivial interaction patterns. Finally, the widespread evidence on persistent heterogeneity and turbulence characterizing markets and economies indicate to abandon crazy simplifications such as the representative agent assumption, as well as the presumption that economic systems are (and must be observed) in equilibrium, and to focus instead on out-of-equilibrium dynamics endogenously fueled by the interactions among heterogeneous agents.

In other words, ACE can be defined as the computational study of economies thought as complex evolving systems (Tesfatsion 2006a). Notice that neoclassical economics, on the contrary, typically deals with economies conceived as simple, linear, homogeneous and stationary worlds. It should not come as a surprise that the class of models used by ACE to explore the properties of markets, industries and economies (called agent-based models, ABMs) are far more complicated – and harder to analyze – objects than their neoclassical counterparts. In the following Section, we will therefore begin by outlying the basic building blocks of ABMs. Next, we will address the question how ABMs can be employed to deliver normative implications. Then, we will briefly review some examples of policy exercises in ABMs. Some final remarks about pro and cons of using ABMs for policy analysis will be left for the concluding section.

Building blocks of ABMs

The last two decades have seen a rapid growth of agent-based modeling in economics. An exhaustive survey of this vast literature is of course beyond the scope of this work20. However, before proceeding, it is useful to introduce the main ten ingredients that tend to characterize economic AB models.

- A bottom-up perspective. A satisfactory account of a decentralized economy is to be addressed using a bottom-up perspective. In other words, aggregate properties must be obtained as the macro outcome of a possibly unconstrained micro dynamics going on at the level basic entities (agents). This contrasts with the top-down nature of traditional neoclassical models, where the bottom level typically comprises a representative individual and is constrained by strong consistency requirements associated with equilibrium and hyper-rationality.

- Heterogeneity. Agents are (or might be) heterogeneous in almost all their characteristics.

- The evolving complex system (ECS) approach. Agents live in complex systems that evolve through time. Therefore, aggregate properties are thought to emerge out of repeated interactions among simple entities, rather than from the consistency requirements of rationality and equilibrium imposed by the modeler.

- Non-linearity. The interactions that occur in AB models are inherently non-linear. Additionally, non-linear feedback loops exist between micro and macro levels.

- Direct (endogenous) interactions. Agents interact directly. The decisions undertaken today by an agent directly depend, through adaptive expectations, on the past choices made by other agents in the population.

- Bounded rationality. The environment in which real-world economic agents live is too complex for hyper-rationality to be a viable simplifying assumption. It is suggested that one can, at most, impute to agents some local and partial (both in time and space) principles of rationality (e.g., myopic optimization rules). More generally, agents are assumed to behave as boundedly rational entities with adaptive expectations.

- The nature of learning. Agents in AB models engage in the open-ended search of dynamically changing environments. This is due to both the ongoing introduction of novelty and the generation of new patterns of behavior; but also on the complexity of the interactions between heterogeneous agents (see point 5 above).

- "True" dynamics. Partly as a consequence of adaptive expectations (i.e., agents observe the past and form expectations about the future on the basis of the past), AB models are characterized by true, non-reversible, dynamics: the state of the system evolves in a path-dependent manner21.

- Endogenous and persistent novelty. Socio-economic systems are inherently non-stationary. There is the ongoing introduction of novelty in economic systems and the generation of new patterns of behavior, which are themselves a force for learning and adaptation. Hence, agents face "true (Knightian) uncer-tainty" (Knight 1921) and are only able to partially form expectations on, for instance, technological out-comes.

- Selection-based market mechanisms. Agents typically undergo a selection mechanism. For example, the goods and services produced by competing firms are selected by consumers. The selection criteria that are used may themselves be complex and span a number of dimensions.

The basic structure of ABMs

Models based on (all or a subset of) the ten main ingredients discussed above typically possess the following structure. There is a population – or a set of populations – of agents (e.g., consumers, firms, etc.), possibly hierarchically organized, whose size may change or not in time. The evolution of the system is observed in discrete time steps, \(t=1,2,\dots\). Time steps may be days, quarters, years, etc.. At each \(t\), every agent \(i\) is characterized by a finite number of micro-economic variables \(\underline{x}_{i,t}\) (which may change across time) and by a vector of micro-economic parameters \(\underline{\theta}_i\) (that are fixed in the time horizon under study). In turn, the economy may be characterized by some macroeconomic (fixed) parameters \(\Theta\).

Given some initial conditions \(\underline{x}_{i,0}\) and a choice for micro and macro parameters, at each time step \(t>0\), one or more agents are chosen to update their micro-economic variables. This may happen randomly or can be triggered by the state of the system itself. Agents selected to perform the updating stage collect their available information about the current and past state (i.e., micro-economic variables) of a subset of other agents, typically those they directly interact with. They plug their knowledge about their local environment, as well as the (limited) information they can gather about the state of the whole economy, into heuristics, routines, and other algorithmic, not necessarily optimizing, behavioral rules. These rules, as well as interaction patterns, are designed so as to mimic empirical and experimental knowledge that the researcher may have collected from his/her preliminary studies.

After the updating round has taken place, a new set of micro-economic variables is fed into the economy for the next-step iteration: aggregate variables \(\underline{X}_t\) are computed by simply summing up or averaging individual characteristics. Once again, the definitions of aggregate variables closely follow those of statistical aggregates (i.e., GDP, unemployment, etc.).

The stochastic components possibly present in decision rules, expectations, and interactions will in turn imply that the dynamics of micro and macro variables can be described by some (Markovian) stochastic processes parameterized by micro- and macro-parameters. Hoverer, non-linearities which are typically present in decision rules and interactions make it hard to analytically derive laws of motion, kernel distributions, time-\(t\) probability distributions, etc. for the stochastic processes governing the evolution of micro and macro variables.

This suggests that the researcher must often resort to computer simulations in order to analyze the behavior of the ABM at hand. Note that in some simple cases such systems allow for analytical solutions of some kind. Needless to say, the more one injects into the model assumptions sharing the philosophy of the building blocks discussed above (cf. Section 5), the less tractable turns out to be the model, and the more one needs to resort to computer simulations. Simulations must be intended here in a truly constructive way, e.g. to build and "grow" a society "from the bottom up", in the spirit of object-oriented programming.

Descriptive analysis of ABMs

When studying the outcomes of ABMs, the researcher often faces the problem that the economy he/she is modeling is by definition out-of-equilibrium. The focus is seldom on static equilibria or steady-state paths. Rather, the researcher must more often look for long-run statistical equilibria and/or emergent properties of aggregate dynamics (that is, transient statistical features that last sufficiently long to be observed and considered stable as compared to the time horizon of the model; see Lane 1993, for an introduction). Such an exploration is by definition very complicated and it is made even more difficult by the fact that the researcher does not even know in advance whether the stochastic process described by its ABM is ergodic or not and, if it somehow converges, how much time will take for the behavior to become sufficiently stable.

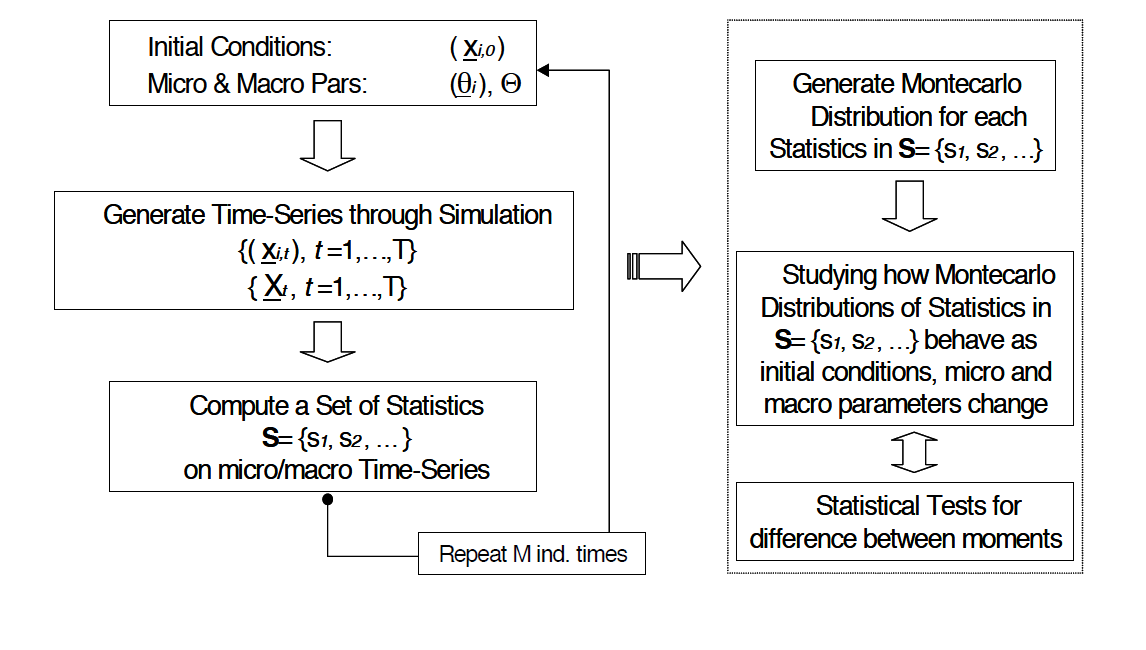

Suppose for a moment that the modeler knows, e.g., from a preliminary simulation study or from some ex-ante knowledge coming from the particular structure of the ABM under study, that the dynamic behavior of the system becomes sufficiently stable after some time horizon \(T^{\ast}\) for (almost all) points of the parameter space. Then a possible procedure that can be implemented to study the output of the ABM runs as the one synthetically depicted in Figure 1.

Given some choice for initial conditions, micro and macro parameters, assume to run our system until it relaxes to some stable behavior (i.e., for at least \(T>T^{\ast}\) time steps). Suppose we are interested in a set \(S=\{s_1,s_2,\dots\}\) of statistics to be computed on micro and macro simulated variables. For any given run the program will output a value for each statistic. Given the stochastic nature of the process, each run will output a different value for the statistics. Therefore, after having produced \(M\) independent runs, one has a distribution for each statistic containing \(M\) observations, which can be summarized by computing its moments.

Recall, however, that moments will depend on the choice made for initial conditions and parameters. By exploring a sufficiently large number of points in the space where initial conditions and parameters are allowed to vary, computing the moments of the statistics of interest at each point, and by assessing how moments do depend on parameters, one might get a quite deep descriptive knowledge of the behavior of the system (see Figure 1).

So far, we have naively assumed that the DGP described by the ABM under study is ergodic and stationary. However, is it possible to check this assumption quantitatively? Recent research indeed provides alternatives to the researcher interested in statistically assessing such an issue, and therefore better understand the behavior of the model, and draw inferences about the real system it is intended to represent (Richiardi et al. 2006). As an example, Grazzini (2012) discusses the use of Wald-Wolfowitz tests applied to ABMs and shows that, under appropriate settings, these procedures can detect non-stationarity and non-ergodicity.

Model selection and empirical validation

From the foregoing discussion, it clearly emerges that in agent-based modeling (as in many other modeling endeavors) one often faces a trade-off between descriptive accuracy and explanatory power of the model. The more one tries to inject into the model "realist" assumptions, the more the system becomes complicated to study and the less clear the causal relations going from assumptions to implications are. ABM researchers are well aware of this problem and have been trying to develop strategies to guide the process of assumption selection. For example, one can try to solve the trade-off between descriptive capability and explanatory power either by beginning with the most simple model and complicate it step-by-step (i.e., the so-called KISS strategy, an acronym standing for "Keep It Simple, Stupid!") or by starting with the most descriptive model and simplify it as much as possible (i.e., the so-called KIDS strategy, "Keep It Descriptive, Stupid!"). A third, alternative strategy prescribes instead to start with an existing model and successively complicate it with incremental additions (this strategy might be labeled TAPAS, which stands for "Take A Previous model and Add Something").

In all these procedures, the extent to which the ABM is able to empirically replicate existing reality should play a crucial role in discriminating the point at which any procedure should stop22.

Notice that the very structure of ABMs naturally allows one to take the model to the data and validate it against observed real-world observations. Indeed, an ABM can be thought to provide a DGP, which we think real-world observations being a realization of. More precisely, let us suppose that we believe that observed data are generated by an unknown (to us) colossal DGP, with an almost infinite number of parameters, which we can label as real-world DGP (rwDGP). Suppose further that such rwDGP can be broken in reasonable smaller weakly-exogenous components, each one with a reasonable number of parameters, and each one describing a small set of variables that we are interested in, on the basis of a small set of other variables. Building an ABM means attempting to approximate one of those small rwDGPs. Due to its stochastic structure, an ABM actually mimics the small rwDGP we are studying by a theoretical DGP that generates the same variables each time we run the model. Of course, we only have one observation generated by the rwDGP, and this makes any inference very difficult (but this has to do with another story, which philosophers call the problem of induction. . . ).

Many approaches to empirical validation (and selection) of ABMs can be in principle taken, and the debate is very open here23.

For example, one might select among ABMs (and within different parameter setups of the same ABM) with respect to the number of stylized facts each of them is able to jointly replicate. A typical procedure to be followed starts with asking whether a particular model can simultaneously reproduce some set of stylized facts for a given parametrization (a sort of "exercise in plausibility"); then explore what happens when the parameter setup changes; finally, investigate if some meaningful causal explanation can be derived out of that step-by-step analysis. This approach has been recently criticized, in that it is not able to identify the correct causal structures that may have generated the observed evidence. Indeed, as argued by Guerini & Moneta (2016a), many alternative causal structures can underlie the set of statistical dependencies observed in the data. To attempt to over-come this issue, Guerini & Moneta (2016b) propose, firstly, to estimate the causal structure incorporated in the model using its simulated outputs, and then comparing it with the causal structure detected in the real-world data that the model aspires to replicate. Both causal structures are derived from fitting vector autoregression models, estimated using both artificial and real-world data by means of causal search algorithms.

Alternatively, one can first select among parameters by calibrating the model (e.g., by directly estimate parameters, when possible, with micro or macro data) and then judge to which extent the calibrated model is able to reproduce the stylized facts of interest. A recent stream of literature tries to pursue this idea and recover the parameters of ABMs using some form of parameter estimation (or calibration). For example, Gilli & Winker (2003), Alfarano et al. (2005), Winker et al. (2007), Grazzini et al. (2013) employ different blends of indirect estimation methods, whereas Grazzini & Richiardi (2015) propose to estimate parameters of ergodic ABMs using simulated minimum distance. Note that this latter technique has the merit of being potentially applicable to both the long-run equilibria of the model and during adjustment phases. Conversely, Recchioni et al. (2015) approach the problem of calibrating the free parameters of ABMs as a nonlinear constrained optimization, which can be solved numerically via gradient-based methods, whereas Fabretti (2012) employs search technologies coming from genetic algorithms to explore the space of all possible parameter combinations in simple ABMs of financial markets. More recently, Grazzini et al. (2015) have suggested a Bayesian inference approach, as opposed to simulated minimum distance, to estimate ABM parameters, whereas Lamperti (2015, 2016) resorts to information-criteria techniques to quantify the distance between the true probabilistic dynamics of the output of the model and the data (to be minimized in order to achieve estimation), without needing to impose any stationarity requirements (see also Barde 2015).

Note that, unlike economists supporting the NNS approach — who hold strong theoretical priors rooted in the DSGE model — ACE scholars are more interested in developing plausible theories, which however are not dogmatically deemed to be the "correct" ones (on this point, see also Colander 2006a). Therefore, estimation and calibration of ABM parameters must not be intended as a way to identify their true, real-world values, but rather to single out ranges wherein true parameters could lie. In this respect, we note also that parameter estimation of ABMs may easily become not computationally viable, especially when the number of parameters to be estimated is large and data availability is scarce.

One of the problems related to all these validation exercises is rooted on their computational requirements. As discussed in Grazzini et al. (2015), the curse of dimensionality makes the practical application of the tools discussed insofar nearly impossible for medium and large scale ABMs. To address this problem, Lamperti et al. (2016b) have proposed to use machine learning surrogates to conveniently filter the parameter space of simulation models, dramatically reducing the computational effort needed to explore the behavior of the model when many parameters are at stake.

No matter the empirical validation procedure actually employed, its basic goal is often to restrict the size of the set of free parameters. In fact, over-parameterized models are difficult to interpret and analyze, because no one knows whether the same conclusions could have been obtained in a simpler, less parameterized model. Even if empirical validation allows one to restrict the set of free parameters to a reasonably-sized one, many methodological problems still remain when the model is used to perform policy experiments. If any parametrization represents an alternative world, which one should be employed to assess policy performance? What is the role of initial conditions? What kind of sensitivity analysis should be performed? Recent developments try to mitigate over-parameterization issues resorting to phase-diagrams (Gualdi et al. 2015), Kriging meta-modeling (Salle & Yıldızoğlu 2014; Dosi et al. 2016f; Bargigli et al. 2016), and machine-learning surrogates (2016b). We shall briefly come back to these issues in the concluding remarks.

Here, it is important to note that the methodological debate within the agent-based community is very lively. Among many interesting lines of methodological research, one of the most crucial ones concerns the issue of realism of the assumptions in economic models (for a more general appraisal, see Schlefer 2012). Indeed, whereas many ABM scholars argue that their approach allows for more realism in the way individual behaviors and interactions are accounted for in theoretical models (as opposed to neoclassical ones), others have maintained that ABM must as well trade o between successful model building and empirical accuracy of assumptions (Deichsel & Pyka 2009). Therefore, in order to provide ABMs that deliver meaningful statistical implications, agent-based researchers must often employ assumptions that are not the most descriptively accurate ones.

Policy experiments in ABMs: Some considerations

ABMs configure themselves as a very powerful device to address policy questions in more realistic, flexible and modular frameworks. Indeed, as far as economic policy is concerned, ABMs have many advantages as compared to neoclassical tools as the DSGE model, which we organize in what follows into two classes: theory and empirics.

Theory. ABMs, contrary to neoclassical ones, do not impose any strong theoretical consistency requirements (e.g., equilibrium, representative individual assumptions, rational expectations). This is because they are not required ex-ante to be analytically solvable. Such no-strait-jacket condition allows for an extremely higher flexibility in model building. If this is coupled with a serious empirical-validation requirement (see below), we are in presence of a semi-instrumentalist approach, where bad (but empirically-plausible) assumptions can be re-placed with better (and empirically-plausible) ones if the model does not perform as expected. Note also that in absence of strong consistency conditions, assumptions can be replaced in a modular way, without impairing the analysis of the model. Indeed, in standard neoclassical models one cannot simply replace the optimization assumption with another one just because the model does not behave well, as that would possibly destroy its analytical solvability. This is not so in ABMs: assumptions – or simply small elements of them – can be taken out of the shelf and easily implemented in the model thanks to the flexibility of computer programming languages.

Empirics. As discussed above, ABMs can be thought as generators of alternative worlds, i.e. theoretical DGPs that approximate the unknown one. Contrary to neoclassical models, the structure of ABMs allows to take them to the data more easily. This can be done in two ways. First, one can validate the inputs of ABMs, i.e. fine-tune modeling assumptions about individual behaviors and interactions to make them more similar to the observed ones. Second, one can validate the model on the output side, by e.g. restricting the space of parameters, individual behaviors and interactions, and initial conditions to those that allow the model to replicate the stylized facts of interest. This allows for a degree of realism that is much higher than that exhibited by e.g. DSGE models (Farmer & Foley 2009). Furthermore, thanks to the theoretical flexibility discussed above, agent-based models can target a rich ensemble of stylized facts at different level of aggregation (i.e. micro vs. macro regularities). More specifically, a macroeconomic agent-based models is typically able to replicate macroeconomic stylized facts such as endogenous growth and economic fluctuations, the emergence of banking crises and deep down-turns, relative volatilities and co-movements of macro aggregates at the business cycles frequencies. The same model can also jointly account for microeconomic stylized facts concerning firm size and growth rate distributions, firm productivity dynamics, firm investment patterns, wage and income inequality, etc. (for a detailed example of the empirical regularities reproduced by a macro ABM see Dosi et al. 2016b). This is a major advantage of ABMs vis-à-vis. DSGE ones, which are typically built – in order to retain analytical solvability – to explain only one or two single macro stylized facts (see the discussion in Aoki 2006, for more details), and cannot replicate by construction any micro empirical regularities given the representative-agent assumption.

But how can one actually conduct policy experiments in ABMs? In a very natural way, indeed. Take again the procedure for ABM descriptive analysis outlined in Figure 1. Recall that micro and macro parameters can be designed in such a way to mimic real-world key policy variables like tax rates, subsidies, interest rates, money, etc. and other key behavioral measures affecting individual incentives in growth, innovation or technologically-related policies. Moreover, initial conditions might play the role of initial endowments and therefore describe different distributional setups. In addition, interaction and behavioral rules employed by economic agents can be easily devised so as to represent alternative institutional, market or industry setups. Since all these elements can be freely interchanged, one can investigate a huge number of alternative policy experiments and rules, the consequences of which can be assessed either qualitatively or quantitatively (e.g., by running standard statistical tests on the distributions of the statistics in \(S\)). For example, one might statistically test whether the effect on the moments of the individual consumption distribution (average, etc.) will be changed (and if so by how much) by a percentage change in any given consumption tax rate. Most importantly, all this might be done while preserving the ability of the model to replicate existing macroeconomic stylized facts (e.g. some time-series properties of observed aggregate variables such as persistence of output growth-rate fluctuations, relative standard deviations, cross-correlations, etc.), as well as microeconomic empirical regularities (e.g. firm size distributions, firm productivity dynamics, firm investment patterns, etc.).

Macroeconomic Policy in ABMs: A Survey